By Monika Arora

The Goods and Services Tax (GST) turned four on July 1, 2021. Like any other tax reform of this magnitude, the journey so far has been a bumpy — one with triumphs, trials and tribulations. As a law introduced to simplify India’s indirect tax system and to remove inter-state trade barriers, GST has been able to meet these objectives.

GST was launched along with GST Network (GSTN), its IT backbone, that has fairly stabilised in these four years. It has enabled automation of every facet of compliance and reporting, reducing compliance effort. With GST, the country has witnessed major changes in policy and administration over the past four years. Here are some areas that may come under spotlight as India enters the fifth year of GST.

READ I Covid-19 lessons: India needs cooperative federalism of the flexible kind

GST rate rationalisation

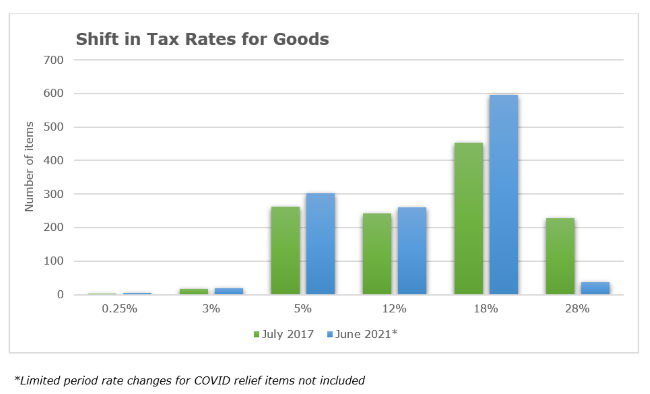

The government has, from time to time, reviewed and rationalised tax rates as can be seen in the rate movement for certain goods in the chart. The rationalisation activity however, seems to have impacted the revenue neutrality position. The 15th Finance Commission report indicates that the current effective tax rate is 11.8%, whereas the estimated revenue neutral rate (RNR) is around 14%.

The government may consider the Finance Commission’s suggestion of restoring the RNR by converging the tax slabs with 3 rate structure and minimising exemptions, which also sits well with the objective of a simplified GST rate system.

READ I MSME 2.0: A policy prescription for inclusive economic growth

GST compensation to states

A related point to the revenue shortfall is the Centre’s commitment to compensate states for any shortfall in revenues due to GST implementation. While the compensation cess was levied on select demerit goods to meet this need, a shortfall in funds owing to the recent economic slowdown led to delays in meeting this commitment.

The compensation for financial year 2020-21 was largely met by way of special borrowings, but the Centre still owes Rs 63,000 crore to states at the end of March 2021. Also, given the prolonged shortfall in revenues, the cess is likely to be extended beyond original end date of June 2022.

Once the compensation period comes to an end, it would be interesting to see how states plan to meet their revenue targets. It needs to be ensured that there are no unilateral changes in SGST laws by different states as that may distort the uniformity of the GST structure.

READ I Towards a robust public health system based on universal healthcare

Tax administration

The government has taken consistent steps towards simplification of compliances. Recent steps of simplification such as annual compliances, integrating e-invoicing portal with GSTN, and quarterly returns for small taxpayers have considerably reduced the compliance burden. While these steps have brought a shift in taxpayer behaviour leading to revenue buoyancy, other measures that restrict credit utilisation to a specified limit and deny credits when vendors fail to report invoices, have adversely impacted taxpayers.

The focus of authorities is on audits and intelligence-based investigations. While these proceedings are aimed to unearth evasion, necessary guidelines on central or state jurisdiction and conduct of audits should be issued to protect genuine taxpayers.

Advance ruling mechanism

The advance ruling mechanism was introduced to provide clarity and certainty to businesses and to limit unwarranted litigation. The said objective was, however, not fully met due to conflicting rulings by various state advance ruling authorities on same/similar issues.

To address this challenge, the government proposed to introduce a National Appellate Authority for AR (NAAAR). However, the same is yet to be notified and operationalised. Given the current difficult times, the situation calls for immediate action.

Anti-profiteering mechanism

The anti-profiteering mechanism was introduced to ensure that no business makes an unfair profit from a tax reduction. While the objective was legitimate, the implementation was marred with ambiguity and legal issues. Consequently, orders passed by the National Anti-profiteering Authority (NAA) led to litigation and undue hardships for taxpayers.

While the tenure of NAA ends in November 2021, it is likely to be extended in view of the government’s continuing efforts on rate rationalisation. For the forum to continue effectively, the government needs to resolve concerns raised on NAA’s powers and investigation modalities.

Functioning of GST Council

With the conclusion of its 43rd meeting recently, the GST Council has been a great example of cooperative federalism, given that decisions are to be taken based on 3/4th majority, with Centre and states having 1/3rd and 2/3rd vote weightages respectively, in any decision.

While the first 37 meetings of the Council did not require voting and decisions were based on consensus, there have been recent incidents of ‘majority driven’ decision making, leaving concerns of some states unaddressed. Such sentiments, if left unattended, could jeopardize the smooth functioning of the Council, and consequently impact the progress on the unfinished agenda of GST.

On the policy front, the GST has many roadblocks to overcome before becoming a stable and mature tax regime. Apart from further simplification of the GST law and policy, the government needs to focus on gaining the trust of the states and get them contribute towards achieving the unfinished tasks on the GST agenda.

(Monika Arora is Partner and Pankaj Grover Senior Manager with Deloitte Haskins and Sells LLP.)