The International Monetary Fund (IMF) has scaled down its 2022 growth projections for the world economy to 3.6%, a drop of 0.8 percentage points from its January forecast. It has also cut the growth forecast for 2023 to 3.6% from 3.8%, citing the impact of the Russian invasion of Ukraine and a fresh wave of Covid-19 pandemic in China. The IMF’s World Economic Outlook report has sounded out an alarm on the inflation front. “The risk is rising that inflation expectations drift away from central bank inflation targets, prompting a more aggressive tightening response from policymakers,” the fund said.

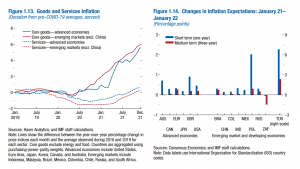

The US Federal Reserve is expected to hike interest rates six more times in the calendar year, while the European Central Bank will end its asset purchase programme in the July-September quarter. The Reserve Bank of India also has signalled monetary tightening at a slow and steady pace. These efforts may not be enough if the inflation remained elevated because of geopolitical tensions. Inflation will affect the purchasing power of the poor worldwide. The IMF sees inflation rising to 5.7% in advanced economies and 8.7% in emerging markets and developing economies.

READ I Timely action on inflation needed to avert hard landing, says Maurice Obstfeld

The outlook calls for a tighter monetary policy. It “will be appropriate to check the cycle of higher prices driving up wages and inflation expectations, and wages and inflation expectations driving up prices,” it says. The IMF acknowledges that for countries most affected by the Ukraine conflict, “the trade-off between safeguarding growth and containing inflation will be more challenging.” The governments need to extend support to vulnerable households even at the risk of high debt, says the report. This needs to be done diligently to avoid worsening the supply-demand imbalances and price pressures, it adds.

IMF sees tough times ahead for India

The IMF has cut its India growth forecast for 2022-23 by 0.8 percentage points to 8.2%. The report warns that the Ukraine conflict will hurt consumption and growth in the long run as India is dependent on crude oil imports to meet 80% of its energy needs. The outlook has cut the country’s GDP growth forecast for the next financial year also — to 6.9% from its January estimate of 7.1%. The IMF projects India’s current account deficit to rise to 3.1% in 2022-23, compared with 1.5% in the previous year.

READ I Easing of public debt burden will cause economic disruption

Despite the cut in its forecasts, the IMF’s growth estimate is still higher than the projections of the Reserve Bank of India that has put the growth for 2022-23 at 7.2%. The Central Statistics Office (CSO) has predicted 8.9% growth for the financial year in its second advance estimate. The gap between the IMF projections and the RBI estimates continues to exist even for the next financial year (2023-24). The IMF expects the economy to grow at 6.9%, while the RBI has forecast 6.3% GDP growth.

The RBI has been reluctant to raise interest rates, fearing the possible impact on the growth prospects of the economy riled by the Covid-19 pandemic and the Ukraine conflict. If the Federal Reserve and the European Central banks choose to adopt aggressive rate hikes, it may have to shed its reluctance and join the bandwagon to avoid a hard landing of the economy.