Global economy outlook: The IMF projects a steady global growth rate with a slight uptick next year. However, these headline figures belie significant regional disparities and underlying vulnerabilities. The July update of the World Economic Outlook highlights resilient economic performances by China and India which continue to be pivotal drivers of global growth. Yet, the findings also point to persistent inflationary pressures, fiscal challenges, and rising geopolitical tensions that pose substantial risks to sustained economic stability.

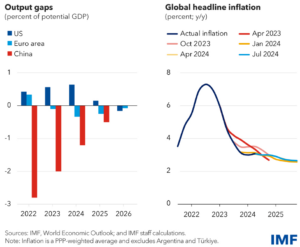

The update projects global growth to remain steady at 3.2% for 2024 and 3.3% for 2025, with notable regional disparities. Major advanced economies, particularly the United States, exhibit signs of deceleration, while the euro area shows potential for modest improvement. The scenario is further complicated by persistent inflationary pressures, especially in the services sector, which have hindered disinflation efforts and may lead to prolonged high-interest rates.

READ | Kerala’s coastline crisis: Rising seas, disappearing land, and women on the frontlines

India’s growth trajectory

India’s growth trajectory continues to be a highlight in the global economic scenario. The IMF has revised India’s GDP growth projection upward to 7% for 2024-25, backed by robust private consumption, particularly in rural areas. The Reserve Bank of India corroborates this optimism, projecting a 7.2% growth for FY25. RBI Governor Shaktikanta Das has stressed on potential structural shift towards an 8% annual growth rate, indicating a new growth trajectory for the Indian economy.

This optimism comes from various factors. Provisional estimates for 2023-24 indicate a GDP expansion of 8.2%, surpassing the previous year’s 7%. This growth was bolstered by a 7.8% expansion in the fourth quarter, according to the National Statistical Office (NSO). The upward revision reflects strong domestic consumption and investment, supported by policy reforms and increased rural spending.

Resilient domestic market

India’s growth narrative is backed by a resilient domestic market. The IMF attributes part of India’s robust growth to an upward revision in 2023’s economic performance, with private consumption playing a pivotal role. Rural consumption, in particular, has shown remarkable strength, driven by government initiatives and improved agricultural incomes. This resurgence in rural demand is expected to sustain momentum, further bolstered by infrastructure development and increased digital penetration in rural areas.

However, the outlook is not without challenges. The IMF projects a slight deceleration to 6.5% in 2025-26, indicating potential headwinds. India’s growth sustainability hinges on addressing structural issues, such as infrastructure deficits, labour market reforms, and enhancing the ease of doing business. Furthermore, external risks, including global inflation and geopolitical tensions, could impact this growth trajectory.

China’s rebound and long-term prospects

China, the world’s second largest economy, also sees an upward revision in its growth forecast. The IMF now projects a 5% growth for 2024, driven by a rebound in private consumption and strong exports. This represents a significant recovery from the pandemic-induced slowdown, with the first quarter showing robust performance.

However, the medium-term outlook for China is more subdued. Growth is expected to decelerate to 4.5% in 2025 and further to 3.3% by 2029. This slowdown is attributed to structural issues such as an aging population and slowing productivity growth. The waning momentum in emerging Asia, particularly China, underscores the need for policy interventions to sustain growth.

China’s ability to maintain a steady growth trajectory will largely depend on its commitment to structural reforms. These include addressing the challenges of an aging workforce and enhancing productivity through technological innovation and urbanisation policies. The Chinese government’s focus on reducing income inequality and transitioning towards a consumption-driven economy will be crucial in mitigating long-term growth deceleration. Furthermore, efforts to stabilise the real estate sector and manage financial risks are essential to prevent potential economic disruptions.

Global economy: Inflation and fiscal challenges

Inflation remains a persistent concern globally. The IMF forecasts a decline in global inflation to 5.9% in 2024 from 6.7% in the previous year. However, services price inflation continues to pose challenges, complicating monetary policy normalisation. The IMF cautions that higher-for-longer interest rates could emerge if inflationary pressures persist, particularly in the services sector.

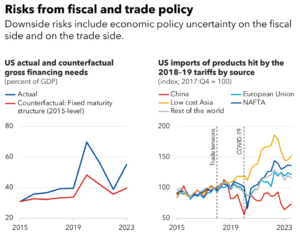

Fiscal challenges add another layer of complexity. The pandemic has left many countries with deteriorated public finances, necessitating credible fiscal consolidation to rebuild buffers. The IMF emphasises the importance of fiscal discipline to address emerging spending needs, such as climate transition and energy security, while mitigating risks to financial stability.

Global trade dynamics are increasingly influenced by geopolitical tensions, which pose significant risks to economic stability. The gradual dismantling of the multilateral trading system, with countries imposing unilateral tariffs and pursuing protectionist policies, threatens to disrupt global supply chains. This scenario could lead to retaliatory measures, exacerbating trade tensions and undermining global growth. It is imperative for nations to engage in constructive dialogue and reinforce multilateral cooperation to ensure a stable and prosperous global economy.

The way forward

The global economic outlook is a delicate balance of risks and opportunities. For India and China, sustaining growth will require addressing structural issues and navigating external risks. Policymakers must focus on boosting productivity, enhancing infrastructure, and fostering innovation to maintain the growth momentum.

Emerging markets, while contributing significantly to global growth, face unique vulnerabilities. The IMF highlights the risks posed by currency depreciation and capital flow volatility, particularly in response to interest rate differentials with advanced economies. Countries with high levels of foreign-currency-denominated debt are especially at risk. Policymakers in these regions must balance monetary and fiscal policies carefully to maintain economic stability, using foreign reserves judiciously to manage potential outflows and ensuring that macroprudential measures are in place to mitigate financial risks.

The broader global landscape demands coordinated policy efforts to manage inflation, ensure fiscal discipline, and promote multilateral cooperation. Trade tensions and protectionist measures could hinder global growth prospects, emphasising the need for a robust multilateral trading system. While India and China continue to drive global growth, the path ahead is fraught with challenges. Strategic policy interventions and multilateral cooperation will be crucial in navigating this complex economic terrain, ensuring sustainable growth and prosperity for all.