India’s merchandise exports touched $421.8 billion in 2021-22, exceeding the target by $21 billion set for the year. This marked a growth of 44.6% and 34.6% over 2020-21 and 2019-20, respectively. As per data released by the Reserve Bank of India, India’s services exports touched a record $254.5 billion in 2021-22, up 23.4% from $206.09 billion in 2020-21. India’s overall exports comprising both services and merchandise touched a record high of $676.2 billion in 2021-2022, up 28.4% from $526.6 billion in 2020-21 and $497.9 billion in 2019-20.

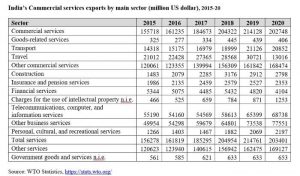

During 2021-22, the services exports were largely led by telecommunications, computer and information services, transport, and other business services. In the coming months, contact sectors such as travel, recreational services, and construction are expected to catch up as well. However, the policy scenario for the economy has changed significantly with the government setting more ambitious targets.

The government announced plans to achieve around $350 billion of exports from its borders in 2022-23 and about $2 trillion by 2027, equally shared between merchandise and services exports. The question remains whether and to what extent this ambitious target is achievable. It is clear that India is looking to garner a more significant space in the global trade, having recently signed comprehensive trade deals with the UAE and Australia. The need of the hour is to set focus on a series of reforms to enable increased trade and indirectly ensuring a smoother flow of merchandise exports.

READ I Explained: Ukraine conflict impact on India’s trade

Global value chain linkages

Since the economic reforms of the early 1990s, India has steadily expanded its share in global value added, exports and foreign direct investment. India’s share in global exports has more than tripled, from 0.5% in 1990 to more than 1.7% in 2018. Like most other economies, India saw its participation in Global Value Chains (GVCs) rise steadily since the 1990s, peaking at 47.6% before the global financial crisis in 2008, before declining to 41.3% in 2018.

India remains a small player with its GVC exports nearing around $245 billion or 1.5% of global GVC exports in 2017 and lagging behind other Asian economies such as the Republic of Korea, Singapore, China and Malaysia in value terms. As per the Asian Infrastructure Investment Bank’s 2021 Asian Infrastructure Finance Report, India needs to capitalise on a higher participation rate in services exports in GVCs and accelerate the country’s recovery from the pandemic.

The government’s focus should now be on building supply chain resilience which is firms’ ability to navigate unexpected supply chain disruptions with their existing capabilities. One of the foremost ways to build supply chain resilience is to enhance infrastructure quality. It is well known today that infrastructure quality is critical in GVCs to ensure timely production of goods and services of international standards at a reasonable cost. Weak infrastructure lowers firms’ competitiveness as reliable players in the production networks.

Backward participation and exports of services are impacted by customs burden as production of these services may depend crucially on import of certain tools and equipment. Quality of power supply also has an important impact on the output of services sector. Most services such as telecommunications, IT/ITeS, wholesale and retail trade, hospitality, finance, transport, education, and health depend crucially on uninterrupted and good quality power supply.

Skill quality is another important determinant for GVC participation for manufacturing and business services. Labor market flexibility or less restrictive labor market regulations have a beneficial impact on GVC participation for primary and low technology sectors, which tend to be labor intensive.

Digitisation and services exports

The group of services in which India holds a competitive advantage include technology and knowledge-intensive sectors such as IT/ICT, financial, telecommunication and business services as well as travel and tourism, entertainment and fitness services. In all these sectors, deployment of digital technologies needs to be accelerated to further streamline the movement of services across borders.

Digitised intermediation platforms provide significant new scope for producers, particularly small and medium players to penetrate new markets. However, developing economies such as India lag in terms of intellectual property protection, IT infrastructure and skills which reduce their ability to fully participate in and benefit from digital trade. Indian consumers constitute a large and lucrative market for the international data giants and they need to be protected against the possibility of abuse of dominance in the data space.

India also needs to promote and develop home-grown giants in the IT and ITeS sector to tap the opportunity arising from the surge in remote work. The proposed Personal Data Protection Bill, 2019 is one such step in the right direction. The Bill seeks to provide protection of personal data of individuals, and proposes establishment of a Data Protection Authority for the same. Likewise, India needs to update its competition law framework as the competition regulators globally keep up to the challenge of adverse impact of big data players that seek to influence consumer behavior to their advantage.

In the post-Covid world, trade in digital services has been expanding due to a spurt in investment in remote working. In the new landscape, firms could be enabled to use remote and artificial intelligence to reduce expenses and increase transparency. The increased digitisation brought about by Covid pandemic has opened up opportunities to enhance services exports especially in high-technology and knowledge-intensive services. Simultaneous reforms in services such as education, health and professional services are needed to capture the export opportunity in the services domain.

Mutual recognition agreements

In the past, India’s FTAs and deals with the ASEAN, South Korea and Japan have not leveraged India’s strengths in services sufficiently. Reforms in services could help in binding commitments in trade agreements in future. Movement of natural persons (Mode 4), for instance, could directly increase if the Government makes efforts in signing mutual recognition agreement in various sectors. Till date, India has only one MRA with Singapore in nursing services.

India has previously pushed for MRAs at the BRICS meet on goods and services in July 2021 in areas such as regulatory standards, conformity assessment, accreditation procedures, qualifications, visas and social security, as a strategy to promote cooperation in the goods and services sectors. India can leverage its bargaining power globally and take more of such initiatives in future to call for harmonization of accreditation practices and reduce barriers in services trade.

(Smita Miglani is an independent economist based in New Delhi. Dr Badri Narayanan Gopalakrishnan is the Lead Adviser (Trade and Commerce) at NITI Aayog, Government of India.)

Dr Badri Narayanan Gopalakrishnan is Fellow, NITI Aayog. Views expressed are personal.