India’s economic aspirations have been tempered by its international commitments towards sustainable development. Climate change has emerged as the toughest challenge to sustained GDP growth in India. India is facing extreme climate conditions and climate-induced natural disasters and the country’s natural capital is diminishing at a fast pace. Policymakers, corporates and researchers are striving to create a robust green finance system and a low-carbon economy without compromising the country’s economic aspirations.

Regulators across Asia are promoting green finance for a sustainable future. Fund flows into environment, social and governance (ESG) investments increased substantially in 2020 compared with 2019. Green finance bonds raised a record $544.3 billion in 2020. Similarly, ESG fund assets under management in Asia topped $60 billion in December 2020. India witnessed optimistic trends in sustainable investment. China led the world by accounting for 20% of the total sustainable deal-making activity, followed by the US at 9%, and India and Italy at 7%.

To meet its commitment to the Paris Agreement and SDGs, India should prioritise green finance and sustainable mandates in investment decisions. Green finance promotes economic growth and improves environmental benefits. The banking sector plays a crucial role in promoting sustainable and socially responsible investment (SRI). New financial instruments such as green bonds, carbon market instruments such as carbon tax and new financial institutions such as green banks / green funds are being established to fund sustainable projects.

READ I Green hydrogen prices will crash to $1 per kg by 2030: Study

Several fiscal and financial incentives are offered in India in line with the country’s commitments under the Paris Agreement. India has committed to reducing greenhouse gas (GHG) emissions by 33-35% from 2005 levels, increasing the share of non-fossil fuel-based electricity to 40%, and enhancing forest cover to absorb 2.5 to 3 billion tonnes of carbon dioxide by 2030.

Preliminary estimates indicate that around $2.5 trillion would be required to implement adaptation actions in critical areas such as agriculture, forestry, fisheries, infrastructure, water resources, disaster management and ecosystems. Raising financial resources for climate change adaptation and mitigation actions of this scale is an unprecedented challenge.

The Union government launched two phases of the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme in 2015 and 2019 to enhance the flow of credit and develop the infrastructure (such as charging stations) to encourage green vehicle production and sales. The government has also brought in a Production Linked Incentive (PLI) scheme to manufacture high-efficiency modules in the area of renewable energy.

Looking into India’s green building finance, residential and commercial buildings utilise more than 37% of the country’s electricity output. Certified green buildings save up to 20-30% on energy and 30-50% on water. Hence, the scope of green building construction in India is enormous. With 70% of the buildings needed by 2030 yet to be built, India has the potential to emerge as the largest green building market in the world. Financing green buildings across housing, retail, commercial, health and hospitality sectors presents an opportunity for lenders.

READ I Unemployment crisis biggest challenge for Sitharaman in Budget 2022

The Reserve Bank of India is taking proactive policy measures to support green finance initiatives. The small renewable energy sector under its priority sector lending (PSL) scheme is eligible for loans up to Rs 30 crore (Rs 15 crore since September 2020) and households are eligible for loans up to Rs 10 lakh for investing in renewable energy. The government is targeting 450 GW of renewable energy generation by 2030.

With an installed capacity of 100 GW of renewable energy in August 2021, India is 4th in the world in installed renewable energy capacity, 5th in solar and 4th in wind capacity. This journey can be continued with supporting policy measures and increased sustainable investment.

In the context of green financial institutions, the Indian Renewable Energy Development Agency (IREDA) has announced plans to become India’s first Green Bank. India Infrastructure Finance Corporation Limited (IIFCL) has also launched a credit enhancement scheme for funding viable infrastructure projects. Bank lending to non-conventional energy constituted about 7.9% of the outstanding bank credit to the power sector as of March 2020.

Banks take steps to step up green finance

Several banks such as State Bank of India, Punjab National Bank, Bank of Baroda, ICICI Bank, HDFC Bank, and Axis Bank have already undertaken environmentally and socially sustainable initiatives across the country.

Green bonds have been issued since 2015. Green bonds were issued by Yes Bank in 2015, Indian Renewable Energy Development Agency in 2017 and 2019, Rural Electrification Corporation in 2017, Power Finance Corporation in 2017, Indian Railway Finance Corporation in 2017, Adani Renewable Energy in 2019, and ReNew Power in 2019. In addition to corporates and the government, the World Bank has also issued green bonds for funding projects in India from time to time.

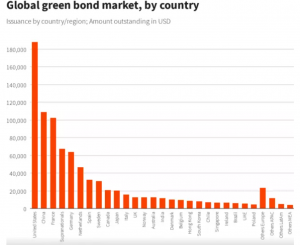

As of February 2020, the outstanding amount of green bonds in India was $16.3 billion. As of 2021, India has the second-largest emerging green bond market after China. However, green bonds constitute only 0.7% of all bonds issued in India since 2018. Although the value of green bonds issued in India constituted a tiny portion of the total bond issuance, India maintained a favourable position compared with several advanced and emerging economies.

From the country point of view, the green bond market hasn’t been able to diversify itself much in terms of assets and remain focused on renewable energy projects. Indian banks and financial institutions, including State Bank of India (SBI), ICICI, Axis Bank, the Trust Group, and HDFC are the most significant global financial institutions funding fossil fuels projects.

In May 2021, SBI and the European Investment Bank launched a new initiative of €100 million (Rs 885 crore) to finance high-impact climate action and sustainable businesses in India. SBI aims to become carbon neutral by 2030 and has taken several initiatives to reduce its carbon impact by installing solar plants, planting trees and organic farming.

India’s seventh-largest commercial bank, Federal Bank, committed to terminate funding of new coal, according to a new report released on October 7, 2021 In India, banks have yet to implement policies to reduce emissions. Among Indian Banks, only IDFC First Bank announced a policy commitment to mitigating climate change.

The UN Environment Programme issued Principles for Responsible Banking in 2019 to guide banks on the environmental and social impacts of projects. Currently, 252 banks are signatories to these principles — Yes Bank is the only one from India. Some NBFCs have signed for a different set of principles, the Principles for Responsible Investment, to incorporate environmental, social, and governance into investment practices. SBI Funds Management Pvt Ltd, Equicap Asia Management Private Ltd, and Indus Environmental Services Pvt Ltd. became signatories in 2019.

As of March 2020, outstanding bank credit to the non-conventional energy sector was around Rs 36,543 crore, which is 7.9% of the total bank credit to the power generation sector, compared with 5.4% in March 2015, according to RBI data. State Bank of India is one of the top 12 banks globally financing coal plants. It has provided Rs 1.57 lakh crore in fossil fuel finance between 2016 and 2020 and has not made any net-zero commitment yet.

Climate change is intensely affecting societies and economies. It is not only an environmental issue today; it is also a threat to the financial system. Its effects bring about substantial economic costs and financial instability.

India is ranked the fifth most vulnerable nation to the effects of climate change, with 2.5-4.5% of its GDP at risk. The World Bank estimates that climate change will reduce India’s GDP by nearly 3% and adversely affect the living standards of almost half of the country’s population by 2050. International Labour Organisation forecasts a loss of 34 million full-time jobs, primarily those of farmers, by 2030 due to increasing temperatures in India (ILO, 2019).

Though India has adopted several fiscal and monetary measures to address the challenge, increasing green investments requires a more intense focus on the financial system towards green sectors. It is essential to sensitise India’s financial sector to the importance and benefits of green finance.

To create a dedicated ecosystem for domestic manufacturing of carbon-neutral technologies, India’s journey to net zero will thrive on the green finance sector to mobilize the requisite capital. Green bond proceeds should go specifically to low carbon climate-resilient projects and the issuance of such bonds needs to be scaled up significantly for green finance. Green finance can play a crucial role in making India’s economy resilient to climate change impacts.

The planet-saving decarbonisation journey potentially needs a USD 15 trillion-dollar investment over the next five decades to support research and development in climate-friendly technologies, to scale low-carbon technologies.

As per RBI reports in 2019, Public finance will not bridge this large capital requirement. Hence, a significant share must come from the private sector, financial intermediation through banks and capital markets; we also need external financial flows for climate investments.

However, few Indian banks have advocated green banking principles as per international standards.

Hence, green growth is highly desirable. Green growth means simultaneously pursuing economic growth through investments in green industries and technologies, creating new (green) financial products and services, and improving the environment.

Green technology is needed to support green growth. Go green means “Tendency should cover all of the finances so banking can add an eco-friendly component to all products wherever possible.” Financial technology must develop to avoid economic uncertainty and promote the economy. Financial technologies can create new business models, applications, processes, products for financial markets, financial institutions, and financial services.

Sustainable digital finance can solve a low-carbon economy. Digital finance integrates big data, artificial intelligence (AI), mobile platforms, cloud computing blockchain, and the Internet of things (IoT). Further Sustainable finance integrates environmental, social, and governance (ESG) criteria into the business or investment decisions for the benefit of both clients and society.

In the global sustainable financial development process, financial institutions and fintech companies in Europe, the United States, and China integrate financial technology actively using blockchain, artificial intelligence, big data, and the Internet of Things, combining green finance to carry out green finance technology exploration and practice.

Big data and machine learning may be helpful to standardize green reporting, making it easier to monitor green investments.

Digitisation can reduce the challenges associated with searching, monitoring, and verification costs for sustainable projects. For instance, digital sensing technologies such as satellites, drones, etc. can monitor compliance with sustainability metrics across investments, thereby reducing costs in monitoring and reporting. The Spatial Finance Initiative can integrate geospatial data and analysis in financial decision-making.

Swiss firm Carbon Delta has developed a Climate Value-at-Risk (VaR) assessment method to quantify climate change risks across investment portfolios. Climate change factored into investment decisions. It uses a combination of publicly available and proprietary data and machine learning to determine such risks. This method can reduce the information asymmetry between companies and investors and between regulators and financial institutions. This can deal with ‘greenwashing’ or false claims of environmental compliance.

Fintech startups, regulators, and governments must collaborate to direct significant capital flow towards decarbonization. Recently, Nasdaq joined hands with Finnish firm Fortum to create an exclusive trading platform for carbon removal credits. The American Bankers Association partnered with ten financial trade companies to release standards and recommendations for financing their transition to a low-carbon economy.

Steps to boost green finance

Investment firms, challenger banks, neo banks, and new-age lending institutions worldwide are investing heavily in building carbon-offset portfolios and eco-friendly innovations. In addition to this, India must explore a formal carbon pricing framework. A carbon price provides a relatively direct way to ensure that more of the costs of climate change are brought into the economic calculus behind investments and consumption, including resource and fuel use. A formal carbon-pricing framework could also be a significant source of fiscal revenues.

Secondly, there is a need to mobilise domestic and international capital. For domestic capital flows, the country should take measures like green Infrastructure Investment Trusts (InvITs), facilitating deeper bond markets, and innovation in green finance instruments. For facilitating global capital flows, the country needs to take measures to reduce hedging costs, adapt external commercial borrowing guidelines, use innovation and de-risk instruments to help more projects reach expected risk-return profiles.

Thirdly, India must provide priority lending for sustainable development. Increasing banks’ prioritised sector lending targets can channel capital to social and environmental goals. Of course, RBI has included it in priority sector lending, but it remains a small part of the loan portfolio. It is also high time for us to consider green banking policy instruments such as macro-prudential policy, micro-prudential policy, market-making policy, and credit allocation policy.

RBI can implement policy by setting a minimum proportion of bank lending to climate and environment-related sectors. Also, it can create concessional green refinancing windows, extending concessional loans to banks that lend to climate-sensitive sectors to manage climate risks, and ultimately making the financial system green and climate-resilient.

To achieve net zero, India needs to decarbonise. It needs to concentrate on the sectors that release the most carbon such as fertilisers, cement, and steel. These sectors are vital to the economy and are robust job creators. India needs to integrate hydrogen into the economy and infrastructure to reduce carbon dioxide emissions. Hydrogen economy can create thousands of jobs, leveraging and reskilling the existing skilled workforce. This initiative will help us with the future net-zero economy.

India is in a race against the clock to accomplish its climate goals. However, it needs a cohesive approach, substantial efforts, and a shared vision among policy makers, regulators, and participants in the financial sector. The country should have a unified strategy around ESG investments, green guidelines, and financial products and define the roles of the private sector, public sector, bankers, and asset managers. This will stimulate the action to align the whole financial system with green finance and drive the engine of sustainable growth in the country.

Naliniprava Tripathy is an Indian economist based in Shillong. She teaches finance at IIM Shillong.