By P Vinod Kumar

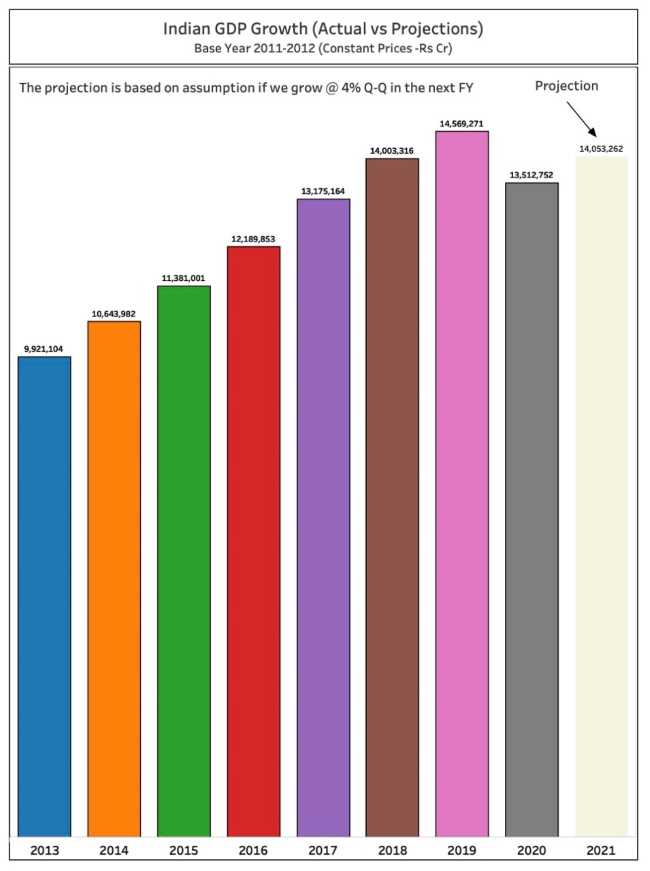

GDP growth numbers 2020-21: There are no surprises in the provisional estimates of national income published by the government of India on Monday. The official figures have put a lid on the widespread speculation about the activity level in the Indian economy in financial year 2021-21 and the shape of the recovery this year. In real terms (adjusted for the price rise or underlying inflation) the gross domestic product (GDP) or the size of domestic economy contracted 7.3% in 2020-21, compared with an expansion of 4% in 2019-20.

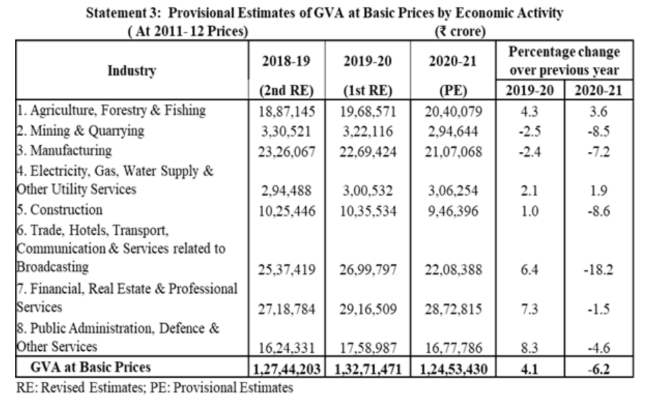

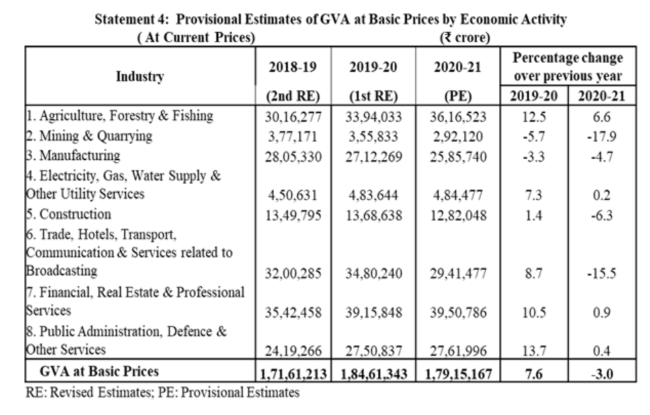

While the slide in GDP growth mirrored both the base effect as well the fall in net taxes on goods and services collected by the government, the latter was expected considering the toll taken by the Covid-19 pandemic on the activity level. The decline in the real value of goods and services produced in the country or the Gross Value Added (GVA) may give something to ponder over.

READ I Legends of the fall: Govt, RBI must clarify on cryptocurrencies

The real GVA according the GoI estimates declined only by a moderate 6.2% for the whole year compared to a 4.1% growth during the previous year. This may leave room for some celebrations in certain quarters considering the back-to-back hit on the economy – first from demonetisation that wiped out roughly 1.5% of the aggregate GDP and then from the debilitating impact of Covid-19 shutdowns. But the argument that the Indian economy still has some steam left to power through the ongoing healthcare crisis may be twice removed from the prevailing reality in the country.

For one, the reading of GDP and GVA growth may come as a surprise on the upside since most estimates were predicting that the FY21 GDP would see double digit contraction. More puzzling may be the fact that considering the massive dive in GDP growth during the first two quarters of the last fiscal, a moderate rise of 1.4% in the fourth quarter (from a low base) throws up many questions in the debate on the shape of economic recovery. For the discerning eyes, the confusion over economic growth rates gets further confounded with the expenditure side throwing up some undisputable numbers. The GDP print at the disaggregated level throws up some pain points that are hard to ignore.

READ I Women and employment: How economic liberalisation failed to address inequalities

GDP growth concerns

Except the figures for the government final consumption expenditure (GFCE) as a percentage of overall GDP, none of the other variables including the critical private final consumption expenditure (PFCE) were well below the last fiscal readings, indicating that the economy is not clawing back to pre-Covid levels. More importantly, it may be safely guessed that household finances were in shambles and unless the purchasing power returned to common people, the road to economic recovery will be a long haul.

This may be enough reason for the policy makers to worry about the future course of the economy since it is foolhardy to believe that the economy will fly back to pre-Covid levels on auto-pilot. Also, the headline numbers do not mirror the gravity of the situation on the ground. Research shows that a large number of those who were pushed into poverty by the Covid-19 pandemic crisis world over are from India. With the virus-induced lockdowns vaporising jobs, leading to income destruction on a massive scale, the time has come for those in power to take a relook at the economic policies pursued and recalibrate them in tune with the hard times ahead.

More than the ups and downs in GDP growth, the policy makers should be worried about disappearing jobs, falling real wages, and contracting household incomes. They can address these concerns through growth-supporting structural reforms that will be rewarding in a longer period. For the ordinary people of India, the blip in GDP growth may just be a reflection of their own misery.

(P Vinod Kumar is Kochi-based independent economist and commentator. Views expressed in this article are personal.)