As Indian economy gets closer to the coveted $5 trillion milestone, it finds itself entangled in a precarious position. It has consistently topped the list of the world’s fastest growing economies, yet the spectre of inflation has cast its shadow, threatening to trip the economy into stagnation. This dilemma is woven into the Reserve Bank of India’s state of the economy report which depicts both the vibrancy and vulnerabilities of the Indian economy.

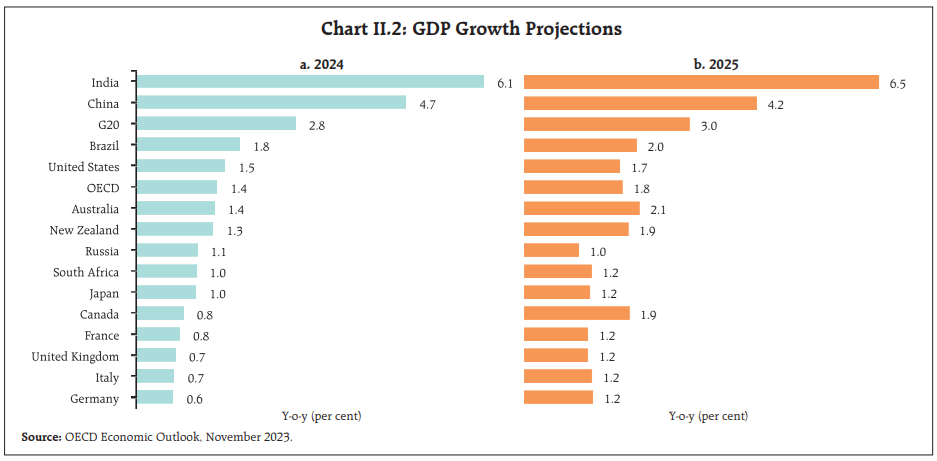

On the one hand, India’s growth story remains compelling. With a revised 7% real GDP growth in 2023, it stands as the fastest-growing major economy, a testament to its inherent resilience amid global turbulence. The report projects a 5.4% headline inflation for FY24, a number that while challenging, signals a potential decline in the subsequent year. The financial sector exhibits commendable stability, with non-performing assets under control and credit growth on an upward trajectory. These glimmers of hope point towards an economy brimming with potential, poised to ascend to even greater heights.

READ I India must balance GDP, climate goals with rising public debt

Indian economy faces sticky inflation

However, the lurking inflation casts a shadow. The 6.95% CPI in October 2023 paints a stark picture, eroding household purchasing power and acting as a brake on manufacturing activity. Food and beverages have become price storm clouds, fuelled by a volatile cocktail of external pressures and domestic supply chain disruptions. The RBI’s efforts to tame the beast through interest rate hikes are commendable, but the central banking is walking a perilous tightrope – every step towards price stability threatens to stifle the flames of economic expansion.

While India’s overall economic picture shows promise, a deeper look reveals disparities within. The urban pockets that drive much of the growth have witnessed a rise in jobs and opportunities, but rural areas often lag behind. This uneven distribution of benefits can exacerbate inflationary pressures in urban centres as demand outpaces rural supply. To address this, investments in rural infrastructure, agricultural modernization, and skill development are crucial. Encouraging migration of surplus labour from rural areas to urban sectors with open job opportunities can also ease supply constraints and boost rural incomes.

The situation warrants a precarious balancing act by the RBI which demands more than just monetary tools. It necessitates a collective effort from policymakers, businesses, and households. The government must craft policies that are not just growth-oriented, but also inflation-sensitive. Streamlining regulations, boosting agricultural productivity, and investing in infrastructure will not only unlock new avenues for growth but also address the supply-side constraints that contribute to inflationary pressures.

Govt, businesses must act in concert

Businesses, the engines of economic dynamism, must adapt with agility, embracing innovation and efficiency to navigate the shifting market dynamics. Households, informed and engaged, can contribute by adjusting their spending patterns, prioritising necessities over frivolities, and playing their part in promoting price stability.

The situation has made the long-promised structural reforms necessary. Unleashing the potential of land, labour, and agriculture can unlock new avenues for growth, boost productivity, and attract the investments needed to fuel the next leg of India’s economic journey. Additionally, fostering a pro-business environment, characterised by streamlined regulations and efficient logistics, will act as a catalyst for entrepreneurial spirit and drive innovation.

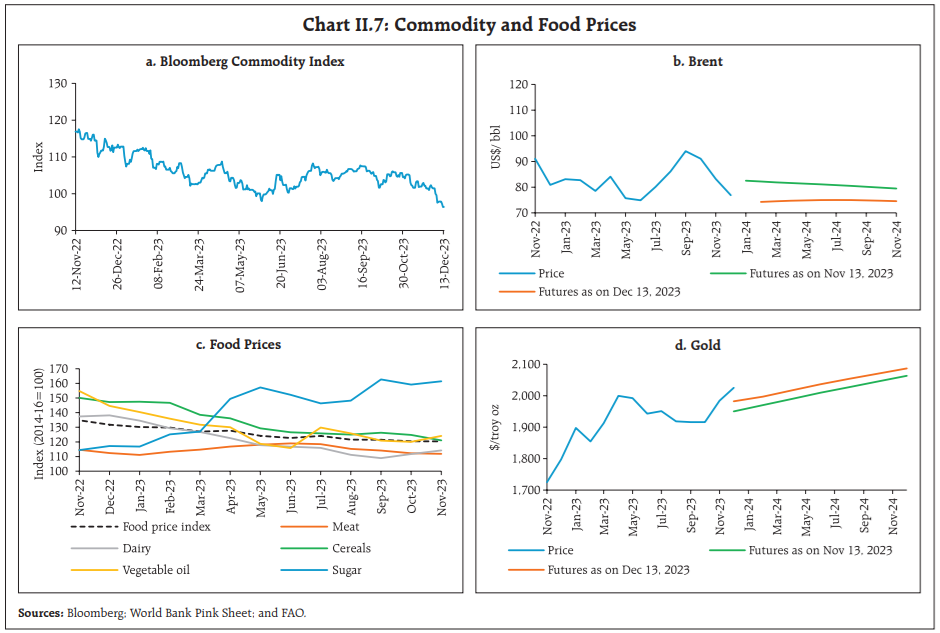

Beyond domestic factors, India’s economic path is inextricably intertwined with the global landscape. The ongoing war in Ukraine, rising geopolitical tensions, and global trade disruptions pose additional challenges. India’s dependence on imported inputs like fuel and fertilizers can amplify inflationary pressures when global prices fluctuate. Diversifying trade partnerships, promoting domestic manufacturing of essential goods, and investing in renewable energy sources can mitigate these risks and foster greater economic resilience.

Ultimately, India’s economic destiny rests not on the shoulders of one actor, but on the synchronised steps of a collective effort. By acknowledging the challenges, embracing bold reforms, and working together, India can achieve its economic journey towards a future of sustained growth, stable prices, and shared prosperity. The potential is undeniable, the path perilous, but with unity and determination, India can cross the tightrope, leaving behind the shadows of inflation and stepping into the sunlight of a vibrant, stable, and prosperous future.