As India emerges from a world battered by pandemic disruptions and geopolitical uncertainties, its economic health is under scrutiny. There is a growing concern about India’s burgeoning public debt, which stands as a testament to its development ambitions. But, India’s external debt position is generally considered to be sustainable as it is well-structured, with a long average maturity of over 5 years.

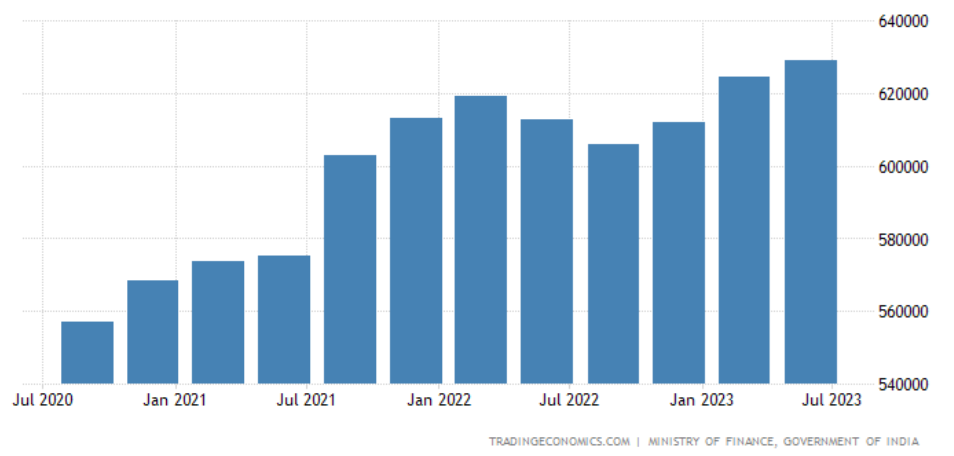

As of June 2023, India’s external debt stood at $629.1 billion, or 18.6% of GDP. This is way below the internationally accepted safe threshold of 60% of GDP. India has plenty of time to repay its external debt obligations as its average maturity is more than 5 years. Additionally, a large portion of India’s external debt is denominated in rupees, which reduces the country’s vulnerability to currency fluctuations.

India’s total external debt ($ million)

A significant portion of this debt is long-term, ameliorating immediate rollover risks and instilling a sense of stability. It provides the Indian economy with the leverage to propel growth without the suffocating pressure of short-term repayment deadlines. Moreover, a fair amount of this debt is owed not to capricious markets but to foreign governments and international institutions, often under favourable terms.

READ I India’s public debt: A strategic approach for fiscal prudence

Red flags in external debt

Yet, the rising tide of commercial borrowings has rightfully sounded alarms. These market-driven debts come with the vagaries of fluctuating interest rates, and with global monetary policy tightening, the burden of these obligations could swell, testing India’s fiscal fortitude.

The government, cognizant of these challenges, is not resting on its laurels. It is working on multiple fronts: enhancing exports and Foreign Direct Investment (FDI) to bolster foreign exchange reserves, deepening domestic debt markets to reduce dependency on foreign funds, and implementing economic reforms to improve productivity and growth potential.

Moreover, the Reserve Bank of India’s efforts in managing and diversifying debt have been commendable. The increase in long-term debt and a decrease in the short-term debt ratio to foreign exchange reserves underscore a strategic shift towards more sustainable borrowing practices. Additionally, the external debt to GDP ratio’s slight decline provides a shard of optimism, hinting at a debt profile that grows proportionately slower than the economy itself.

However, there are undeniable risks on the horizon. A sudden surge in global interest rates could amplify repayment costs, while an economic downturn could weaken India’s foreign exchange earnings, compromising its debt servicing capabilities. Moreover, the spectre of a global financial crisis could induce capital flight and exacerbate financing difficulties.

To navigate these challenges, India must harness its demographic dividend, channel investments into technology and infrastructure, and maintain a judicious mix of internal and external borrowing. Fiscal prudence, combined with strategic growth initiatives, is imperative. Diversifying the economy, pursuing digital transformation, and investing in human capital development are critical to bolstering resilience against external shocks.

India’s external debt scenario is a delicate dance between leveraging global capital for growth and safeguarding against potential external sector vulnerabilities. The nation’s policymakers are walking a tightrope, balancing ambitious development with the imperative of fiscal sustainability.

The path ahead for India is not predetermined towards a crisis. Rather, it is a path that requires meticulous navigation, with a clear-eyed view of the risks and a steady hand on the policy levers. India’s economic journey is far from reaching a distressing crossroad. With astute management, the current external debt can be an instrument of growth, not a chain of constraint.

The nation’s current state of external debt is, therefore, not an outlier, but a reflection of a larger global dynamic, with India as an active participant in the international financial system. While the balance is delicate, the tools at India’s disposal and the country’s track record give room for measured optimism.

The risk of a debt crisis in India appears low but it is not to be trivialized. India must continue to deploy a combination of strategic debt management, economic reform, and resilience-building to ensure that its external debt remains a vehicle for sustainable development rather than a vortex of fiscal instability. With deliberate actions and informed policy choices, India can continue to tread a path of prudent economic expansion, avoiding the pitfalls that have ensnared less vigilant economies.