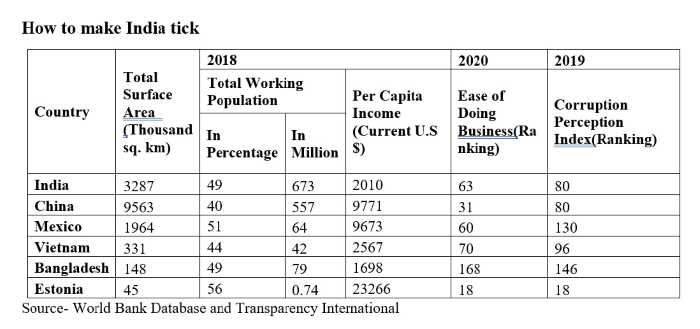

The twenty-first century is touted as an Asian century with China and India occupying pride of place in the world economy. While China has taken great strides to become a manufacturing powerhouse, India has, so far, failed to achieve its potential. Now China is facing the ire of the world for mis-handling the new coronavirus outbreak and many developed countries, which were hitherto fully dependent on China for their manufacturing needs, are exploring alternative production hubs. Surprisingly, countries such as Vietnam, Mexico, Bangladesh and Estonia are preferred over India by several multinational corporations as their manufacturing hubs. What makes these countries tick? What can India learn from them?

Learning from others

Businesses are run by profit motive. China had just 100 multinationals operating within its territory in 1980 and the number has swollen to a million by 2019. China provides land and basic infrastructure to foreign investors. The availability of abundant labor at reasonable wages helps the production units stay profitable. The numerous tax breaks, grants, low-cost government loans, and subsidies also help. China also boasts of a strong workforce, both in terms of numbers and quality. The sheer size of China’s population makes it an attractive destination for investors. The large market attracts capital into high-end industries such as healthcare, information technology, engineering, and luxury goods.

Now, consider the reasons why multinationals are pursuing other countries. In Vietnam, companies enjoy tax incentives extending up to 30 years and tax holidays in some cases. An exemption for import duty is allowed for 5 years. Free land is offered in some cases, while others are given incentives for 15 to 19 years. Incentives are offered to employ women and members of minority communities.

READ: Can India match Chinese success in post-Covid global economy?

Mexico has a vast network of highways and a good number of ports at the Gulf of Mexico and the Pacific. The country shares a long border with the US and allows duty-free imports. Tax concessions and financial assistance are offered to exporters, and certain industries are offered free land at industrial parks across the country. In addition to NAFTA, Mexico has free-trade agreements in place with many countries.

Bangladesh provides tax holidays for nearly 7 years, calculated from month of production. It also offers concessional import duties and tax exemptions. Special facilities and venture capital support are provided to export-oriented industries under ‘thrust sectors’ and foreign investors. The companies can avail loans from local banks on easy terms. Similarly, for foreign direct investment, there is no limit for foreign equity participation, i.e. 100% foreign equity is allowed.

Estonia consistently ranks as a world leader in human capital, digital capability, and ease of doing business. A majority of the workforce is multilingual, and the value-added is high. Estonia recently ranked first in Europe for entrepreneurial employee activity and competitiveness. Design, engineering and digital expertise are increasingly integrated, making Estonia a leader in the fields of IOT, block chain and telecommunications. Estonia boasts of capabilities in research, development and application of software, high-tech systems, digital identity technologies and telecommunications. Estonia has a history in trade, which is now being augmented with modern integrated supply chains, making it a preferred location for doing business with the Nordic region and Germany. Estonia has the most competitive tax code amongst OECD countries and a strong investment-grade credit rating. Estonia also offers e-residency which permits starting a company from anywhere in the world, accessing business banking and easing declaring taxes online.

READ: Covid-19: An opportunity for battered banks to reinvent themselves

Businesses make a beeline to these favored destinations because of the possibility of making profits. Then, the issue to be considered is why China or other countries provide financial and infrastructural support to multinationals. The reason is that the cost incurred in attracting and retaining multinationals is easily covered by the benefits. The most important benefit is employment generation followed by meeting domestic demand and earning foreign exchange through exports that can be used to fund imports as well as for buying foreign assets. The income from foreign assets, excess foreign exchange reserves and source of supply chain gives the host countries economic clout and geo-political power. In 2012, China accounted for 40% of official global foreign exchange reserves. The cycle sets in, and as one industrialist explained, China does not have factories, it has industries and industrial towns. The sheer magnitude of production helps reap the economies of scale and a level of efficiency that no other country can match. To achieve the scale of production and global integration, the policy makers have to plan at a grand scale.

Why India is not a natural alternative

There are many reasons. First, there is a lack of modern infrastructure and network of roads. The banking system is not considered as welcoming and advanced as those in the favored destinations. The other reason is a casual approach to work where workers are not disciplined or focused during working hours. Similarly, there is also a constant complaint that Indians do not meet deadlines and that they are lax in supplying goods as well as making payments. Third, the country is also facing a hostile global press that overplays the negative aspects of the sociopolitical developments in the country. Fourth, there is red tapism that makes it extremely difficult to do business in India. The memory of retrospective tax and Vodafone case has not yet been forgotten by the multinationals. The recent developments in the telecom sector and some court rulings gave India the image of a rent-seeking state.

READ: Coronavirus impact: Indian economy may prove doomsayers wrong

A roadmap for India

The COVID-19 pandemic has changed the status quo and many business practices would change. The alternatives are explicitly being explored. Some countries like Japan have set up special funds to assist companies interested in relocating their business from China. So, India needs to actively pursue an aggressive policy to market itself as an alternative.

The first and foremost is the image building exercise that India has to adopt. To begin with, India should build on the Swachh Bharat image and project the clean and hygienic cities that it has now, unlike in the past. India should use its embassies and diplomatic missions across the world to interact with multinationals and foreign governments and sell the idea of doing business in India. The twin strategy should follow a laser-beam approach to focus on specific multinationals, especially those operating in China. A road show approach should be adopted in countries from where India can expect multinationals to come to India. In both the strategies, the focus should be on arithmetic precision to show how India will help the multinationals improve their profits and costs will be minimized. The focus should be on better facilities, tax incentives, subsidies and infrastructure that the competitors are offering. India has to market its technically skilled labor, abundant availability of cheap labor force, and efforts to build a world-class infrastructure.

READ: Amid coronavirus gloom, a great opportunity beckons India

The vast but untapped Northeast can be promoted as a base for production activity. Trade Associations, which are interlinked globally, should be able to showcase India to similar associations abroad. The two stock exchanges in India, should also be able to attract multinationals. The successful experiment with export processing zones can be replicated and the incoming multinationals can be assured of quality infrastructure. The financial stability, presence of financial institutions across the country and strong sectoral regulators such as the RBI, SEBI, and IRDA should also be highlighted.

India will have to undertake an image building exercise to show to the world that things are changing. The infrastructure is becoming modern. The global media has to be convinced that India has emerged and negative blitz against India will harm global welfare. India is a large country and has substantial unmet demand in the hinterlands. Huge investments are needed to meet this demand and to employ the millions of Indians who join the country’s workforce every year. To achieve its potential to be a global economic powerhouse, India should engage foreign companies in a mutually beneficial partnership.

Dr Charan Sigh is a Delhi-based economist. He is the chief executive of EGROW Foundation, a Noida-based think tank, and former Non Executive Chairman of Punjab & Sind Bank. He has served as RBI Chair professor at the Indian Institute of Management, Bangalore.