By Susmita Dasgupta

There is no apparent reason why steel prices are rising the way they do. The Covid-19 pandemic has the economy on its knees — projects are stalled, earnings have fallen, and so have investments. The prices of raw materials are holding with a sharp downward trend. There has been no increase in the prices of electricity or labour. Interest rates are holding steady or falling. In short, nothing justifies the steep rise in domestic steel prices.

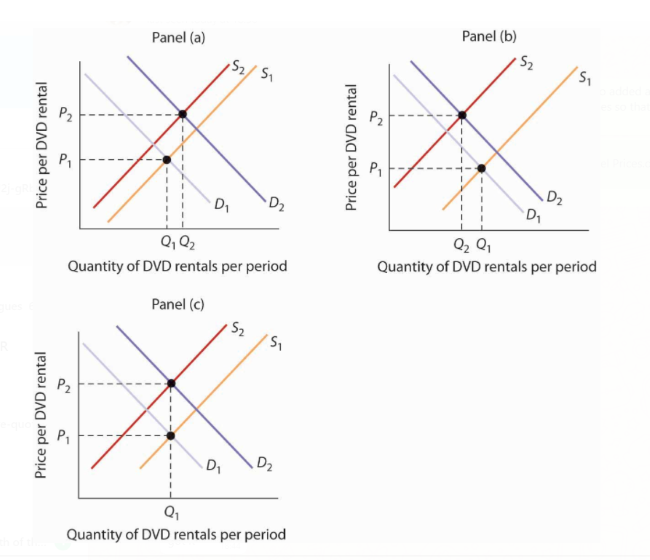

There has been no increase in costs. The only reason for steel prices to rise would be supply shortages owing to the partial shutdown of plants. Flight of labour, disruption in transport, and lack of demand saw plants cutting production, leading to shortages. Only a few plants led by energetic entrepreneurs are making procurements. Rakes are lying empty and trucks are parked away in lots. The demand also has fallen. According to economics texts, lower demand and lower supply will see a new equilibrium. The prices at the new equilibrium will depend on the slope of the demand and supply curves. Slope of curves represent elasticities, or the response of supply and demand to changes in prices.

READ I 4G spectrum will help Indian Railways step up safety, security

Can high steel prices be justified?

The diagrams below explain the situation. It has demand and supply curves in normal times and in pandemic times. Both demand and supply shrink when the prices rise as quantities produced and consumed are lower. Thus, with a contraction in both demand and supply, prices tend to rise. We represent prices on Y axis and quantity on the x axis. Due to cutbacks in both demand and supply, there is a fall in volumes. Prices are bound to rise when both demand and supply fall. That is what has happened.

Global prices of steel rose steeply in the second half of the financial year ended March 2021. The prices of hot-rolled coil in the US market rose from $550 a tonne in May 2020 to more than $1,600 in May 2021. During the same domestic prices were hovering around Rs 70,000-71,000 per tonne. The demand for steel products had picked up during the period, but the second wave of Covid-19 led to a fall. The demand for steel products in the domestic market is expected to pick up in the second half of the current financial year. The industry sees this price differential as an opportunity to raise prices.

READ I Hard lessons: Layers of government must work in tandem to beat Covid-19

Steel prices swayed by signals

Indian markets are encountered with an abnormal rise in prices that needs to be explained. Once there is an increase in price logically delivered by market forces, stories do the rest. Story after story report the price rise, fanning the discourse of shortages. Stories have their cues; they are often coded communication between the speaker and the listener.

In the recent elections in West Bengal, the BJP leaders campaigned that cow urine cured Covid-19. They were saying this only on television. The impact was instant as cowherds across the state packed pouches of cow urine and sold these at Rs 25 to Rs 40 per unit. There was neither belief nor ideology in the story of cow urine, it was just a hint for people intending to do business.

Similarly, the sudden announcement that SAIL was winding up its sales office was also a cue to create panic. There is no way the sales office of SAIL could have affected prices as transactions happen through dealers and material sourced through plants and stockyards. Yet this story had the impact of sending steel prices through the roof. News items on the sale of public sector facilities also created panic about supplies in the market. Economies that have booming stock markets against falling GDPs are bound to be swayed by fiction.

Earlier this year, MSME minister Nitin Gadkari had flagged the issue of cartelisation by big players in cement and steel industry. Cement and steel producers are exploiting consumers by charging high prices despite no significant increase in power or labor costs. This is a clear sign of cartelisation in the industries, he had said in January. He had indicated that the government may set up a regulator for the two industries.

(Dr Susmita Dasgupta, Former Joint Chief Economist, Joint Plant Committee, ministry of steel. The views are personal.)