The Covid-19 crisis began with a global financial market convulsion which involved plunging asset prices, gyrations and capital flows to emerging markets and strains in the treasury market in the US. Capital account volumes exploded to unprecedented levels that were both positive and negative. Strong policy action by advanced economies and countercyclical responses by emerging and developing economies pulled the world back from the brink of complete economic disaster. Lockdowns imposed by governments across the globe in response to the pandemic involved big losses.

The global financial market is in an expansive phase, but it changes turn when major central banks begin to tighten the monetary policy. Emerging markets and developing economies will be particularly vulnerable to an uneven global rebound in which inflation pressures in richer countries (mainly the US) lead to a sharp tightening while economic conditions are more subdued in the low- and middle-income countries. The world economy cannot remain reliant on exceptional policy action — financial market resilience badly needs strengthening.

READ I RBI holds interest rates, braces to back govt borrowing

Where financial markets stand today

The explosive growth of international markets especially in the 1990s and 2000s kept up till the global financial crisis occurred. After growing sharply until 2008, asset stocks grew more slowly since then. They have been rather flat for emerging markets and developing economies whereas in richer countries, they continued to grow albeit at a much slower rate. However, recent data from the US is useful and indicative and pertains directly to the crisis period. The US Treasury data provides a fairly unique view on the capital account of the US and how it behaved around the time of the initial Covid-19 crisis.

US resident transactions in US assets were much higher than US resident transactions in foreign assets. This reflects the centrality of the US capital market and dollar assets in the world economy. At the height of the crisis, where there were big spikes, looking at the transactions in the US asset markets, the numbers reached roughly $7 trillion. The monthly volume of trading is huge in these markets. Markets need to be capable of handling these volumes or transactions in a crisis. In the spring of 2020, the markets were facing a strain. The Federal Reserve had to come in with ad hoc and special facilities to handle the situation.

Capital inflows to 26 emerging market economies between 2014 and 2021 soared as central banks in the advanced economies cut interest rates. One notable feature of the response of emerging markets to the Covid-19 crisis was that the central banks mounted unprecedented countercyclical policy programmes. These consisted of interest rate cuts, quantitative easing purchases (mostly of sovereign debt), sometimes in close coordination with fiscal authorities. Indonesia even allowed a direct purchase of government debt by the central bank.

The central banks carried out liquidity enhancing operations, macro-prudential earning (e.g., relaxed capital requirements), market function enhancements, along with responses by fiscal authorities. Some US measures such as Fed foreign exchange swamps for selected countries helped. In March 2020 (known as the dash for cash period), it became hard for foreign central banks that held treasuries as reserves to even sell them at liquid prices. The Fed set up a special repo facility for foreign central banks to be able to do so.

READ I Spectre of inflation comes back to haunt Indian economy

Covid-19 response

The macro response to Covid-19 represented a welcome countercyclical response unlike in the past, especially in the 2008-2009 crisis. Many central banks cut interest rates even as their currencies depreciated, showing the value of exchange rate flexibility. One could ask whether emerging markets are now in a brave new world where we should think of them as equivalent to advanced economies in terms of their ability to navigate global financial markets and capital flows.

This would be a bit premature as emerging markets started in a relatively strong cyclical position. They built on a track record of inflation credibility as well as impressive growth in policymaker skill. Additionally, they surfed on the wave of incredibly aggressive monetary and fiscal actions in advanced economies, driving interest rates to very low levels that are expected to persist.

We should recognize that emerging market finances were stretched by the crisis and there has been scarring which could worsen over time. The governments had to provide fiscal support to their economies and health expenditure was exceptionally high. Revenues fell as a share of GDP and there have been supply-chain-driven inflation pressures. In terms of long-term growth, one thing to worry about in many emerging market countries and some advanced market countries is that the disruption of education due to lockdowns is going to be an impediment to growth.

There are financial stability risks that are worrisome. A lot of government debt resides in emerging markets banking systems. This has been pointed out by a number of analysts and institutions such as the IMF. (Global Financial Stability Report, 2021) Credit easing during the crisis may confront authorities with harsher trade-offs later when interest rates rise. It is great to open up the spigot of credit to all to meet their financial commitments later when interest rates go up. So, there will be an issue of possible zombie borrowing. The same is true for macro prudential easing measures that were taken in many cases.

Uneven vaccine access and low fiscal space will magnify the unevenness of the global rebound. The global community has really failed in terms of effectively getting vaccines to many emerging market countries, particularly low-income countries in Africa. Aside from the moral and human dimensions of this, we all have self-interest in this too because large unvaccinated populations can be breeding grounds for new variants like the Delta and Omicron.

READ I Budget 2022: A pathbreaking document, but for wrong reasons

There is a general issue to be discussed about the global architecture of public health and how the global community can enhance it and prevent the vaccine nationalism seen throughout the world. If you look at India, it has some wonderful facilities for producing vaccines like the Serum Institute and we need such facilities in more countries when the next pandemic hits — and it certainly will hit.

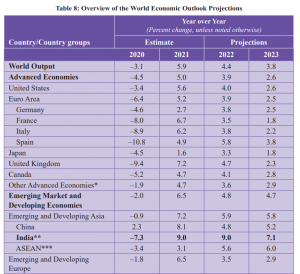

The debt-to-GDP ratio in advanced economies rose sharply during the pandemic. The emerging markets also witnessed a similar rise in public debt during the crisis. However, in many emerging nations, with the exception of developing Europe, the levels of public debt had been rising since the middle of 2010s. There are different reasons for this but one notable reason is that over the first decade of this millennium, rapid growth in emerging and developing economies led to a fall in the debt-to-GDP ratios which, in turn, led to a growing middle class and demands for government to do more.

This created an environment of slower growth; government debt levels rose and now they are high. The levels tend to be lower for emerging and developing economies. The percentage increase in debt-to-GDP ratios was comparable to those in advanced economies. There are a number of emerging markets and frontier markets that have very high debt levels. For e.g., Ghana is approaching a 90% debt-to-GDP ratio which is a worrisome situation.

The global financial cycle is a potent factor linked to capital flow surges and stops. Co-authors Ellen Rey, and Sylvia Miranda-Agrippino (BoE) have developed an index of the Global Financial Cycle which is called GFCy. It uses a latent factor model to show that a single global unobservable but measurable factor drives asset and commodity prices to such a degree that it explains more than 20% of their variance. They used asset prices from a large range of securities and commodities. Global Financial Cycle Indicator is derived without reference to output at all. It is based on asset and commodity prices. The coherence between the GFCy and the actual GDP growth is fairly remarkable.

Emerging economy growth is very closely linked to the global financial cycle. There’s an ECB working paper by Beatrice Schoebel and co-authors which also constructs the quantity-based measures of GFCy. A paper by Davis et al. in the Journal of International Economics computes a global factor for GFCy and another for energy prices. There are two factors behind capital flows — one of these is very much correlated with the Miranda-Agrippino and Rey measure and the other is correlated with energy. These account for large fractions of the variance of gross capital flows in advanced economies (50%) and emerging markets (40%).

It is important to think about how the US monetary policy affects the world economy. The nominal exchange rate of the dollar as an indicator of the global financial conditions emerge from the thinking that when the dollar is strong, global financial markets are in retraction and when the dollar is weak, they are in expansion.

There is a negative correlation between the normalised GFCy and the dollar nominal effective exchange rate. The dollar’s exchange rate is strongly negatively correlated with global trade. This probably reflects in a number of factors like dollar invoicing and world trade, availability of trade credit, and effective US financial conditions on global investment. When the dollar is strong, global commodity prices tend to plunge.

Tackling inflation

Interest rates will see a rise in advanced economies (especially in the US). As global interest rates rise, public finances and emerging markets will be stressed, possibly leading to a crisis. Dollar appreciation is going to be a potent channel by increasing the real value of dollar debts that many corporates and some governments have.

Currently, US policy is still accommodative. So, we are still in an expansive stage but capital flows to emerging markets have already begun to contract. This is going to be a particular problem if the Fed and other central banks fall behind the curve on inflation and tighten abruptly. US tightening raises risk premia in emerging markets.

The supply chain-driven inflation pressures that all countries face will be an additional challenging factor for emerging markets and developing countries as well as for food prices. There is currently a spike in global food prices which is only comparable to the spikes in 2011 and 2007-2008. For emerging markets, failing to tighten monetary policy could erode hard-won credibility.

Non-bank financial institutions have become increasingly big drivers of capital flows, yet they are not regulated. Reforming the market for US Treasury — the world’s safe asset — is needed. Enhancing the Global Financial Safety Net (GFSN) with the IMF at its centre is also an important step required. Rethinking the use of capital flow measures together with monetary and macro prudential policies is important.

The prospect of liquidity problems morphing into solvency problems means that the infrastructure for restructuring sovereign debt needs to be rethought. In any such solution, China is critical because it is now providing lending to many nations, particularly lower-income countries. Exchange rate flexibility remains essential. Macro policy success require luck, but the more we prepare, the luckier we will be.

The Fed will do a 25 basis points hike in March after the jobs report which had 467,000 jobs created in January despite the Omicron crisis. This is an incredible number and it is way above market expectations. Moreover, the December job numbers were revised upwards. A 50 basis points hike will be avoided at this stage because that would create panic in the markets.

(Maurice Obstfeld is professor of economics at the University of California, Berkeley. He was Chief Economist at the International Monetary Fund.)