S&P Global Ratings on Wednesday cut India’s growth forecast for 2022-23 to 7.3% from its March projection of 7.8%. The rating agency cited persistently high inflation and high commodity prices triggered by the Ukraine crisis for the cut. It also raised its consumer price inflation estimate for the country by 90 basis points to 6.3%.

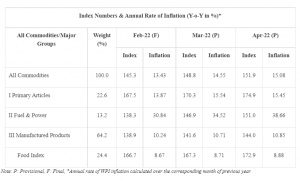

Inflation based on the Wholesale Price Index recorded a new peak of 15.1% in April, extending its double-digit run to the thirteenth month running. The retail inflation rate for the month was 7.79%, which is the highest in eight years. Most of the blame would fall on the elevated global commodity prices and a heat wave in the northern parts of the country that is pushing the prices of vegetables, fruits, and milk.

India can ill afford the prices to rise as it will make the prices of essential food items beyond the reach of the poorest sections of the society. If the inflation continues unabated in double-digits, the RBI will have to resort to rate hikes in its June monetary policy committee meeting. Soaring prices had forced the central bank to call an unscheduled meeting on May 4 and hike the repo rate by 40 basis points and the CRR by 50 basis points.

READ I Mancession to shecession: Why did pandemic recession hit women harder

With the Russia-Ukraine war showing no signs of abating and the country facing a heat wave, bringing down inflation is not possible without strong policy measures that could adversely affect the recovery of the Covid-ravaged economy. The extreme heatwave in the northern parts of the country saw temperatures soaring above 50C in several parts. This March was the hottest since India started to maintain records in 1901.

An article, State of the economy, published in the RBI Bulletin on Tuesday, gave glimpses of the future policy direction. It said controlling inflation, along with better infrastructure and macroeconomic stability, is critical for triggering growth. It said the Ukraine crisis has put the global economy under a cloud by pushing commodity prices and disrupting global supply chains. Emerging economies like India may see capital outflows and higher commodity prices that may push the inflation further, the article said.

Spectre of inflation grips world economy

Soaring commodity prices are riling most world nations, forcing them to take unprecedented steps. India announced a ban on wheat imports as its traders rushed to benefit from a 50% increase in global wheat prices. Indonesia imposed a ban on palm oil exports as prices began to shoot through the roof. The emerging market economies are the biggest losers of the Ukraine war, triggered by reckless decisions and superpower rivalries.

READ I FSSAI sides with industry, puts consumers at risk

Inflation has assumed global dimensions with the rate touching 8.5% in the US and 7.8% in Europe as the prices of raw materials rose by 16%. The prices of Steel and Lithium increased by 250% and 98% compared with those in the previous year. Since the beginning of the wat on Ukraine, crude oil price crossed $100 per barrel mark. It is estimated that global energy prices will rise by a half this year, the steepest increase in more than 50 years.

Both Russia and Ukraine supply several essential commodities to the rest of the world. Together, they account for a third of global wheat supplies. Russia is the major source of oil and natural gas to Europe. The war and the NATO sanctions against Russia has disrupted the supply of these essential commodities, pushing inflation to levels unseen in several decades. If the war doesn’t end soon, the world could see a repeat of what it witnessed during the oil shock of 1970s.

As discussed earlier, this will need some extreme measures that could lead to a hard landing. World nations will be forced to choose financial stability over growth. This will be a particularly difficult situation for the emerging markets as they need sustained high GDP growth to pull the poorest sections of their populations out of poverty. Many experts expect central banks to choose stagflation or recession over runaway inflation.

Prachi Gupta is an Assistant Editor with Policy Circle. She is a post graduate in English Literature from Lady Shri Ram College For Women, Delhi University. Prachi started her career as a correspondent with financialexpress.com. She specialises in policy impact studies.