The Federal Reserve has been raising the benchmark interest rate aggressively since May 2022. The Fed has raised the policy rate by 275 basis points in the last 3 months as inflation soared from 1.67% in February 2021 to 9.1% in June. Similarly, the European Central Bank (ECB) and the Bank of England (BOE) have raised the policy rates by 125 basis points each during the period.

Most countries have already raised policy rates to tackle runaway inflation. Japan continues to maintain an ultra-loose monetary policy while Russia (to boost exports) and China have lowered the benchmark rates.

An analysis of the countries that raised the interest rates reveals that high inflation is a consequence of the expansionary monetary policy that the US, ECB, BOE and others had been following since 2008. The US economy had been experimenting with complex derivative products such as asset- and mortgage-backed securities since early 2000 and has suffered the consequences of financial engineering and soft-touch regulation in 2008.

READ I NPAs: Delays, haircuts will lead to tight lending norms

The balance sheet of the Federal Reserve quadrupled between 2008 and 2012 and then doubled from $4.31 trillion in March 2020 to $8.82 trillion on September 6, 2022.

The aggressive hikes in policy rates by the advanced economies, especially the US, have rattled the exchange rates across the world. The reserve currency of the global economy, the dollar, is strengthening while the euro, the pound sterling, as well as the rupee are depreciating along with many other major currencies. Interestingly, the price of gold (generally seen as a safe haven) has been declining in the last few weeks, along with the price of crude.

Domestic economy and interest rates

In sharp contrast with most other countries, India’s economy has been performing well in recent years. India is the fastest growing economy despite the Covid-19 pandemic crisis and all forecasts show that the growth trend will be steady in the next two years. Industrial production measured in terms of IIP is also recording healthy growth. Sectors related to infrastructure such as cement, steel, and electricity are performing well.

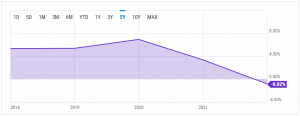

India real interest rate

Inflation measured by wholesale price index (WPI) is declining both for food and fuel in recent months. Inflation based on the consumer price index (CPI) for food and all-commodities is below 7% which implies that domestic inflation is around the upper band of the inflation target. This cannot be compared with the advanced economies where inflation is 4-5 times the targets/trend.

The exchange rate is volatile and going by the depleting foreign exchange reserves, the RBI seems to be attempting to control the volatility. However, the rupee has breached the psychological barrier of Rs 80 to the dollar. The inflation differential between the US and India for long has been in the range of 4-5% which implies a correction in the exchange rate.

READ I Weak rupee leaves few policy options for RBI

The exports are performing well despite the slowdown in destination countries and the current account deficit is expected to be contained at 3.5% in the current financial year. The financial sector, a reflection of the real sector, is performing well by all indicators and NPAs are expected to decline.

What should the RBI do now

The market players in India are recommending a 50 basis point hike to match the 75 bps hikes by the US and ECB and 50 bp hikes by BOE, Australia, New Zealand, Brazil, and Indonesia. This assessment is problematic for the following reasons:

- The argument that interest rate differential between the US and India needs to be reduced so that capital flight does not take place is unsubstantiated. The policy hike by the US since May 2022 is 300 bps while that by India is 140 bps and that by BOE and ECB is 125 bps. It seems the differential is already factored in.

- The difference in the real policy rate is another consideration. The real policy rate in India is around (-)1.50% while that in the US is (-)5.3%. In normal times, real interest rates range between 0.5-2%. Thus, these are abnormal times and absurd real interest rate differentials would not matter on a monthly basis.

- The inflationary pressures in India are not due to expansionary monetary policy (as in the US) or fiscal policy (as in the UK), but because of the rise in commodity prices triggered by the Russia-Ukraine war, and thus temporary. These would be corrected as the war ends.

The correction in the prices of crude oil have already begun and that due to food would ease with the new harvest of wheat in the next 6 months. In contrast, corrections in prices in the US and UK are expected to correct in 15-18 months because the reasons are embedded in expansionary monetary and fiscal policy. Hence, the response in India must be different from that in advanced economies.

The Indian economy is performing well in terms of various parameters. It is hoped that the RBI will not succumb to the prodding of the markets or to the temptation of narrowing the interest rate differential. The rise in policy interest rate will kill the nascent recovery in India, as housing and business investment will suffer. The rich countries are engineering a recession because they can afford high unemployment rates through allowances.

The rise in policy rate will negate the hard work put in the past by the RBI and the government is calibrating a balanced/measured stimulus which is not too restrictive nor aimed at flooding the markets. The robust results are out there seeking celebration. The blind imitation of the advanced economies is not desirable and India should stand its ground confidently. The foreign investment comes to India not because of interest rate differential, but for the strong fundamentals and growth potential.

Dr Charan Sigh is a Delhi-based economist. He is the chief executive of EGROW Foundation, a Noida-based think tank, and former Non Executive Chairman of Punjab & Sind Bank. He has served as RBI Chair professor at the Indian Institute of Management, Bangalore.