Anxieties and expectations abound in the runup to budget presentations, and the situation in Kerala this year was no exception. Usually there would be discussion on the state of the economy before the presentation of the budget, with the Economic Review prepared by the State Planning Board being tabled on the previous day. This time this did not happen as the Assembly was not in session. However, there were indications about the state of the economy that have been confirmed by the Economic Review presented by finance minister KN Balagopal with Kerala Budget 2022-23 on March 11. The Review says:

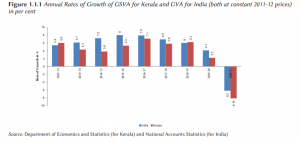

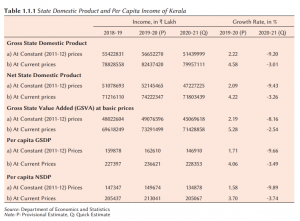

The Covid-19 pandemic has inflicted a shock to the economy and severe stress on state finances, with Kerala’s economy suffering a contraction in Gross State Domestic Product (GSDP) in 2020-21 in relation to Budget Estimate of 2020-21. The contraction in GSDP could have been more severe but for the economic stimulus of ₹20,000 crore announced at the early stage of the pandemic in March 2020. This stimulus package targeted the most vulnerable and also benefited the entire society and greatly reduced the impact of Covid-19 on GSDP.

The Economic Review further noted that notwithstanding the economic insecurity compounded by natural calamities, the state took all possible measures to ensure the well-being of the people ignoring fiscal prudence. The uncertainties disrupted the state’s normal revenue receipts, and Covid-induced fiscal measures increased the government’s expenditure obligations. The Review pointed out that “policies and events beyond the control of the state government have affected its fiscal health.

READ I Budget 2022 misses the point on education, innovation

Challenges to cooperative federalism

The implementation of the Goods and Services Tax (GST) has brought restrictions and limitations on the intervention of states in raising their taxes”. It was also noted that the delay in getting the GST compensation put additional pressure on the state finances. The Review stated that though the Union government collects a substantial amount of revenue through cess and surcharges, but “the share of revenue from cess and surcharges is not part of the divisible pool of resources that is shared with the states”. The shareable net proceeds to Kerala have been continuously falling. During the 15th Finance Commission period the share of horizontal devolution has shrunk to 1.925% from 2.5% during the 14th Finance Commission period, causing a significant loss to the state’s revenue receipts.

The state of the economy presented by the Planning Board was a clear indication that there were great limits to the government’s revenue generation amid a host of challenges from national and international situations. This would have naturally been reflected in Kerala Budget 2022-23. Some of the statements made by the finance minister on the eve of the Budget also evoked fears that the government would be compelled to come up with major taxation proposals and austerity measures. Fortunately, that did not happen.

More importantly, some of the major sources of the state’s income that do not reach the exchequer properly eluded the attention of the finance minister. This is, of course, not the first time that such issues go unnoticed. For example, a major loss of revenue comes from tax evasion by commercial establishments, and this has apparently gone up with the introduction of GST. The ailing economy of the state would find a substantial leg up if proper mechanisms of tax surveillance and vigilance over bureaucratic meddling (by way of corruption) were put in place.

READ I Easing of public debt burden will cause economic disruption

Pandemic, war pose challenge

The state budget (2022-23) document turned out to be the development vision of the Left Front government. The finance minister made his initial observations in reference to the global situations caused by the pandemic as well as the Ukraine conflict. While he was confident that the changing conditions of the post-pandemic world would cause a transition from solitude to togetherness, he expects that this would lead to wealth creation and increased income for people and the state. He highlighted the risk from a possible fourth wave of Covid-19 and the inflationary potential of the Russia-Ukraine war.

Curiously, the finance minister’s first statement of an allocation came with a brief note on the Russia-Ukraine war which, he said, has pushed the world towards a possible World War II with nuclear weapons. Mr. Balagopal allocated Rs 2 crore for a global peace conference on nuclear disarmament and world peace.

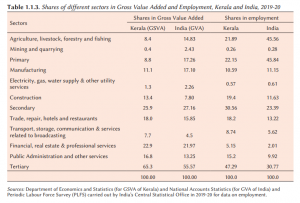

The Budget speech echoed the Left Front government’s short-term and long-term strategies for achieving the goals set for the coming years and not just for the current financial year. Many of the budget proposals have a long-time span which means that subsequent budgets must also take care of additional allocations. The Planning Board Review already indicated that with the beginning of a series of setbacks — starting with the introduction of the goods and services tax (GST) regime, demonetisation, shortfalls in fiscal federalism, natural disasters, Covid-19 and with the outbreak of the Ukraine war — the long-term prospects for the Kerala economy are anything but reassuring. Yet there are positive notes in the budget. These are evident in the new schemes put in place in a wide range of sectors — from health and higher education to information technology, agriculture, industry, fisheries, and cooperatives.

READ I Universal pension can transform Indian economy

Over the last three decades, the Left Front governments in Kerala have encountered problems in negotiating between the challenges of a neoliberal order, recessionary trends and the welfare agenda of the state. This is crucial when the budget deficit has been increasing for several years, if not decades. The state’s debt has also been skyrocketing for a long time. The Planning Board says that Kerala’s outstanding debt liabilities at the end of 2020-21 were ₹2,96,900.85 crore. Amid the burgeoning budget deficit and escalating state debt, the government adopted an approach that says the state cannot keep itself in fear, but must be forward looking with development projects, however contentious they might be. The allocation of ₹2000 crore for the controversial Silver Line project is a case in point.

Here, the state finance minister has followed the path charted out by his predecessor TM Thomas Isaac who used to say “money is not a problem” in any development project. In fact, the institutionalisation of the Kerala Infrastructure Investment Fund Board (KIIFB), patterned on a business mode, was critical in instilling confidence in ‘doing business’ in all sectors of the society and the economy. The finance minister’s Budget speech has given a clear signal that all major development projects including in higher education and knowledge economy infrastructure have a circuit trail of KIIFB. But do we have any concern about who should eventually bear the long-term liabilities of KIIFB-based projects, by way of interest and repayments?

Kerala Budget 2022-23: Focus on knowledge economy

The Kerala Budget 2022-23 seeks to bring in major changes in the higher education sector with a view to ensuring that the pay-offs of research should be utilised for the productive sector. When Balagopal says that the quality of higher education should be beneficial for practical life, he gives the message that universities and research institutions should be cost-effective and be incentivised for their output in terms of production. As the author has already commented on the subject, the idea of translational labs and incubation centres that promote entrepreneurship is a clear indication of the direction in which universities will have to traverse. Though such proposals follow the Union government’s overall approach, it is not clear whether the state will adhere to the National Education Policy (NEP) 2020 which emphasises multidisciplinary universities, colleges, and liberal arts programmes.

The Budget has proposals for setting up IT hubs and science parks. Surely in an ecologically sensitive state, we cannot afford to have mega industries that spell disaster for our bio-eco system. In the Budget, knowledge economy is again emphasised with the objective of strengthening the value-added production of the state and its domestic income. While such initiatives are generally welcome, the question whether liberal arts and multidisciplinary programmes need to be sustained remains unanswered. The budget is apparently muted on the question insofar as many universities and institutions of higher education are compelled to negotiate between the persistent disproportional allocation—between science and social sciences/humanities. This can already be seen in the very pattern of sanctioning new programmes and courses. While emphasising quality spinoff in higher education, the most crucial question is whether the universities in Kerala have the intellectual wherewithal to resist political pressure.

The Budget follows the Left Front government’s broad approach that there should be consistent government intervention in varied spheres of the economy — distressed quite frequently by recession, pandemic, war, and reverse migration. Therefore, the primacy given to sectors shattered by global reversals is the bright side of the budget. However, there might be criticism that the allocation for containing inflation (to ensure food security) is insufficient for a massive middle-class population as well as for the poor. Yet many would tend to see it as a good beginning in terms of state intervention rather than a return to austerity mode. The subsidies being offered to rubber cultivators and other agriculturalists could be a reasonable step (though there were criticisms that such allocations in the past remained on paper and did not yield any positive outcome).

Admittedly, Kerala’s productive sectors have enormous opportunities to develop and mature, given the state’s manpower and technology spinoffs. The most challenging job of the government is to generate capital to carry out its short-term and long-term development projects. Likewise, if revenue generation is the key to the state’s development policy, it must reinforce the existing tax collection measures to offset the shortfalls in GST compensation from the Centre. However, with KIIFB at its disposal, the Pinarayi Vijayan government is apparently in high spirits to move ahead with its agenda of Nava Keralam and the associated development projects. But only time can tell how such financing can best serve the real economy of the state.

The author is ICSSR Senior Fellow and Director, Inter University Centre for Social Science Research and Extension (IUCSSRE), Mahatma Gandhi University, Kerala. He also served as Dean of Social Sciences and Professor of International Relations and Politics at Mahatma Gandhi University.