Kerala finds itself grappling with a significant fiscal challenge due to its diminishing share of central tax revenue, attributable to its population decline. The reliance on population data from the 2011 Census of India for tax allocation has triggered concerns among southern states, particularly Kerala, where stringent population control measures have resulted in a decline in population growth. Consequently, Kerala is at a disadvantage, as states with larger populations are favored in tax allocation, regardless of other pertinent parameters.

The 15th Finance Commission‘s recommendations, based on various criteria including income distance, population, demographic change, fiscal capacity, area, and developmental needs, play a pivotal role in determining the distribution of tax revenue among states. For horizontal devolution, the Commission suggested 12.5% weightage to demographic performance, 45% to income distance, 15% each to population and area, 10% to forest and ecology, and 2.5% to tax and fiscal efforts. The share of states in central taxes is recommended to be 41% for the 2021-26 period. However, cess and surcharge collected by the Union government are not included in the divisible pool and hence are not shared with the states.

READ I RBI dividend bonanza: Infrastructure boost or inflationary threat

Population data and the 15th finance commission

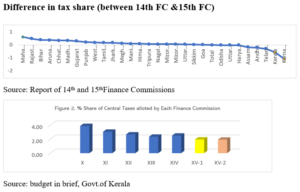

The state’s revenue sharply declined, falling to 1.925% in the 15th Finance Commission from 2.5% in the 14th Finance Commission. Kerala’s diminishing share of the divisible pool, aggravated by rapid per capita income growth, underscores the challenges faced by the state. Despite its commendable achievements in healthcare and education, Kerala is facing an acute fiscal crunch.

In the income distance criterion, Kerala ranks second highest after Haryana. Under this criterion, Karnataka’s share is 1.093, while Kerala’s is 0.57. Kerala suffers greatly in this regard, exacerbated by rapid per capita income growth. The state’s ageing population presents additional fiscal challenges.

With an increasing number of elderly citizens, Kerala faces rising healthcare and social security costs. These demographic changes necessitate greater financial support to maintain the high standards of social welfare and public health that Kerala is known for. The current tax allocation formula does not adequately account for these evolving demographic needs, further straining Kerala’s fiscal resources.

In Karnataka, the increase in income offsets population growth, whereas in Kerala, the decrease in population overshadows income growth. The income distance criterion is based on the equity principle, meaning states with the lowest income receive a larger share. Despite ranking tenth in terms of income level alone, Kerala’s low population rate skews its position when income is measured per capita. This results in Kerala being treated as the highest in income distance, thereby receiving a disproportionately low share of tax proceeds.

Is Kerala getting shortchanged?

The crux of the issue lies in the unequal distribution of tax proceeds, primarily dictated by population metrics. The use of outdated population data for tax distribution is another critical issue. Relying on the 2011 Census data does not reflect the current demographic realities and growth trends of states. This outdated approach disadvantages states like Kerala that have experienced significant demographic shifts. Updating the data to reflect more recent census results or implementing a rolling average of population figures could provide a fairer basis for tax distribution and better address the dynamic population changes.

While states like Kerala have diligently pursued population control policies, their efforts seem to be overlooked in the current formula, which favors states with larger populations. This discrepancy not only disincentivises states’ exceptional merit in areas such as population control and human capital but also undermines the fundamental principles of fiscal federalism.

System must reward progress, not size

The current system overlooks states’ efforts and achievements in human capital development. Kerala’s investments in education and healthcare have yielded significant benefits for its population, yet these contributions are not adequately rewarded in the tax allocation formula. Recognising and incentivising states that excel in human capital development could foster a more balanced and equitable distribution of resources, encouraging other states to prioritise similar initiatives.

For instance, multiplying tax effort by the 2011 population and scaling demographic performance by the 1971 population has resulted in favoring large populated states, seemingly surpassing other states despite questionable reflections of their true performance criteria. The inequities inherent in the current tax allocation criteria underscore the need for a more nuanced approach that considers states’ evolving demographic and economic landscapes. States like Kerala, with a growing elderly population and a focus on human capital development, require special attention to ensure equitable resource distribution.

It is imperative for the Finance Commission to revisit its criteria for tax allocation, considering the principles of fiscal federalism and the specific needs of each state. This may entail reconsidering the weightage assigned to population data and adopting a more holistic approach that factors in variables such as income distance, performance criteria, and demographic trends. Alternatively, compensating through grants could be considered to address inter-state disparities or to support highly meritorious cases.

(Shamna Thachaparamban is assistant professor at Gulati Institute of Finance and Taxation, Thiruvananthapuram.)