State of the Indian economy: The government received higher net direct tax collections by 11.2% in the first two and a half months of this financial year, with advance tax inflows for the first quarter of 2023-24 rising 13.7%. It has collected Rs 3.80 lakh crore so far this fiscal year in direct taxes, indicating increased economic activity.

The news comes right on the heels of higher dividends from public sector undertakings (PSUs) which will also bolster government revenues. The government is also expected to receive an all-time high equity dividend of Rs 63,056 crore from 67 listed PSUs for FY23, highlighting not just the financial health of the PSUs but also the economic activity in the country.

READ | PSUs to pay Rs 63,056 crore election year dividend windfall to govt

In fact, several other indicators also point towards economic recovery, making India a rare bright spot at a time when major economies around the globe are facing the possibility of a recession. India is the fastest growing major economy in the world and has outperformed most other G20 nations in the last two years.

While there is some breathing space for policymakers and the government, several threats also loom large over the Indian economy.

There are several positives to cite for the Indian economy. It has shown resilience in the face of global challenges, and is expected to achieve a real GDP growth rate of 7.2% in financial year 2022-23. This growth rate is way higher than the 7% rise projected by the National Statistical Office (NSO). According to the latest NSO data, India posted a higher-than-expected GDP growth rate of 6.1% in the January-March quarter. This commendable growth can be attributed to robust investment and private consumption. On the supply side, the agriculture and services sectors remained strong, while the manufacturing sector faced some pressure due to high input costs.

Concerns with Indian economy

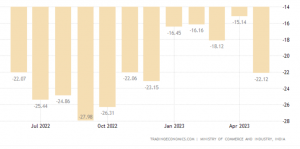

However, causes of concern for the Indian economy also loom large. India’s goods trade deficit in May 2023 stood at $22.12 billion which is the highest in the past five months. There is also growing concerns over the slowing demand for Indian services in the global market which is reflected in lower growth of remittances this year. India’s services exports in May 2023 reached a multi-month low at $25.3 billion, raising serious concerns about the stagnation of the country’s much-touted services exports and the potential widening of the current account deficit.

India merchandise trade deficit ($ billion)

A slowdown in services exports will also have a trickle-down effect on urban consumption, as the IT sector plays a vital role in employment generation. Services exports are gradually aligning with the weaker trend in goods exports overall. The growth of services exports fell to 0.7% year-on-year in May from 7.4% in April and 26.7% for the entire 2022-23.

Although India’s trade performance witnessed strong growth in FY23, it has been on a declining trend in FY24. Factors contributing to this decline include a high base, geopolitical tensions, and recessionary fears resulting from monetary tightening, which have led to a decrease in consumer spending across advanced nations.

Moreover, there are immediate concerns that could hinder economic prospects. The deviation in monsoon patterns due to the Biparjoy Cyclone is one such concern. Predictions of El Nino effect this year raise concerns of below-average monsoon rain this year and its potential impact on the Indian economy. The effect could lead to subpar monsoons, which will quickly impact agriculture and rural consumption. Reduced yields of rice and pulses due to poor rainfall may cause price increases and contribute directly to inflation.

While India is among the fastest growing world nations, many millionaires seem unconvinced. Reports show that many ultra-rich people are leaving the country for places like Dubai. According to the Henley Private Wealth Migration Report 2023, it is projected that 6,500 Indian millionaires will leave the country. India trails only China on this list, with an expected 13,500 millionaires leaving this year. Analysts attribute the migration of High Net-Worth Individuals (HNIs) to various political, social, and economic reasons.

It is important to note that true growth should be considered equitable, which has not been the case for India. The country’s growth has predominantly benefited a select few, failing to translate into significant progress for the poor, particularly in rural India. The government needs to frame policies that ensure that the benefits of a booming economy reach all segments of society, rather than just a privileged few.