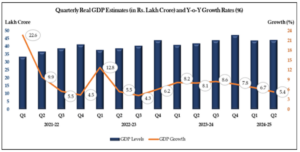

India’s economic growth stumbled in the July-September 2024 quarter, with GDP expanding at just 5.4%, the slowest pace in nearly two years. While the government has blamed global headwinds and inflationary pressures, numbers point to a deeper malaise: the shrinking and financially strained urban middle class.

Private consumption, which accounts for nearly 60% of India’s GDP, has been a significant growth driver. However, the urban middle class — the backbone of this consumption — faces stagnating real wages, mounting household debt, and surging costs of living. Reports indicate that real wage growth in India has been negligible, at just 0.01% over the past five years. This stagnation has severely eroded purchasing power, compelling households to cut back on discretionary spending.

Even consumer-focused firms like Nestlé India, Hindustan Unilever, and Colgate-Palmolive have noted a slump in demand. Nestlé India’s managing director candidly referred to the phenomenon as India’s shrinking middle class, highlighting a crisis that threatens broader economic stability.

READ I Trump 2.0: India braces for trade tussle with US

Challenges to Indian middle class

Several inter-related factors have combined to stall middle class growth and, by extension, overall GDP growth.

Food inflation remains alarmingly high at 10.87%, disproportionately impacting middle-income households. This has forced consumers to prioritise essentials over discretionary goods, with ripple effects across the economy.

India annual inflation rate

Elevated interest rates, necessitated by the Reserve Bank of India’s (RBI) inflation-targeting framework, have made housing, consumer loans, and other forms of credit prohibitively expensive. An oversupply in residential real estate markets has created affordability issues, limiting investment and consumption in this critical sector.

Increasing automation in white-collar jobs and the rise of artificial intelligence (AI) are squeezing employment opportunities for the urban middle class, further dampening income levels and spending capacity.

Policy responses and mis-steps

While the government has attempted to stimulate growth through public spending, fiscal constraints have limited its capacity. Central government capital expenditure during April-October 2024 was 15% lower than the previous year. States, burdened by high revenue expenditures from populist schemes, have also scaled back infrastructure investments.

At the same time, the RBI’s tight monetary policy, aimed at curbing inflation, has inadvertently constrained credit growth and dampened consumer sentiment. The central bank finds itself in a policy bind: cutting rates risks fuelling inflation, while maintaining high rates stifles already subdued private consumption.

The slowdown also raises uncomfortable questions about the structural underpinnings of India’s recent growth trajectory. The boom of the past three years—characterised by 7%+ growth—was fuelled by loose monetary and fiscal policies, as well as a surge in global liquidity. With these stimulants now withdrawn, the economy appears to be reverting to its potential growth rate of 6.5%, exposing vulnerabilities in private consumption and investment.

Adding to domestic pressures are external challenges, including global economic uncertainty and the threat of Trump-led US tariffs, which could disrupt India’s export-driven industries. Rising oil prices and rupee depreciation further constrain fiscal and monetary policy options.

Policy imperatives for revitalisation

The current crisis offers an opportunity for introspection and course correction. Policymakers must address the structural issues that leads to the middle class squeeze to reignite sustainable growth.

The government should prioritise reforms that enhance productivity and create high-quality jobs, particularly in manufacturing and technology sectors. Wage stagnation, a core issue, requires targeted interventions, including upskilling initiatives and labour market reforms. The RBI could consider incremental measures such as reducing the Cash Reserve Ratio (CRR) to inject liquidity without compromising inflation control.

Expanding tax relief or offering targeted subsidies for middle-income households could alleviate immediate financial pressures and boost consumption. Policies aimed at curbing real estate speculation and promoting affordable housing could also reinvigorate urban consumption and investment.

The government must urgently ramp up infrastructure spending to stimulate demand and crowd in private investment. State capacity should be strengthened to ensure efficient implementation of growth-enhancing initiatives.

India remains the fastest-growing major economy globally, but the slowdown in GDP growth and middle class consumption reveals cracks in the foundation. The urban middle class, once a reliable engine of growth, needs targeted support to regain its economic footing. Failure to act decisively risks prolonging the slowdown and undermining India’s long-term growth potential.

As the government and RBI prepare their next steps, the focus must shift from temporary fixes to structural reforms that address the root causes of the middle class crisis. Only then can India restore its growth momentum and chart a sustainable path forward.