The Pakistan economy is teetering on the brink of collapse, facing a slew of daunting challenges such as skyrocketing inflation, acute balance of payments crisis, rapid currency depreciation, massive debt obligations, and a shortage of foreign exchange reserves. This downturn can be attributed to a multitude of internal and external factors, notably political and economic instability, persistent deficit financing, severe income inequality, and the devastating floods of 2022. To stabilise the economy in the medium term, critical steps include restoring the democratic process, reforming expenditure patterns, and prioritising key sectors.

Pakistan achieved independence in 1947 alongside India, but its first democratic elections did not occur until 1970s. Since then, Pakistan has had 29 prime ministers, none of whom completed a full 5-year term. This political instability has contributed significantly to the country’s economic woes. With each change in government, new policies often contradict the previous administration’s decisions, leading to economic disasters and ongoing instability.

Between 1960 and 1990, Pakistan experienced an average annual growth rate of 6%, placing it among the top 10 fastest-growing developing nations. During this period, the economy transformed, with the agricultural sector’s share dropping from 50% to 20%. However, since the 1990s, Pakistan has lagged behind in most economic indicators, experiencing sluggish growth, mounting debt, persistent trade deficits, and continuous currency depreciation.

READ I BRICS expansion could benefit India, but at a cost

Covid adds to Pakistan economy’s problems

The COVID-19 pandemic further slowed growth, causing a contraction in 2020. Although growth resumed in 2021, it was hampered by increasing debt burdens and political instability in 2022. The current situation can be summarised as follows: Pakistan’s economy is in intensive care, politicians are in conflict, and the people are crying out for help.

Pakistan is the world’s fifth most populous country, with a population of approximately 143 million people. Of these, 35 million are food insecure, with 8 million facing emergency levels of food insecurity, according to the United Nations. Poor individuals are particularly hard-hit by existing economic issues such as inflation, unemployment, currency depreciation, and forex depletion. When they lose their jobs, those living paycheck to paycheck suddenly fall into poverty when economic slowdowns occur.

READ I Online gaming: India needs innovative approach to regulation

Economy burdened by deficits

Economic policies have often prioritised short-term objectives, neglecting long-term growth prospects. Pakistan consistently runs high fiscal deficits, and the accumulation of debt necessitates significant adjustments to achieve fiscal sustainability in the medium term. Pakistan’s fiscal deficit increased by 115% in the first quarter of 2022-23.

In addition to fiscal deficits, Pakistan continually grapples with a trade deficit. According to the Pakistan Bureau of Statistics, Pakistan’s trade deficit reached $2.8 billion in December 2022. Pakistan’s exports consistently fall short of its imports, contributing to a persistent deficit. To address external trade imbalances, the country adopted a devaluation strategy, raising manufacturing costs by increasing the prices of imported raw materials, particularly machinery. Additionally, high-interest rates were implemented due to substantial public borrowing to finance fiscal deficits, leading to financial crowding out and reduced savings for private investment.

Persistent inflation, rupee slide cause of concern

Pakistan is grappling with soaring inflation and a severe balance of payments crisis. While Pakistan’s Ministry of Finance had forecast inflation to remain between 21% and 23% for 2023, actual inflation reached a 50-year high. In March 2023, prices had risen by 35% compared with the previous year. Food inflation stood at 40%, exceeding the overall inflation rate, and transport prices surged by 41% in December 2022.

Pakistan’s inflation ranks second in Asia, trailing only Sri Lanka’s 50.6%. To combat this rampant inflation, the State Bank of Pakistan raised the policy rate by 3% to 20% in April 2023. Despite these measures, inflation remains difficult to contain, forcing people to allocate a significant portion of their income to food expenses, adversely affecting their living standards and reducing funds available for education, healthcare, and other basic necessities.

Adding to the economic challenges is the sharp depreciation of the Pakistani Rupee. In 2022, the rupee depreciated by approximately 30% against the dollar. In January 2023, Pakistan removed the artificial cap on its currency, causing the PKR to plummet by 20% against the dollar in just a few days. By the end of December 2022, the PKR had weakened to 224.40 against the dollar, and as of now, it stands at 283.86 to $1. In 2023, Pakistan’s currency has been the worst-performing in Asia, while in 2022, it was India’s currency that held that dubious distinction.

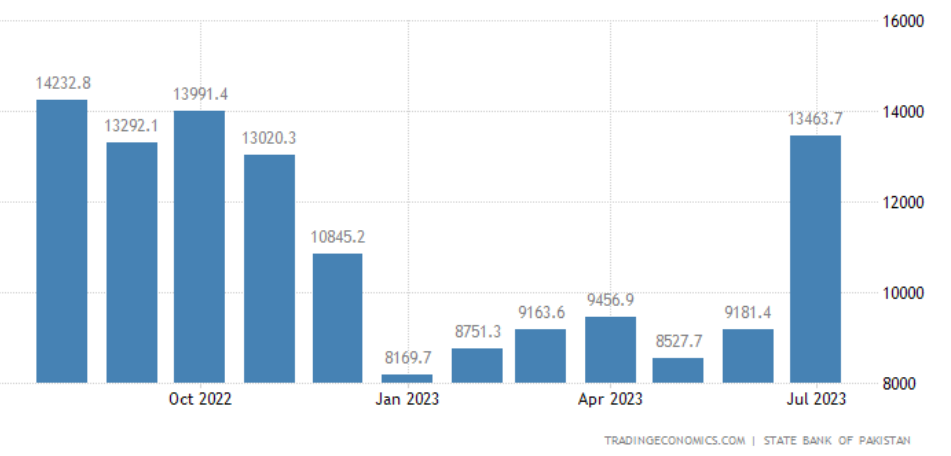

Pakistan’s depleting forex reserves

The relentless depreciation has depleted Pakistan’s forex reserves significantly. At the end of March 2022, reserves stood at $11.425 billion, dwindling to $6.715 billion by December 2022, and currently, Pakistan holds only $3.25 billion in forex reserves. This amount is sufficient to cover only three weeks of imports, forcing the country to limit essential imports, which directly impacts various industries, including textiles and mobile assembly.

Foreign Direct Investment (FDI) is another potential source of forex, but Pakistan’s FDI has plummeted by 44% in 2023, with figures dropping from $1.22 billion in 2022 to $68.3 million in 2023. FDI tends to flow to countries with high global rating agency ratings, and Pakistan’s rating has declined due to its dwindling forex, increasing the risk of debt default.

The depletion of forex reserves and reduced imports have led to the closure of many factories, resulting in widespread job losses. In February 2023, Pakistan’s largest petroleum refinery, Cnergyico, temporarily closed due to a lack of foreign exchange reserves and currency depreciation, making it challenging to purchase crude oil. Analysts warn that the textile industry may collapse due to insufficient funds for essential imports, rising electricity costs, and the elimination of the energy subsidies that were previously provided to the sector.

It is estimated that over one million people could lose their jobs in the textile sector. In October 2022, the All Pakistan Textile Mills Association (APTMA) reported that 1,600 garment factories nationwide had shuttered due to the removal of electricity subsidies, resulting in the loss of five million jobs. In December 2022, APTMA again reported that mills were operating at less than 50% capacity utilisation. According to the Pakistan Institute of Development Economics (PIDE), youth unemployment in Pakistan exceeds 31%, with an overall unemployment rate projection of 8.5% for 2023.

Experts say Pakistan’s economy is on the brink of collapse, as reflected in growth projections from various international organisations. Recently, the World Bank revised Pakistan’s GDP projections for 2023 from 2% to a mere 0.4%, citing ongoing economic challenges, low forex reserves, and significant fiscal and current account deficits as primary reasons.

The Asian Development Outlook for April 2023 forecasts Pakistan’s GDP growth at a sluggish 0.6% in 2023, down from 6% in 2022, with inflation and unemployment projected at 29.5%. The latest projections from the International Monetary Fund (IMF) estimate a 0.5% GDP growth rate and 27% inflation for 2023. These forecasts paint a grim picture for Pakistan’s economic prospects.

While not everyone in Pakistan is suffering economic distress, the country paid a substantial $1.2 billion for imported cars in the last six months despite its economic collapse. The IMF’s managing director commented that those who are prospering in the public or private sector should contribute to the economy, and subsidies should benefit the poor rather than the wealthy.

Pakistan is plagued by high income inequality, with the poverty headcount ratio increasing significantly. Pakistan’s performance lags behind other Asian economies, with the richest 10% being 16 times wealthier than the poorest 10%. Pakistan’s Gini coefficient, a measure of income inequality, is the worst among comparable countries, standing at 29.6, compared to 32.4 for Bangladesh, 35.7 for India, and 38 for the world as a whole.

Several factors have contributed to Pakistan’s economic woes. The catastrophic floods of 2022 destroyed a substantial portion of crops, leading to food shortages and soaring food prices. These floods also displaced millions of people, leaving them without shelter. According to a World Bank report, the 2022 floods affected 33 million people, displaced 8 million, and caused $15 billion in damage. Pakistan received $10 billion in flood relief from various countries and international institutions.

The COVID-19 pandemic further exacerbated Pakistan’s economic challenges. While countries with stronger economic foundations fared better and were able to revive growth post-pandemic, Pakistan’s economy contracted by 0.4% in 2020 compared to a positive 1.9% in 2019. Pakistan suffered a 50% drop in exports and lost one-third of its revenue due to the pandemic and associated lockdowns.

Domestic political instability has also played a significant role in the economic downturn, with the ousting of Prime Minister Imran Khan in April 2022 and the global rise in fuel prices due to the Russia-Ukraine war further straining Pakistan’s economy. Pakistan’s reliance on fuel imports exacerbated the situation, increasing product costs and pressuring forex reserves. Ongoing tensions with India have also resulted in missed opportunities for intra-regional trade and investment.

Pakistan’s dependence on external debt has been a longstanding issue, driven by factors such as corruption and income inequality. Over the past 25 years, Pakistan’s debt has increased fivefold, averaging a 14% annual increase while GDP growth barely reached 3%. This situation has led to an unsustainable debt burden, with one-third of the budget allocated to debt servicing, exceeding the entire federal government revenue in the fiscal year 2022–23.

By the end of December 2022, Pakistan’s external debt reached 17.87 trillion PKR, and it increased to 20.69 trillion PKR by the end of January 2023. Long-term loans reached 27.51 trillion PKR, with 30% of foreign debt owed to China. Pakistan faces the daunting task of repaying $22 billion in 2023.

Pakistan is currently grappling with multiple economic challenges, including high inflation, unemployment, a significant current account deficit, fiscal deficits, currency depreciation, mounting external debt, and dwindling forex reserves. The short-term outlook hinges on a $1.1 billion aid package from the IMF, part of a $6.5 billion loan program. However, Pakistan has struggled to meet the IMF’s conditions, which include establishing an anti-corruption task force, raising electricity tariffs, imposing levies on petroleum products, increasing tax collection, and implementing substantial budget cuts.

To achieve long-term stability, Pakistan must invest in key sectors and human capital formation, shifting focus away from military spending to prioritise education and development. Reforms in expenditure patterns and sector prioritisation are urgently needed to address the country’s economic challenges.

(Aamir Ahmad Teeli is Research fellow, central university of Tamil Nadu. Firdous Ahmad Malik is Research Fellow, National Institute of Public Finance and Policy, New Delhi.)