The Reserve Bank of India kept the key interest rates unchanged and retained its accommodative stance at the first meeting of its monetary policy committee in the new financial year. The decision to maintain the status quo was in line with market expectations. The central bank said it would chart a gradual, calibrated withdrawal from monetary easing over a multi-year time frame. However, with the RBI shifting to a more hawkish stance, markets players can expect a series of interest rate hikes in the coming monetary policy reviews.

The RBI restored the liquidity adjustment facility corridor to the pre-pandemic level of 50 basis points by introducing a standing deposit facility at 3.75%, signaling the intention to absorb excess liquidity from the financial system. The move will result in a 40-basis point increase in overnight rates. The SDF will also allow flexibility to remove liquidity.

READ I Timely action on inflation needed to avert hard landing, says Maurice Obstfeld

RBI holds interest rates

This was the eleventh meeting in a row without any change in policy rates. The last rate cut was on May 22, 2020 when the economy was under the grip of the Covid-19 pandemic. The RBI has maintained the repo rates at 4% since then. The RBI had cut repo rate by 115 basis points to support economic recovery since the Covid outbreak.

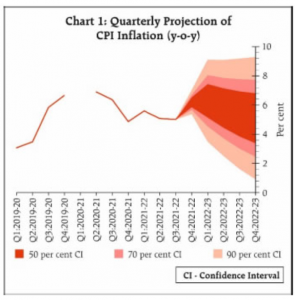

The RBI expects CPI inflation to average 5.7% in the financial year, compared with its earlier projection of 4.5%. Retail inflation will average 6.3% in the three months ending June 2022 and 5%, 5.4% and 5.1% in the subsequent periods. The RBI feels that inflation could be stickier than initially thought.

While the central bank expects crude prices to stay around the $100 mark, the price rise is not limited to fuel items. The rise in crude oil prices triggered by the Russian invasion of Ukraine poses risk to inflation. With geopolitical tension and supply chain disruptions fueling inflationary pressures, supply management steps will be needed to check rising prices.

READ I ‘India’s unemployment crisis an opportunity to create an economic miracle’

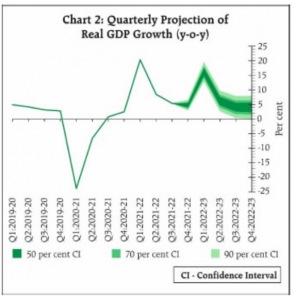

The central bank cut its GDP growth projection for 2022-23 from 7.8% to 7.2%. RBI sees GDP growth of 16.2% in the April-June quarter and 6.2%, 4.1% and 4% in the subsequent quarters. The global economy is facing increased risk with the outbreak of Russia-Ukraine war and the resultant sanctions.

Commodity prices increased substantially, affecting importing nations like India. The volatility in commodity prices reflected in financial markets too. High crude prices, supply chain disruptions, and inflationary pressures have affected advanced economies and emerging markets alike.

Most central banks are struggling with monetary tightening. As a result, sovereign bond yields in advanced economies are hardening. The markets tanked, but witnessed correction recently. The world economy is facing headwinds of uncertainties triggered by the pandemic and geopolitical tension.