Monetary easing cycle set to end: The Russia-Ukraine crisis has presented policymakers with a dilemma as they face spiralling inflation and a decelerating recovery from the economic crisis triggered by the Covid-19 pandemic. Amid the debate on a possible oil price shock, monetary responses and growth concerns, there are several questions that beg for answers. Will the current spurt in crude oil prices lead to stagflation? What should be the monetary stance of an oil importing country like India at this juncture? A quick glance at 30-year trends in oil price movements may help answer these questions.

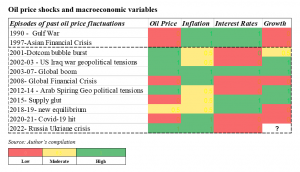

Historically, the rises and falls in crude oil prices were triggered by some specific event. For instance, crude prices rose sharply in August 1990 in response to Iraq’s invasion of Kuwait and the consequent Gulf War. Prices rose sharply in the runup to the US attack on Iraq in 2002-03. Similarly, during the global boom in 2003-07 and geopolitical tensions caused by the Arab Spring (2012-14), crude prices scaled up.

The prices crashed following the Asian financial crisis in 1997, global financial crisis in 2008, the supply glut in 2015 caused by excess production and recently when the Covid-19 pandemic hit. The Russia-Ukraine war led to a sudden spike in crude oil prices to $133 a barrel in March 2022, rising as much as 41% since the start of the tension.

READ I Timely action on inflation needed to avert hard landing, says Maurice Obstfeld

Crude oil prices and imported inflation

Indian economy is heavily dependent on oil imports. India meets around 80% of its energy needs through imports. In 2021-22, crude oil imports accounted for 32% of our total imports. While for the consumer, the impact is largely in the form of fluctuations in the fuel bill, for the economy, the linkages are much more complicated. There are three major channels through which oil price volatility impacts our economy. The first and the most important is the trade channel. An increase in oil prices raises India’s import bill and leads to an increase in its current account deficit (CAD).

The second channel is that of domestic inflation. With fuel prices completely deregulated, an increase in crude prices translates to higher retail prices of petroleum products and hence higher fuel inflation. The third channel is through the government’s fiscal management. Though the impact of this channel has come down after the deregulation of fuel prices, it still plays an important role. Therefore, increase in crude oil prices leads to higher production cost, impairing the supply of goods. Due to higher costs, consumers eventually cut down on consumption, leading to a reduced output, and subsequently the economy goes into recession.

Let us examine what happened historically in the event of oil price hikes. In the 1990s, the Reserve Bank of India (RBI) followed a contractionary policy and subsequently experienced lower growth rate. Nevertheless, in 2001 and 2003, despite higher crude prices, the RBI’s monetary policy was expansionary, given the moderate level of inflation. The expansionary monetary stance helped aggregate demand pick up, offsetting the oil price shock. During the global boom, the RBI was cautious and resorted to a contractionary monetary policy to contain the spiralling inflation, meeting the objective of price stability and growth judiciously.

READ I Courting trouble: Inflation and politics of fuel pricing

Monetary easing and growth concerns

The RBI resorted to an expansionary policy during the Arab Spring in 2012-14 despite high oil prices. Moderate inflation gave the central bank enough headroom for such policy measures which eventually supported GDP growth. From the past episodes of oil price shocks, it is evident that more than the intermittent oil price shocks, prevailing inflation and underlying price pressures in the economy influenced the monetary policy stance. Currently, there is evidence of underlying price pressure in the economy from even before the crude oil prices rose, given the double-digit wholesale inflation and surging retail prices.

Milton Friedman famously said, “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” This is clearly the case with the Indian economy where the shock from the pandemic hit output and the central bank increased liquidity in the banking system through purchases of foreign and domestic assets. Part of the increase in liquidity has seeped into the economy as a rise in currency in circulation.

Since the pandemic struck, money supply growth increased to 16.8% year-on-year in February. At the same time, output contracted sharply and recovery decelerated. Growth in currency held by the public surged 25.7% year-on-year. This indicates that more money is now chasing fewer goods and services, contributing to higher inflation.

RBI has not attempted to combat the rising prices, thinking that it is transitory due to supply chain disruptions and keeping the growth objective in mind. The persisting price pressure in the economy warrants a contractionary monetary policy, despite growth concerns. Therefore, we may be witnessing the end of the interest rate easing cycle, which may leave some scars on growth prospects.

The current easing cycle is deeper in terms of duration than the quantum compared with the previous ones. The sharp slowdown in estimated economic growth along with a significant hit to private consumption due to job losses and an almost-absent private capex activity make a case for the elongated easing cycle. However, the continuation of the easing cycle is restricted, given the sticky inflation situation. Crude oil and commodity prices have not been tamed, causing imported inflation.

The hawkish global rate cycle is prevailing in the wake of rising interest rates in the US, rupee instability and fiscal concerns. Higher spending coupled with a significant shortfall in revenues suggests higher fiscal deficit which is inflationary. Hence, the RBI will take cognizance of these factors in its upcoming meeting (April 6-8th ) and is expected to put an end to the easing cycle of interest rates to arrest the price pressure which is not transitory. Had the price pressure been intermittent, the RBI would have had the headroom for elongating the easing cycle to take care of growth.