RBI MPC meeting: The global economy has witnessed significant changes in the last four weeks, specially after the collapse of Silicon Valley Bank. Since then, efforts have been made to contain the risk to banking in the US. The sale of SVB has addressed all the immediate concerns about the financial sector. The moderate rate hike of 25 basis points by the US Federal Reserve on March 22 reflects the concerns over the Fed action as against the expectation of 75 basis points rate hike.

The moderation in hike despite inflation staying above 6% indicates that the Fed is reconsidering its interest rate trajectory. The UK and Europe have similarly moderated the hike in policy rates despite persistence of high inflation.

READ I Focused policy key to higher private investment, faster growth

RBI must facilitate growth

Domestically the economy is performing well. The performance of fertilisers, coal, electricity, steel, natural gas, cement and refinery products improved in January compared with corresponding month in the previous year. Similarly, the Index of Industrial Production (IIP) has persistently exhibited positive growth in mining, manufacturing and electricity.

The Purchasing Manager’s Index (PMI) – manufacturing at 55.3 in February 2023 is higher than in January and the long-term average of 53.7. The PMI has shown growth in straight twenty months. Similarly, PMI- services at 59.4 in February is higher than in January. Business activity index is at its highest in 12 years. The high-frequency indicators also show a positive trend.

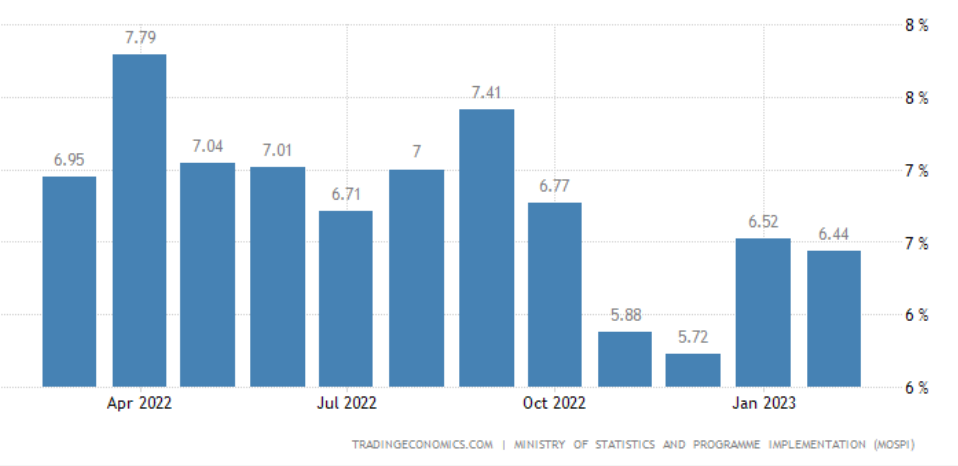

India consumer inflation

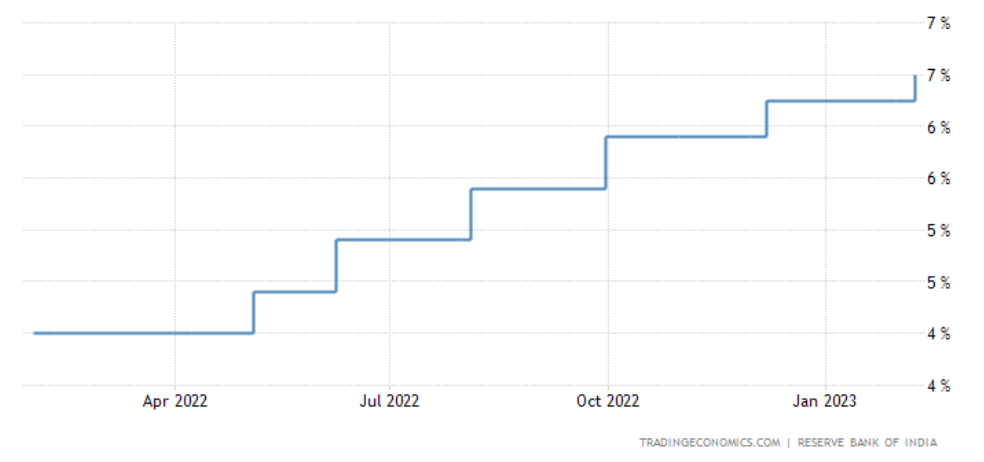

India policy repo rate

The sales of two-wheelers, passenger vehicles, tractors and commercial vehicles grew by around 15% in February from previous month and is expected to be higher in March. There is a concern on the agriculture sector as El Nino weather conditions in the pacific could mean a weaker monsoon.

The fiscal performance of the government is encouraging. The GST collection at 1.5 lakh crore in February 2023 is 12% higher than February 2022. The direct tax collections up to March 10, 2023 reveal that corporate income tax increased by 13.6% while personal income tax by 20.7%.

Consumer Price Index (CPI) shows that inflation is around 6.44% while Consumer Food Price Index (CPFI) is 5.95%, both lower than the January figures. This suggests a decelerating trend. Bank credit is expanding by 15.7% compared with 9.5% in the previous year while deposits are increasing by 10.3% and 8.8% respectively. The oil prices are moderating to $79 from $95 in January, 2023.

Given that the Indian Economy is performing well, the green shoots should be encouraged. An increase in interest rates can lead to stifling of growth which emerging countries like India cannot afford. Indian economy has the capacity to grow above 9% per annum, but because of the global recessionary trend, even the best growth projections hover around 6.1%. The increase in interest rate which causes an immediate pass through to the consumers can dent the growth initiatives.

A 25 basis point hike in housing loan interest can lead to an increase of EMI or lead to restructuring of the loan. In view of the fact that housing is connected with nearly 275 industries with forward-backward linkages, slowing down of the housing sector can impact industry. Similarly, the loan products for automobiles/electronics can have a negative impact on growth.

The meeting of the RBI Monetary Policy Committee has started and the bi-monthly policy is expected to be announced on Thursday. The market anticipates a 25 basis points hike in the benchmark repo rate. The Monetary Policy Committee, in its last meeting, had raised the repo rate by 25 basis points to 6.5%. This was the sixth hike in repo rate in the current rate hike cycle that started in May 2022. The central bank has, so far, raised the short-term lending rate by 250 basis points to rein in runaway consumer prices.

As the Federal Reserve and other important central banks have moderated the increase in the policy rates considering its impact on the financial sector, the RBI needs to consider the impact on the economy and employment. Hence, it’s time for the RBI to press the pause button on interest rate hikes.

Dr Charan Sigh is a Delhi-based economist. He is the chief executive of EGROW Foundation, a Noida-based think tank, and former Non Executive Chairman of Punjab & Sind Bank. He has served as RBI Chair professor at the Indian Institute of Management, Bangalore.