The Reserve Bank of India’s decision to hold key interest rates came as a surprise. Both the RBI and the government are bullish on the Indian economy’s growth prospects. While the Economic Survey projected 8-8.5% growth, the RBI has forecast 7.8% expansion. The world’s fastest growing major economy would be expected to tackle inflation and liquidity imbalances more firmly. By retaining the accommodative stance and keeping the rates unchanged, the RBI is sending out the message that post-Covid economic recovery is too fragile to absorb interest rate hikes.

The western economies are bracing to take on inflation with central banks taking steps to curb easy money and rising prices. The US consumer price index rose 7.5% in January which is a 40-year record, putting pressure on the Federal Reserve to rein in the galloping prices. The index rose 0.6% from December, beating most forecasts. India, closely integrated with the global economy, is sure to have spill-over effects.

READ I Spectre of inflation comes back to haunt Indian economy

RBI dilemma over interest rates

Inflation is emerging as a big threat in India too. The Consumer Price Index rose to 5.59% (just below RBI’s tolerance level) in December 2021 which is a five-month record. Wholesale inflation was 13.56% in December. The RBI chose to ignore the threat of inflation instead of taking decisive steps towards price stability.

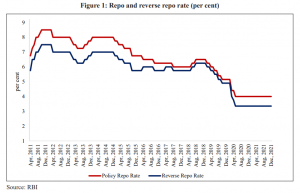

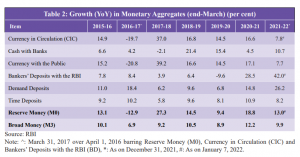

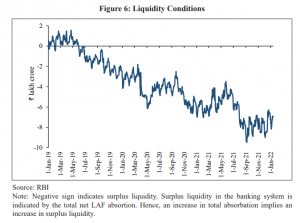

The Monetary Policy Committee decided to keep the repo rate unchanged at 4%. It voted for continuing with the accommodative stance to sustain growth, while keeping the reverse repo rate at 3.35%. There were wide expectations that the reverse repo rate would be cut to absorb excess money from the banking system. The central bank, however, tweaked its market operations to absorb excess liquidity into the system.

While there are various views about the existence of asset bubbles, no one can deny that the prices of some assets look too high, considering the depressed demand conditions in the economy. Rising crude prices, weakening rupee and high input prices are affecting the post-Covid economic recovery. The consistently high WPI inflation may eventually push retail inflation beyond RBI’s upper limit of 6%.

READ I Budget 2022 fails to build on govt’s public health initiatives

The RBI is facing a monetary policy dilemma. If it does not raise policy rates, asset bubbles will be created and if it raises rates, economic recovery may be hampered. Higher rates mean lower growth and higher unemployment. Keeping rates low means postponing an imminent crisis, leading to a crash-landing. The central bank will eventually raise rates as it needs to pull inflation back to 4%. Policy normalisation will happen in phases — liquidity normalisation started in the second quarter of the current fiscal. The RBI has to ensure that a reverse repo rate hike does not impact the economic growth prospects.

The monetary policy is not aligned with that of the US Federal Reserve, ECB, and the Bank of England. Most central banks follow the Fed lead on inflation targeting and interest rates. Low rates and the gap with developed markets will further weaken the rupee, but the RBI has the comfort of $632 billion in forex reserves.

The RBI cannot allow interest rates to soar with the government looking to raise Rs 16.6 lakh crore to finance the budget deficit. RBI will try to limit rate hikes this financial year unless crude oil prices shoot through the roof.

Anil Nair is Founder and Editor, Policy Circle.