Repo rate may stay unchanged: The Monetary Policy Committee of the Reserve Bank of India will hold its bimonthly meeting between June 6 and June 8 in the backdrop of stellar performance by the Indian economy in the last few months. The Q4 GDP growth rate had bettered the projections made by the RBI and independent forecasters. The economy grew at 6.1%, much higher than the expectations of 4.2- 5.1% growth.

High growth rates are observed across various sectors of the economy such as agriculture, manufacturing, construction, trade, and real estate, indicating a widespread and balanced expansion. The stellar Q4 performance by the economy is reflected in the annual GDP growth rate, which is estimated to be 7.2%, surpassing the projected range of 6.8-7%.

READ I India’s stellar Q4 GDP growth rate unveils hidden narratives

Major factors point to repo rate freeze

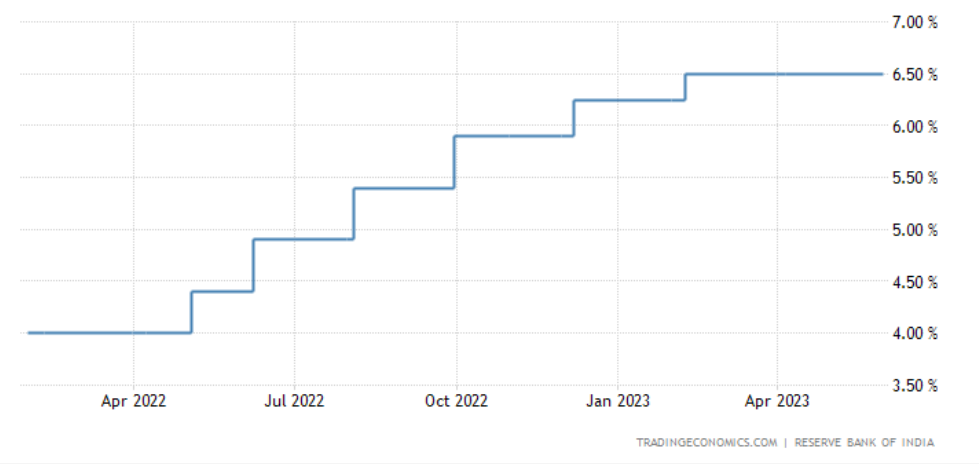

The Reserve Bank had paused its rate hiking spree in April after raising the repo rate by 250 basis points from 4% to 6.50% in 11 months. The rate high by the RBI was in sync with the policy actions by the US Federal Reserve and other central banks of most OECD countries.

On an annual basis, agriculture and real estate have displayed exceptionally strong performance. The government’s fixed capital formation including capital expenditure has shown impressive results, indicating positive prospects and a multiplier effect that can extend over the next few years. Recent data on agriculture reveals record production in crops like rice, wheat, maize, oilseeds, sugarcane, mustard, rapeseed, and soybean.

RBI pauses after 250 bps hike in repo rate

In the industry sector, the IIP has shown improvement, particularly in mining, motor vehicles, transport equipment, beverages, and chemical products. Core industries, excluding crude, have experienced significant growth, with coal, fertilizers, steel, and electricity recording growth rates of more than 8%. On the fiscal front, the economy has performed well, exemplified by the impressive GST collections in May, which saw a 12% increase compared with the previous year.

Total revenue receipts amount to Rs 1.7 lakh crore, while the government’s revenue expenditure stands at Rs 3.1 lakh crore. The proportion of revenue receipts to annual revenue is 6.3%, and for expenditure it is 6.8%. Overall, the economy is beginning to demonstrate robust growth and positive signs of recovery.

The Purchasing Managers’ Index (PMI) in manufacturing for May reached a high level of 58.7, surpassing April’s 57.2 and indicating a strong economic cycle. Stock purchases are expanding at the fastest rate in 12 years, and exports are performing well. The PMI in services for April stands at 62.0, driven by the finance and insurance sectors. The private sector’s PMI output increased to 61.6 in April from 58.4 in March, showing strong performance across different sectors.

Exports reached $65 billion in April, up from $63.75 billion in the same month last year. Imports remained low at $66.4 billion compared with $72.1 billion in April 2022. This leads to a positive trend in current account deficit.

Unemployment figures show a slight increase in April 2023 compared with March 2023, although there are fluctuations in urban and rural areas, according to the CMIE data. However, unemployment has declined in May 2023. Global trends indicate moderation in overall prices, and inflation in India has also moderated across various indices such as the CPI, WPI, CPI-IW, CPI for RW, and CPI for AL. The CPI for food is around 3.8%, which is reasonably under control and close to the target range of 4+/-2%. Inflation, as indicated by food and general WPI, remains low.

Crude oil prices have rapidly declined to $68 per barrel from $103 per barrel last year, while gold prices have recently increased due to global uncertainty. The US Federal Reserve, as well as regulators of the UK and Euro area, is adopting a more moderate approach to interest rate hikes, and India should consider these trends for future prospects.

The geopolitical and economic situation is unfavourable due to the ongoing Russia-Ukraine war and the US Congress’s support for widening deficits in the US. Recent IMF research, as captured in the Fiscal Monitor released in April 2023, indicates a positive relationship between government fiscal deficits and inflation, suggesting potential inflationary pressures in the US economy.

In advanced countries, immediate inflation correction may not occur unless higher inflation figures are accepted as targets. Nonetheless, interest rate adjustments in advanced economies may be less aggressive than initially anticipated for the remainder of the year.

Considering the aforementioned factors, it is important for the RBI to foster domestic economic growth, detach from external factors, and promote the strengthening of positive indicators. So, the MPC is expected to vote for keeping the repo rate unchanged at 6.5%. The decision will be announced on June 8, 2023.

Dr Charan Sigh is a Delhi-based economist. He is the chief executive of EGROW Foundation, a Noida-based think tank, and former Non Executive Chairman of Punjab & Sind Bank. He has served as RBI Chair professor at the Indian Institute of Management, Bangalore.