The Bangladesh economy was the envy of its South Asian neighbours not so long ago. It was one of the fastest growing economies in the world, and was touted as a model for emerging markets. It was growing at a decent pace even during the pandemic years, but the recent macroeconomic numbers seem to spell trouble for the economy.

The Bangladesh government has rushed to the International Monetary Fund for a $4.5 billion bailout package to tide over the crisis. The economy is facing trouble on multiple fronts — it is facing an energy crisis, high inflation, lower remittances, erosion in forex reserves, and poor demand for its exports.

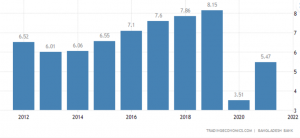

Bangladesh annual GDP growth rate

The Russian invasion of Ukraine marked a turnaround in the fortunes of the Bangladesh economy which fared decently during the pandemic crisis. The derailment of the growth story is triggering political upheaval. The country is facing massive protests that threaten the reign of Sheikh Hasina.

READ | Global minimum tax: EU signal may prompt a flurry of action by others

Rise and fall of Bangladesh economy

For the last 15 years or so, Bangladesh has been the poster child of global economic development. It powered economic growth by linking its demographic dividend with global supply chains, especially in the field of readymade garments. Bangladesh was among the poorest nations when it gained independence from Pakistan in 1971. The country is on the path to exit the United Nations’ list of least developed countries by 2026. Poverty has also fallen from 43.5% in 1991 to 14.3% at present. Bangladesh’s human development indicators are also robust compared to its peers, especially women’s workforce participation and empowerment.

So, what went wrong with the Bangladesh economy?

Bangladesh’s phenomenal success was based on exports success which, in turn, was based on the country’s cheap labour. Readymade garments comprise 80% of Dhaka’s exports. Such high reliance on a single product was meant to cost Dhaka someday and it happened during the coronavirus pandemic. When the global demand fell, Bangladesh’s economy suffered. The country had no buffer in the absence of a vibrant domestic economy built on a wide economic base, skilled labour force and efficient infrastructure.

Last month, Bangladesh reached out to the IMF seeking economic help. The country is set to receive $4.5 billion in economic assistance. That the country has sought assistance marks a sharp reversal from its earlier days when Bangladesh was giving stiff competition to the Indian economy. Bangladesh continues to post impressive GDP numbers which grew by over 3% during 2020 at the height of the coronavirus pandemic, making its economy a rare bright spot amid the pandemic.

This year as well, the Bangladesh economy is expected to grow by over 7%. So, GDP is not the problem. According to the International Monetary Fund, Bangladesh’s robust economic recovery has been derailed by the Russian invasion of Ukraine which led to a current account crisis, both in absolute terms and as the percentage of GDP. Widening of the current account deficit means that incoming money is less via export of goods and services while the outflow of money is large on account of rising imports.

With the looming recession and high inflation, consumer spending has slowed down across the world. This does not augur well for the country which relies heavily on exports to sustain growth. Rising dollar made the situation worse by appreciating against the taka. Weaker taka meant that import bills became higher, aggravating inflationary pressure at home.

The country’s forex reserves also depleted in the meanwhile from last December’s $46,154 million to $33,790 million, a fall by over a fourth.

Bangladesh sought help to cushion the economy against the global headwinds. But the problem seems to be deep-rooted. According to the IMF, Bangladesh needs to actively attract private investment, address climate change, accelerate growth and enhance productivity. Furthermore, the country cannot recover from its current problems under an authoritarian regime and inherent corruption in the country.

Absence of a social security system, stable institutions, and the rule of law resulted in private investors losing confidence in Bangladesh’s business environment. Until all these are not fixed, the country cannot hope to overcome its current woes.