The rupee ended FY2024-25 bruised, but not broken. After depreciating 2.42% over the fiscal year, the rupee staged a sharp comeback in March 2025 — its strongest monthly performance since November 2018 — as the dollar index softened and foreign institutional investors returned to Indian equities. Yet, even as the currency strengthened to Rs 85.47 per dollar, analysts are cautious. The road ahead for the rupee in FY 2025-26 is paved with both opportunity and uncertainty.

With global trade dynamics shifting under the weight of rising protectionism, led by a fresh wave of US tariffs, and with monetary policy in flux across major economies, the rupee’s direction will be shaped as much by Washington as by New Delhi.

READ I Post-Brexit and post-US: The UK foreign policy must pivot to Europe

A volatile backdrop

The rupee’s near-term volatility reflects a classic case of external shocks versus domestic resilience. The Trump administration’s aggressive tariff measures — including new levies on autos and energy — have introduced significant uncertainty to global trade, rattling currency markets and pushing the dollar to recent highs. While the dollar index fell 3.21% in March, a potential reversal remains a threat, especially with the US Federal Reserve expected to slow its rate cuts.

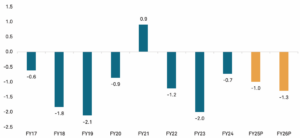

Swinging fortunes: Rupee vs dollar

S&P Global predicts only one Fed rate cut in the first half of 2025, with the next likely postponed to the second half of 2026 due to tariff-induced inflation in the US. This “higher-for-longer” interest rate scenario could strengthen the greenback and keep emerging market currencies, including the rupee, under pressure.

Geopolitical risks further muddy the waters. Elevated crude oil prices — with Brent holding above $74 per barrel — and fears of retaliatory tariffs threaten to widen India’s current account deficit, estimated to rise mildly to 1.3% of GDP in FY26. Though manageable, such imbalances could amplify rupee volatility if foreign fund flows reverse.

A soft landing at home

Despite these headwinds, India’s macroeconomic fundamentals offer a degree of insulation. The economy is projected to grow at 6.5% in FY26, underpinned by robust domestic consumption, benign inflation, and supportive fiscal and monetary policies. Importantly, India enters FY26 with a comfortable foreign exchange reserve buffer and a low external debt-to-GDP ratio, reducing vulnerability to sudden capital flight.

Inflation is expected to moderate to 4.4% — close to the RBI’s comfort zone — driven by easing food prices, lower commodity costs, and a likely normal monsoon. This creates room for the RBI to cut policy rates by 50–75 basis points over the course of FY26, following its first cut in February after nearly two years. Lower borrowing costs will support consumption and investment, aiding rupee stability through stronger growth momentum.

India’s current account balance (% of GDP)

Moreover, the rupee continues to benefit from a relatively balanced flow dynamic. While India’s merchandise exports are expected to struggle amid subdued global demand — with US and China growth slowing to 2.0% and 4.1%, respectively — services exports remain a bright spot. India’s share in global services exports has climbed to 4.3%, thanks to a surge in IT, professional, and consulting services.

In January 2025, India’s services exports outpaced goods exports for the first time, providing a valuable buffer for the rupee. As global capability centres proliferate and digital services gain traction, this trend is likely to persist, strengthening the rupee’s long-term outlook.

Capital flows: The swing factor

Foreign institutional investment (FII) flows will remain the swing factor. March saw a dramatic turnaround, with over Rs 32,488 crore flowing into equities. Yet, this came after an outflow of Rs 1.24 trillion earlier in the fiscal. As CR Forex Advisors’ Amit Pabari notes, equity market performance and capital inflows will be critical in anchoring the rupee.

India’s improving business competitiveness — climbing to 25th globally in business efficiency — coupled with a push in manufacturing through Production Linked Incentive (PLI) schemes, is expected to draw long-term foreign capital. However, near-term FII sentiment remains fragile and will be heavily influenced by US monetary policy, crude prices, and risk appetite.

On technical grounds, the rupee is likely to find support in the Rs 85.40–85.50 range, with resistance around Rs 85.90–86.50. But these levels are vulnerable to sharp shifts in dollar sentiment or commodity shocks.

Taking stock of both global and domestic trends, most analysts expect the rupee to weaken modestly over FY26, settling around Rs 88 to the dollar by March 2026. This implies a depreciation of about 3% from current levels — not dramatic, but enough to warrant attention from policymakers and import-dependent sectors.

Unlike in FY14, when India faced a full-blown balance of payments crisis, today’s scenario is marked by lower vulnerability but more frequent, complex shocks. Then, high CAD, fiscal deficits, and inflation made India part of the ‘fragile five’. Today, the pressures are largely external — a function of global policy shifts rather than domestic mismanagement.

Policy imperatives for India

In the face of heightened global volatility, policy coordination will be key. The RBI is expected to continue using its forex reserves to curb excess rupee volatility. Simultaneously, government policy must ensure capex momentum remains strong and inflation remains benign, particularly food inflation, which disproportionately affects poorer households.

The FY26 budget’s focus on infrastructure, welfare spending, and tax cuts for the middle class supports this goal. Meanwhile, targeted steps to reduce food supply volatility — via better cold storage and resilient agriculture practices — will help anchor inflation and support currency stability.

The rupee in FY26 will not be immune to global turbulence, especially with a protectionist US and a slowing world economy. However, India’s robust services exports, stable macro indicators, and growing investment momentum provide a cushion. While the rupee may depreciate gradually to Rs 88/$, the path will likely be less jagged than in previous episodes of stress.

In a world where resilience is increasingly prized over efficiency, the rupee’s trajectory will ultimately reflect India’s ability to remain a steady ship in stormy waters. That requires not just smart monetary and fiscal management, but also a relentless push toward productivity, innovation, and global competitiveness. Only then can the rupee find more lasting strength — not from sentiment alone, but from sustained fundamentals.