Food inflation has become a pressing concern that demands immediate and strategic intervention. Inflation disproportionately affects those who spend a significant portion of their income on food, widening inequality and threatening the economic stability of millions. The persistent rise in food prices, driven by a confluence of factors including climatic shocks and supply chain disruptions, is not only a macroeconomic challenge but also a social one, with the potential to widen the gap between the rich and the poor.

An article written by RBI officials say that while the primary drivers of food inflation such as supply shocks are beyond the reach of monetary policy, a disinflationary approach is still crucial to control overall price pressures. The article highlights the challenge of managing food prices, which constitutes a significant portion of the consumer price index. Despite the conventional belief that food price changes are transitory, the persistent nature of inflation has rendered this assumption increasingly untenable.

The article titled Are Food Prices Spilling Over? authored by Michael Debabrata Patra, Joice John, and Asish Thomas George, points out that while core inflation has been on a downward trend due to effective monetary policy actions and a reduction in cost-push shocks, the persistent pressures from food inflation continue to pose a threat. It cautions that treating inflation as a temporary phenomenon is no longer viable, as failure to address it could lead to unanchored inflation expectations, generalisation of price pressures, and a loss of economic stability. This could result in weakened consumer and business confidence, compromised external sector sustainability, and ultimately, negative consequences for India’s growth prospects.

READ I Boosting FDI inflows: Answer may lie in competitive federalism

Causes of sticky food inflation

Food inflation has reached alarming levels in India, with reports indicating a staggering 30% annual increase in food prices, even as the general inflation rate hovers around 5.1%. For a significant portion of the population, particularly those who allocate over 50% of their income to food, this is devastating. The burden of rising food costs is not evenly distributed; it falls most heavily on the poor and lower-middle-income groups which struggle to make ends meet. While government programmes like the Pradhan Mantri Garib Kalyan Yojana offer some relief, they are not sufficient to counter the severe impact of sustained inflation.

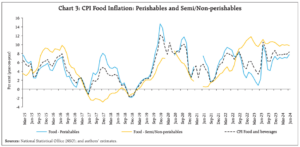

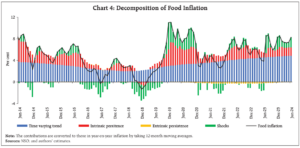

The persistence of food inflation in India is largely attributable to repeated and intensifying climatic shocks. The decade from 2020 to 2024 has been marked by a significant uptick in inflation, averaging 6.3%, a stark contrast to the 2.9% average from 2016 to 2020. The sharp rise is primarily due to a series of overlapping supply shocks caused by climate events, such as irregular monsoon patterns, unseasonal rainfall, and extreme temperature fluctuations. These disruptions have severely affected agricultural productivity, particularly during the crucial kharif and rabi seasons, leading to lower crop yields and higher prices.

Furthermore, global climatic phenomena like the El Niño and La Niña events have exacerbated these conditions, making food inflation a more persistent and widespread issue. The stickiness of food prices, especially in categories like vegetables, pulses, and spices, has become endemic, challenging the conventional wisdom that inflation is transitory and localised. The broad-based nature of this inflationary pressure, seen in over 50% of months from June 2020 to June 2024, indicates that high inflation has become a persistent issue that cannot be dismissed as merely a short-term concern.

Economic and social consequences

The implications of persistent food inflation extend beyond the immediate rise in food prices. Empirical evidence suggests that high food prices can spill over into non-food components of the economy, driving up costs in sectors like manufacturing and services. This spillover effect is particularly worrying because it can lead to a more generalised inflationary environment, undermining the effectiveness of monetary policy.

Moreover, the persistence of food inflation is affecting the inflation expectations of households, leading to demands for higher wages and further increasing production costs. This vicious cycle threatens to erode the progress made in reducing core inflation and could destabilise the broader economy if not addressed promptly. As the Reserve Bank of India’s analysis shows, inflation is no longer a localised or temporary phenomenon; it has begun to affect inflation expectations, which could lead to widespread economic instability if not managed effectively.

Taming food inflation a priority

Addressing food inflation is not just about economic stability; it is also about social equity and long-term growth prospects. High inflation disproportionately affects the most vulnerable sections of society, exacerbating inequality and threatening social cohesion. Moreover, if left unchecked, it could lead to a loss of policy credibility, undermining consumer and business confidence and eroding India’s external sector sustainability and competitiveness.

Given the inelastic nature of food demand, even small price increases can have significant impacts on household budgets, particularly for the poor. Therefore, taming food prices must be a top priority for the Indian government, not only to stabilise prices but also to protect the livelihoods of millions of citizens and ensure sustainable economic growth. The persistence of inflation has the potential to undo years of economic progress, making it a critical issue that requires immediate and focused attention.

Enhancing agricultural resilience

One of the most effective ways to combat food inflation is by enhancing agricultural resilience to climate change. The government must invest in developing and promoting climate-resistant crop varieties that can withstand the increasingly erratic weather patterns. This includes improving irrigation infrastructure, which is crucial for mitigating the effects of droughts and unseasonal rainfall. By ensuring that farmers have access to reliable water sources, the impact of climate shocks on crop yields can be significantly reduced.

In addition to infrastructure improvements, there is a need for timely support mechanisms for farmers affected by extreme weather events. This could take the form of crop insurance schemes that are responsive to the unique challenges posed by climate change. Moreover, strengthening supply chains and reducing post-harvest losses through better storage and transportation facilities will help stabilise food prices and ensure that food inflation does not spiral out of control.

Monetary and fiscal policy coordination

While monetary policy has played a key role in controlling overall inflation, it is not sufficient to address food inflation on its own. There needs to be better coordination between monetary and fiscal policies to manage food price volatility. This could include targeted subsidies for essential food items, which would help to ease the burden on the most vulnerable populations. By reducing taxes on food products, the government can further alleviate the pressure on household budgets and help contain inflationary expectations.

Public investment in agriculture should also be increased to boost productivity and reduce dependency on imports, which are often subject to global price fluctuations. By focusing on increasing domestic production, particularly of staple crops, India can reduce its vulnerability to international market shocks and ensure a more stable food supply.

Revisiting labour laws

Revisiting labour laws to unleash the demand for labour is crucial for addressing the broader economic challenges posed by food inflation. Labor-intensive industries, particularly in the agricultural sector, have the potential to absorb the displaced workforce from sectors affected by technological advancements like AI. By reforming labour laws to make it easier for businesses to hire and retain workers, the government can help ensure that economic growth translates into job creation and higher incomes, particularly for the lower-middle-income groups.

Such reforms would also help mitigate the impact of inflation by increasing household incomes, thereby improving the ability of families to cope with rising food prices. However, these reforms must be carefully designed to protect workers’ rights while also promoting flexibility and productivity in the labour market.

Strengthening social safety nets

Expanding and enhancing social safety nets like the Pradhan Mantri Garib Kalyan Yojana can provide immediate relief to those most affected by inflation. These programs should be designed to offer more than just temporary relief; they must also include components that help lift people out of poverty over the long term. This could involve integrating vocational training and education initiatives that equip beneficiaries with the skills needed to secure better-paying jobs.

In the context of food inflation, social safety nets should also include direct cash transfers to low-income households, which would enable them to purchase food and other essentials without falling into debt. By ensuring that these programs are well-targeted and efficiently administered, the government can make a significant impact on reducing the hardships caused by inflation.

Managing inflation expectations

The Reserve Bank of India (RBI) must continue to monitor and manage inflation expectations, which are crucial for maintaining economic stability. Clear communication about policy measures and inflation targets can help anchor expectations and prevent the unanchoring that feeds inflationary pressures. This involves not only setting realistic inflation targets but also ensuring that the public understands the steps being taken to achieve them.

In addition to managing expectations, the RBI should remain vigilant in its monetary policy stance, ready to adjust interest rates if food inflation shows signs of spilling over into core inflation. By taking a proactive approach to monetary policy, the RBI can help prevent the persistence of inflation from leading to a broader inflationary spiral.

The persistence of food inflation poses a significant threat to economic stability and social equity. Taming food prices must be a priority, not only to protect the most vulnerable but also to ensure sustainable and inclusive growth. By adopting a comprehensive strategy that addresses the root causes of inflation and strengthens the resilience of the agricultural sector, India can mitigate the impact of rising food prices and pave the way for a more stable and prosperous future.

The task of taming inflation is complex but essential. It requires a coordinated effort across multiple fronts, from enhancing agricultural resilience to reforming labour laws and strengthening social safety nets. With determined action and effective policies, India can overcome the challenge of food inflation and secure a brighter economic future for all its citizens.