By Anandadeep Mandal and Neelam Rani

The global economy is facing one of the most severe crises in the last 100 years. Indian economy is also reeling under the impact of the Covid-19 pandemic and the measures taken to contain it. The Reserve Bank of India plays a key role in the efforts to revive the economy. The monetary policy measures affect the economy in various ways. Asset prices are key determinants of the monetary policy stance taken by the RBI. In this article, we examine the impact of monetary policy stances on Indian financial markets. To avoid endogeneity issues in our analysis, we accommodate the factors that affect both the monetary mechanism and financial markets. These factors are macroeconomic news and changes in risk premia. We also consider the interplay between the monetary initiatives taken by the RBI and the asset prices in the financial markets.

Our analysis focuses on the impact of the monetary policy changes taken to contain the economic downturn triggered by the COVID-19 pandemic on three key asset prices: the real effective exchange rate, the market interest rate of 10-year government bonds and the NSE stock index. The changes in the monetary policy are captured by the three-month benchmark yield, as it is assumed to change only as much as the RBI’s move represents a shock in the financial markets. In this article, we refer this rate as the policy rate. Further, it is worth noting that keeping the RBI’s policy rate unchanged during the pandemic crisis represents a surprise in the market that would effect a change in the short-term yield.

READ I Industry-university partnership key to innovation, growth

The real effective exchange rate

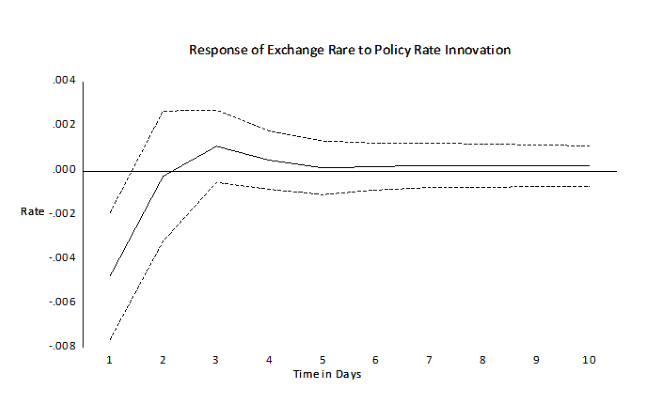

When the monetary shocks are channelled and identified with changes in short-term interest rates, an increase in money supply causes depreciation in the value of the currency. Thus, we see a depreciation of the rupee when the RBI take steps to boost economic growth. In examining the impact of monetary policy actions on the exchange over a 10-day scenario, we see the exchange rate recovering on the third day and settles to its adjusted trend dictated by other factors such as the share of foreign currency in the Indian economic portfolio of goods. Further, actions such as restricted selling of GILTs by the RBI send a signal that stimulates recovery of the exchange rate.

READ I Free trade pacts: Why India must be wary of signing more

10-year government benchmark bond

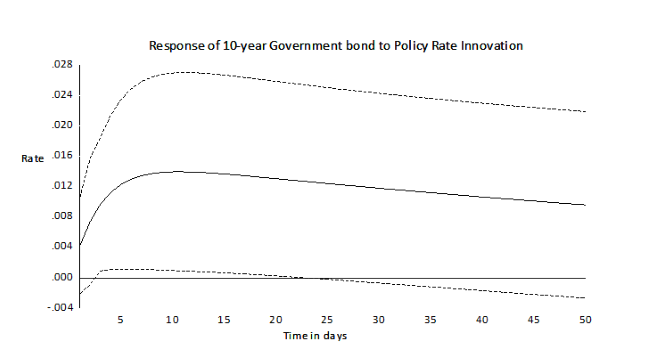

The monetary transmission suggests that monetary expansion leads to lower short-term and long-term interest rates. The government buys bonds to infuse money into the economy. However, it requires money to fund its investments and meet its revenue expenditure. Hence, they RBI has sold bonds in the last few months, the last time on August 29. When the RBI sells bonds, the price is pushed down and hence it increases the interest rate (yield). Increasing interest rate during periods of recession is unfavourable as the cost of borrowing increases. Thus, the RBI plays a balancing role by selling as much as it can without pushing the yield beyond the threshold. Therefore, we witnessed restricted selling of GILTs, commonly referred as Operation Twist by the RBI. RBI sold bonds bearing a coupon of 5.77% at a cut-off yield of 6.1448%.

Another key issue that impacts the investors is the inflation. Inflation has an inverse relationship with interest rates. Thus, with increasing yield due to restricted selling of GILTs by the RBI, the inflation should go down. However, we see a reverse scenario in the present economic environment. The inflation is rising. This is because of a fall in aggregate supply, induced by the steps taken by the government to control the spread of COVID-19. In other words, we are witnessing cost-push inflation. The RBI is conducting such restricted and supervised GILT selloffs because it looks to keep the interest rate low to facilitate economic recovery without stoking inflation.

READ I Nirmala Sitharaman asks banks to lend aggressively to boost GDP growth

The graph below shows that the monetary policy shocks affect the spot yields positively. However, the impact gradually subsides as the horizon gets longer. A fall in yields that is concentrated in forward rates could potentially be interpreted as either pushing back the expected timing of lift-off from the lower bound of the monetary interventions, or as a drop in the term premia. Consequently, we see sudden changes in policy rates leading to a reversal of the forward yield curve.

The stock indices

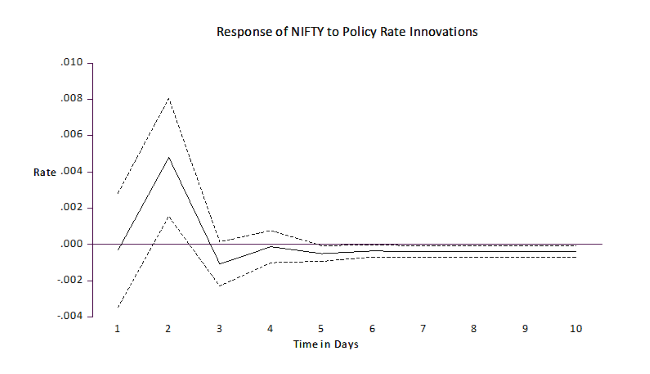

Examining the impact of monetary policy instruments on the stock market is important because of the substantial impact on the economy and resource allocation via stock market. Stock market performance is greatly affected by innovations in monetary policy, while stock prices reflect economic development to a great extent. Stock market performance not only responds to monetary policy decisions and affects the economy, but also provides feedback to the government and the RBI regarding the private sector’s expectations on key macroeconomic variables.

READ I Carbon emissions and economic growth: Learnings for India

The stances of monetary policy taken by RBI can influence stock market returns via five possible channels: (i) the interest rate channel, (ii) the credit channel (iii) the wealth effect, (iv) the exchange rate channel and (v) the monetary channel. Out of these, the most significant one is the interest rate mechanism. Monetary easing increases the value of a firm by reducing the discount factor and by increasing the firm’s nominal revenues. Therefore, a fall in interest rates leads to a rise in stock prices. This is evident from the NSE index that responded positively to monetary interventions but, the index tends to adjust from the third day onwards. This suggests that monetary policy decisions affect stock prices not only through the trade-off between interest gains and stock returns, but also through their influence on investors’ expectations. Therefore, it is evident that the COVID-19 induced economic uncertainties are playing a key role in defining the new-normalcy in the market.

(Dr Anandadeep Mandal is an Assistant Professor of finance at the University of Birmingham, UK. Dr Neelam Rani is Associate Professor in finance at IIM Shillong.)

Dr Neelam Rani is an Associate Professor in the area of Finance at IIM Shillong.