Trump backtracks on tariff war: The global trade order is in disarray, shaken by President Donald Trump’s aggressive push for reciprocal tariffs—an economic gamble that has prompted nations to reassess alliances and scramble for alternative partnerships. In an increasingly multipolar world, this abrupt escalation in trade tensions has created a sense of urgency, forcing countries to pursue new bilateral deals and navigate a geopolitical order fraught with uncertainty.

Trump’s latest tariff salvo, which took effect Wednesday, slapped a staggering 104% duty on Chinese goods and imposed stiff levies on imports from dozens of countries. The fallout was immediate. Global financial markets plunged, wiping out trillions in market value. Oil prices dropped more than 4% amid fears of reduced Chinese demand. Brent futures tumbled to $60.36 a barrel, and US crude slipped to $56.96. Gold, typically a safe haven in times of economic distress, struggled to regain footing, down 0.2% to $2,039.76 per ounce.

Amid mounting market chaos and internal dissent, President Trump—initially defiant—suddenly reversed course. By Wednesday afternoon, just hours after urging Americans on social media to “BE COOL” and buy the dip, he announced a 90-day pause on tariffs for most countries, while doubling down on China with a 125% tariff. The abrupt reversal stunned his economic team and caught even top aides off guard.

“I know what the hell I’m doing,” Trump told Republicans Tuesday, dismissing growing fears of a self-inflicted economic crisis. But according to senior officials, it wasn’t confidence that drove the change—it was the markets. Treasury Secretary Scott Bessent and other advisers had privately warned that the sharp rise in government bond yields could spark a financial panic. The bond markets, more than any diplomatic entreaty, forced Trump’s hand.

Inside the White House, there was a mad scramble to reframe the backpedal as part of a masterstroke. “This was his strategy all along,” Bessent insisted. Press Secretary Karoline Leavitt echoed the spin, citing Trump’s bestselling The Art of the Deal as inspiration for the move. Yet Trump himself undermined that narrative when he admitted to reporters that he was acting “instinctively, more than anything else.”

READ I PSUs: The overlooked engine of sustainable growth

Global trade in flux

The impact of Trump’s tariffs has been global. While India, long wary of free trade agreements, is now actively seeking bilateral deals with the UK, the EU, and even China, countries like Vietnam and Spain are trying to dodge steep US levies—46% on Vietnamese goods and 25% on EU products. Finance Minister Nirmala Sitharaman recently voiced optimism about clinching a long-pending trade deal with the UK, marking a shift from India’s traditionally protectionist posture toward greater engagement.

“This is a time of global uncertainty,” Sitharaman said, before her meeting with UK Chancellor Rachel Reeves. The push for trade diversification aligns with India’s broader economic strategy—Make in India and Aatmanirbhar Bharat—which seeks to boost self-reliance without closing the door to global commerce.

Vietnam and Spain, too, pledged to enhance economic and defence ties, signalling a broader trend of countries leaning into new partnerships in response to Washington’s tariff shock. Old geopolitical allegiances are being re-evaluated as the Trump administration’s confrontational trade stance forces unlikely diplomatic realignments.

Tariff war threatens China showdown

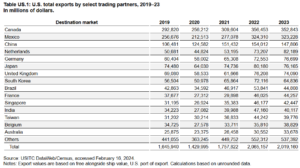

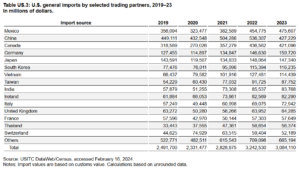

At the heart of this trade storm lies the confrontation between the world’s two largest economies. Trump’s punitive tariffs on Chinese goods—aimed at correcting what he views as an unfair $295 billion trade deficit—have pushed Washington and Beijing to the brink of a full-blown trade war. China has responded in kind, refusing to capitulate to what it sees as economic bullying.

With the US–China trade corridor accounting for $585 billion last year, any escalation carries global implications. The International Monetary Fund estimates that the two nations together contribute nearly 43% of global GDP. A prolonged tariff war could slow their growth, tip both economies into recession, and cause a domino effect on global investment and trade.

China’s overcapacity in manufacturing further complicates matters. With a $1 trillion trade surplus and a glut in sectors like steel, any drop in US demand could prompt Beijing to flood global markets, including India, with cheap goods. India’s domestic industries are already bracing for impact, fearing dumping practices that could decimate local production.

Domestic discord and an unfolding drama

Inside Trump’s second-term White House, the tariff strategy has sown confusion. While trade hawk Peter Navarro pushed for sweeping levies to revolutionize American manufacturing, others like Bessent and Commerce Secretary Howard Lutnick urged restraint and more targeted measures.

But Trump, determined to fulfil his campaign promise of a universal base line tariff, often ignored their advice. His strategy, forged over decades and impervious to contradictory data, views tariffs not merely as economic tools, but as symbols of strength and self-reliance. This conviction clashed with the reality of collapsing markets and investor panic.

As the crisis deepened, Bessent arranged a meeting aboard Air Force One to convince the president to pivot. He stressed the need for a defined endgame and warned of a looming Black Monday if Trump didn’t adjust course. Trump partially relented, pausing tariffs for 90 days while framing the move as a negotiation tactic to isolate China.

Yet ambiguity persists. “You almost can’t take a pencil to paper,” Trump told reporters when asked how he would decide on future exemptions. “It’s really more of an instinct, I think, than anything else.”

Fallout and the road ahead

The markets rebounded after the pause announcement, validating fears that Trump’s tariff aggression could trigger a financial crisis. Behind the scenes, many of Trump’s closest advisers admit the real credit belongs to the bond markets, not a well-thought-out strategy.

India, like many other nations, is now addressing this volatility with a mix of caution and opportunity. The Reserve Bank of India responded swiftly, cutting interest rates by 25 basis points to cushion the economic blow. RBI Governor Sanjay Malhotra acknowledged that tariff-related measures have “clouded the economic outlook across regions,” warning of new headwinds for growth and inflation.

Meanwhile, Chinese President Xi Jinping has signalled a pivot of his own, pledging to strengthen ties with neighbours like Japan, South Korea—and potentially India—as Beijing braces for prolonged economic and strategic tensions with the US.

While Trump’s tariff drama may have taken a 90-day pause, the global economic tremors it unleashed are far from over. What began as a campaign promise to make America wealthy again has become a high-stakes test of whether instinct can trump strategy in the world’s largest economy.