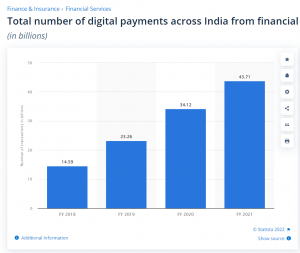

UPI123Pay and digital payments: India recorded a 33% increase in the volume of digital payments in 2021-2022. The number of digital transactions rose to 7,422 crore in the financial year from 5,554 crore last year, according to the ministry of electronics and IT. The bulk of these transactions was done on NPCI’s Unified Payment Interface. UPI recorded 452.75 crore transactions valued at ₹8.27 lakh crore in the first 11 months of the fiscal. The Covid-19 pandemic saw the exponential growth of digital payment apps in India.

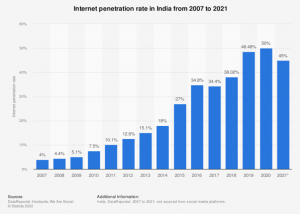

Despite the unprecedented growth in digital transactions, there still exists a gaping digital divide between the rural and urban populations as well as between genders. The gender-based disparity exists despite smartphone ownership among women growing faster than it is among men in recent years. India has around 44 crore feature phone users and around 74 crore smartphone users. In 2020, there were 74.9 crore internet users and most of the country’s web traffic was from mobile internet users. However, India’s internet penetration was just 54.2% in 2021.

The number of smartphone users and internet users are almost the same at around 75 crore. However, it is challenging to access internet from a feature phone. This created a problem for those who wanted to make online payments using feature phones as the process previously needed an internet connection. This was making the financial inclusion of a large number of Indians difficult. Digital inclusion is a prerequisite for financial inclusion.

READ I India does not have to give up the right to buy Russian oil

UPI123Pay and its importance

The National Payment Corporation of India (NPCI) launched the Unified Payment Interface (UPI) in 2016. This revolutionised India’s payment technology. UPI enabled online payment or bank transfers from one account to another. At present there is already an ongoing offline UPI service in India which can be accessed via the National Unified USSD Platform (NUUP) using the code *99#. However, the facility did not gain much popularity and so the RBI came up with the UPI123Pay service.

UPI transactions were made using the internet. It was accessible only to people having internet access. But this is no longer the case. The Reserve Bank of India and the National Payment Corporation of India launched UPI123Pay on March 9, 2022. The platform enables offline payments and was introduced to include people with no internet access and feature phones. Alongside this, DigiSaathi, a 24×7 helpline, was launched to handle digital queries and grievances.

The policy debate of availability vs accessibility always remains in the limelight when any policy is being launched. This step taken by the RBI is a great example of providing accessibility rather than focusing on only availability. The UPI technology was made available by the NPCI in 2016, but a real sense of governance took place only when it was made accessible to everyone. It is an important step towards a cashless economy and an inclusive digital payment infrastructure.

READ I Financial inclusion: Some steps to give farmers access to funds

How to use UPI123Pay

The UPI123Pay is a three-step process — call, choose and pay. It is mandatory to link accounts with a mobile number. Further, users have to set their UPI PIN by using their debit or credit cards. After the above steps are followed users can transact money like a smartphone user. Now the user is required to call on Interactive Voice Response (IVR) number 08045163666.

- On the IVR menu, select your preferred language.

- Now choose the bank linked with UPI.

- Press ‘1’ to confirm the details.

- Press ‘1’ to send money by using your mobile number.

- Enter the mobile number of the recipient.

- Confirm the details.

- Now enter the amount that you want to transfer.

- Enter your UPI PIN and authorise it to transfer the amount.

The RBI’s press release said that UPI123Pay offers four distinct options.

App-based functionality: An application will be installed on feature phones (if the phone infrastructure supports it) allowing UPI functions that are available on smartphones as well.

Missed call: In this method, the user has to give a missed call from their registered phone number to the phone number they want to transfer money to. Once this step is performed, the user will receive a call where they can enter their UPI PIN, and payment will be processed.

Interactive Voice Response (IVR): UPI payment through pre-defined IVR numbers would require users to initiate a secured call from their feature phones to a predetermined number and complete UPI on-boarding formalities to be able to start making financial transactions without an internet connection.

Proximity sound-based payments: This uses sound waves to enable contactless, offline, and proximity data communication on any device.

Impact and challenges

India is the leading market for digital payments. It recorded the highest number of real-time payment transactions since 2019, followed by China (1,570 crore transactions) and South Korea (600 crore transactions). However, further growth in digital payments is difficult without making digital payment services available offline. The UPI system has shown tremendous results in the past. There are several reasons behind the success of UPI, the most prominent one being UPI’s interoperability which allows users to make and accept the payments from different payment apps.

Users do not need to choose a common payment gateway to process the transactions. After demonetisation, a notable shift was observed towards digital transfers in urban areas though rural parts still opt for cash transactions due to lack of digital literacy. Rural people’s access to the internet is around 16% compared with the 45% in urban areas. It is difficult to link rural parts of India with the internet as trust is the biggest factor when it comes to money. It is hard to burden rural areas with banking inclusion and digital financial inclusion at the same time.

Many people in rural areas have faced challenges such as banking frauds which make them more sceptical of online payments. Hence, services like UPI123Pay make more sense for people residing in rural India. However, there are certain challenges in offline digital payments such as poor infrastructure and network accessibility in rural areas creating a gap between service users and providers. If people face any difficulty in payments and reporting grievances, it would further deteriorate the trust of users. Further, it is very challenging to replace tangible assets like cash with digital money.

India’s digital payment system is dynamic and aims to rope in maximum number of users. People use feature phones for varied reasons such as cost, education, age, and type of usage. So, it becomes crucial to give feature phone users access to the digital payments system. Rolling out of the UPI123Pay service is a challenging task, but it is a major step that will help rural India become tech-savvy and bridge the urban-rural digital divide.

(Shiv Chhatrala is a master’s student at Christ University, Bangalore.)