As we usher in 2024, it’s time to reflect on the journey of the world’s leading economy in 2023, a year defined by unexpected resilience. Despite fears of a recession, the US economy showed remarkable strength, quickly recovering from a historic downturn and adeptly navigating challenges like the Ukraine conflict and fluctuating oil prices. Remarkably, it achieved a smooth transition, marked by easing inflation, stable low unemployment, and the potential for Federal Reserve rate cuts.

The year bore witness to the US economy’s ability to withstand severe shocks. The inflation cool-down was a particularly striking feature, with consumer prices increasing at a much slower pace than anticipated. The year also saw a blockbuster performance by stocks, further boosting economic confidence.

READ I Indian economy: Can the growth engine defy global headwinds?

Emerging challenges for US economy

The new year, however, does not come without its challenges. While the past year was a story of overcoming odds, the new year brings its own set of potential risks. Economists warn that 2024 might mark the end of what could be termed the free-lunch economy — a period characterised by expansionary monetary and fiscal policies. The economy is stepping into a phase where the resilience built on post-pandemic stimuli might wane, impacting households, especially those in the lower income bracket.

While the labour market appears robust, underlying weaknesses may surface, potentially affecting employment rates. Technological advancements in recruitment processes and changing economic dynamics might alter the traditional understanding of job vacancies and unemployment relationships.

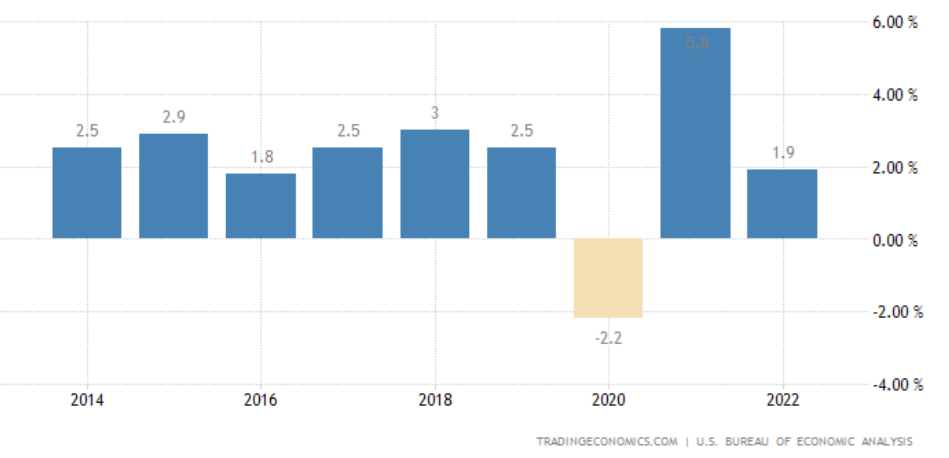

US economy: GDP growth rate

The Federal Reserve’s planned rate cuts hinge on the continuation of the current inflation trajectory. Any deviation, either a stagnation or a rise in inflation rates, would pose significant dilemmas, potentially forcing the Fed to choose between inflation management and economic growth.

The upcoming presidential election in 2024 also casts a shadow of uncertainty. Contentious elections could lead to market volatility and socio-economic unrest, impacting the broader economy.

Comparative insights

Looking beyond the US, it is essential to understand its economic performance in a global context. For instance, compared to the EU, the US has shown faster GDP growth over the past two decades, particularly in terms of per capita output. However, regional disparities within both the US and Europe highlight the complexity of economic performance and growth.

In contrast to the US, China’s economic journey in 2023 was less triumphant. Though defying dire predictions of a crash, its growth fell short of initial targets, reaching an estimated 5.2%. The year started strong, but headwinds like the zero-COVID policy, a struggling property sector, and global trade disruptions caused a mid-year slump. While policy interventions helped stabilise the economy, long-term concerns remain.

China’s property market faces significant challenges, with potential spillover effects on the wider economy. Demographic imbalances and slowing productivity further cloud the outlook. Despite these bumps, China’s sheer size and its focus on internal consumption offer a buffer against external shocks. Nevertheless, the government must navigate these delicate challenges to secure sustainable growth in the years ahead.

Beyond the US and China, the global economy in 2023 remained fragile. The Ukraine war triggered energy and food crises, pushing inflation levels higher and exacerbating existing inequalities. While most major economies avoided recession, growth slowed significantly. Developed economies like the EU faced additional hardships due to their dependence on Russian energy imports, while developing nations grappled with debt burdens and currency depreciation.

Uncertainties like the continuation of the war, the effectiveness of central bank policies, and potential new geopolitical flashpoints continue to cast a shadow. The world requires concerted international efforts to address these challenges and foster a more resilient and inclusive global economic recovery.

As we navigate through 2024, the US economy faces a critical juncture. The resilience seen in 2023 was commendable, but it does not guarantee a smooth path ahead. The economic landscape is evolving, marked by the end of expansionary policies and the onset of more complex economic trade-offs.

The coming year will test the robustness of the US economy’s recovery and its ability to adapt to new challenges. While optimism remains a key theme, vigilance and adaptability will be crucial in steering the economy towards sustained growth and stability.