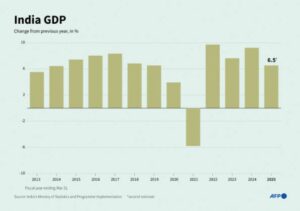

What Q3 GDP numbers tell about economy: The latest estimates of India’s economic growth, measured by Gross Domestic Product (GDP), are out. India’s economy grew by 6.2% in the October-December quarter of FY25, recovering from a seven-quarter low but still falling short of last year’s growth. The figure is also lower than the Reserve Bank of India’s (RBI) estimate of 6.8% for the quarter.

The GDP data for Q3 confirms projections by the Indian government and RBI about stable yet slowing economic performance in 2024-25. Growth rebounded in the October-December period after a concerning slowdown in July-September, which was triggered by a manufacturing slump on a high base. While the manufacturing sector has recovered, the base effect remained a factor. The data also confirms a revival in consumption growth, although investment remains subdued. Encouragingly, exports performed well despite global trade challenges. The rebound was largely driven by government spending and private consumption, aligning with trends suggested by high-frequency indicators.

READ | Carbon market: A $200 billion opportunity awaits India

Slowdown in GDP growth momentum

In the second quarter of FY25 (July-September), GDP growth slumped to 5.4%, shocking observers and signalling a sharper-than-expected deceleration in India’s economic momentum. The slowdown in FY25 has been more pronounced than initially anticipated. The government now projects GDP growth for the full 2024-25 fiscal year at 6.5%, down from 9.2% in 2023-24. However, the revised estimate is a slight improvement over the earlier projection of 6.4%.

Despite the slowdown, India is still expected to remain the world’s fastest-growing major economy, with projections hovering around 7%. The GDP, which represents the market value of all goods and services produced within India’s geographical boundaries in a specific period, is a key indicator of economic health. Weaker GDP growth translates to lower tax collections for the government and weaker corporate earnings, which in turn dampen investor confidence. This is reflected in the ongoing foreign institutional investor (FII) sell-off in Indian stock markets.

Investor sentiment has soured in recent months. Since its peak of 85,978 on September 27, 2024, the Sensex has declined by around 16%. The fall is driven by a combination of global and domestic factors. On the global front, the possibility of increased tariffs under Donald Trump’s potential second presidency has unsettled investors.

Surprising upswing in private consumption

Before the release of FY25 GDP data, it was widely believed that private consumption demand had slumped. This is critical because private consumption is the largest contributor to India’s GDP growth. However, the latest numbers suggest that private consumption demand has been more resilient than expected, playing a key role in pulling up GDP growth.

Contrary to earlier concerns, private consumption has outperformed other growth drivers such as government spending and private capital expenditure. Going forward, domestic consumption will remain a crucial factor in mitigating external uncertainties. However, rural demand will depend on climate conditions and government interventions.

Narrow base of consumption growth

A concerning trend highlighted in Blume Ventures’ Indus Valley Annual Report 2025 is that India’s consumption is driven by a small elite, constituting around 10% of the population. Two-thirds of discretionary spending in the country comes from this segment. Worryingly, this affluent consumer base is not expanding; rather, the rich are getting richer while the number of wealthy individuals remains stagnant.

For sustainable economic growth, consumption must extend beyond this privileged segment. With a billion people out of 1.4 billion lacking the means for discretionary spending, the economic benefits of growth remain limited. This uneven consumption pattern, led by a small wealthy class, could prevent India from reaching the economic dynamism seen in countries like China.

Challenges to economic growth

India’s economy faces mounting challenges, particularly with the looming threat of a U.S. tariff war. Additionally, the industrial sector—especially manufacturing—has been a drag on growth. The manufacturing sector is expected to grow at just 4.3% this year, a steep drop from 12.3% last year. Construction, electricity, gas, and water supply segments have also seen slight slowdowns. Similarly, most service sector segments have expanded at a slower pace compared to the previous year.

Despite these concerns, Chief Economic Adviser V. Anantha Nageswaran remains optimistic. He argues that India’s economic momentum is likely to persist, supported by a rebound in exports, rising government and private spending, and the economic boost from the Mahakumbh event. These factors are expected to keep growth stable in the final quarter of FY25.

India’s GDP growth for this year and the next is likely to hover around 6.5%, below the desired 7% mark. The broader picture suggests that India is experiencing a cyclical slowdown, but the worst may be behind us following the July-September slump. Looking ahead, a pickup in rural demand and increased government spending—evident from the Centre’s 51% rise in capital expenditure in January—could provide a much-needed boost to economic activity.

While gradual improvements are expected, growth will likely remain below potential for some time. This calls for sustained policy support, including accommodative measures from the RBI. The sharp decline in growth from last year suggests that further monetary easing could help stabilise the economy.