The Reserve Bank of India is having a tough time to meet its twin objectives of maintaining price stability and boosting economic growth because of the macroeconomic complexities triggered by the Covid-19 pandemic. Stagflation, a doble-edged sword, is now gawking at the country — the real output is contracting while inflation is breaching RBI’s comfort level of 6%. As an inflation-targeting central bank, RBI is hamstrung in using monetary policy to support growth. The economic crisis has kindled a debate on inflation targeting. What should RBI focus on – wholesale price inflation or consumer price inflation – while deciding policy rates, given the elevated food prices. Can RBI continue to neglect India’s food price dynamics while formulating the monetary policy?

Given the objectives of RBI policy, effective monitoring of the current and future course of inflation is highly desirable. However, the debate currently is about which measure of inflation will be relevant foe inflation targeting. The deliberations got further impetus with RBI’s recent publication entitled ‘Are food prices really flexible? Evidence from India’, where it discussed the stickiness in food prices. With empirical evidence suggesting price stickiness among food product categories, questions are being raised about the usefulness of core inflation in policy formulation. The headline inflation is calculated from all items in the basket, while core inflation excludes food and fuel items.

READ I Monetary policy: RBI must pause rate cuts to anchor inflation expectations

The central banks the world over are divided on this matter. For instance, European Central Bank and the Bank of England explicitly focus on headline print while US Federal Reserve is focused on core inflation derived from the personal consumption expenditure (PCE) index. However, the Federal Reserve in its Jackson Hole Symposium in August 2020 resorted to a paradigm shift by resorting to Flexible Average Inflation Targeting (FAIT), tolerating more than 2% inflation in the long term, shying away from a rigid target of core inflation. By doing so, the FED showed an inclination on considering long-run headline inflation and the actual price pressure in the economy.

In India, food price trajectory commands a great deal of attention with food items accounting for more than 46% in the overall Consumer Price Index (CPI) basket, the highest among inflation-targeting economies. On the contrary, in advanced economies food component constitutes only about 10% weightage in CPI. Food inflation as the major component has definitely limited the scope of monetary policy action when growth is stalling, especially in the wake of the coronavirus pandemic. At the same time, it is worthwhile pondering over the factors that make food price dynamics important for policy decisions in a country like India.

READ I Farm Bills 2020: Death warrant to mandis, end of small farms

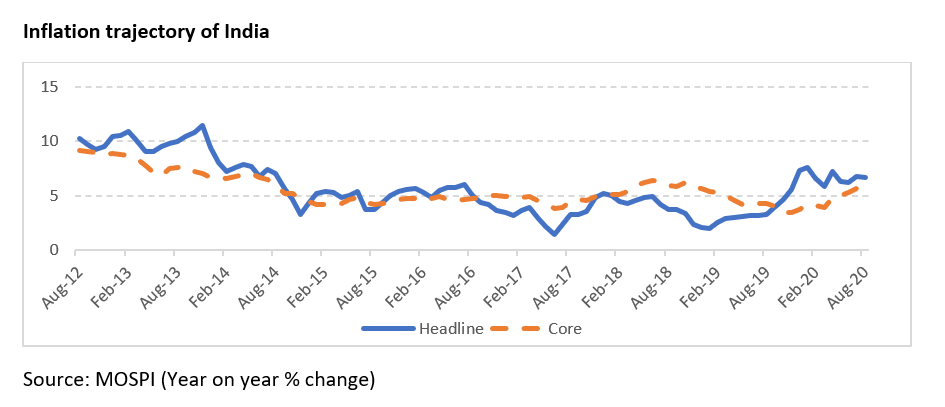

Core inflation as a factor in policy decisions may be appropriate for an economy wherein the food and fuel components are volatile due to short-term supply disruptions. However, in India, there is a persistent divergence between headline and core inflation trajectories — core inflation remained consistently high during H2 2016 to H1 2019 and then changed the course. The reversal in trend was evident even before the pandemic. The growth has been subdued and there was a fall in aggregate demand. Post pandemic and subsequent lockdown, supply chain disruptions pushed both the curves with food prices escalating at higher rates and later showing a converging trend. The rise in core inflation is mainly driven by gold and silver prices, the demand for which has picked up because of economic uncertainties.

Now, the RBI’s empirical findings show that the elevated food prices are not temporary, but rather sticky in the long run. If that is the case, should the central bank incorporate it in its policy inputs? It would be a wise thing to do in the face of empirical evidence that food prices have a cascading effect on the core inflation and contributes to the headline print in the long-run.

READ I National Education Policy 2020: Will it truly champion liberalism?

According to a study by the National Institute of Public Finance and Policy, there is a positive expenditure elasticity among food categories with higher elasticity in items such as milk, vegetables and fruits. There is significant elasticity in protein-rich food items too. The considerable positive demand – supply gap in these categories put an upward pressure on prices even in the normal times. The pandemic-induced supply disruptions widened this gap further, causing higher level of food prices. The transmission of elevated food prices usually occurs through a rise in input cost, substitution effect and real income effect of food producers. Both implicit and explicit effect of food inflation on headline has been evident. The disconnect between the global crude oil prices and retail fuel price is another factor potentially impacting food prices by increasing transportation cost.

Thus, the food inflation trajectory needs closer attention while formulating the monetary policy. During a high volatility episode of food and energy prices, focus on core inflation may be highly misleading as it neglects the cascading effects. Headline inflation may be a better measure of future inflation trajectory in such cases. Given that India assigns maximum weight to food basket among inflation targeting nations, tweaking of weights makes sense. This may reflect the actual scenario of consumption and price rise without fully neglecting the sticky components of food inflation.

Dr. Aswathy Rachel Varughese is Assistant Professor at Gulati Institute of Finance and Taxation, Thiruvananthapuram, Kerala.