The flow of funds for halting biodiversity loss, limiting climate change to below 1.5°C, and achieving land degradation neutrality by 2030 will need to double by 2025 and triple by 2030, says a UN Environment Programme report. The nature-based solutions are significantly under-financed, says the State of Finance for Nature 2022, the report prepared by UNEP along with the Economics of Land Degradation Initiative, a programme for promoting sustainable land use.

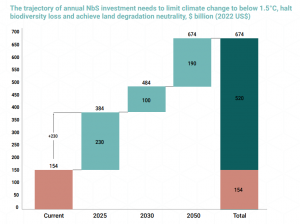

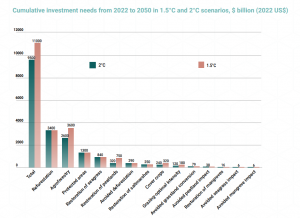

The report is the second in a series that looks to analyse the progress against global climate targets and the funding of nature-based solutions to address biodiversity loss, climate change, and land degradation. It says the current flow of funds is just $154 billion per year which is less than half of the $384 billion required by 2025, and a third of the $484 billion per year required by 2030. Without sufficient finance, the world will fail to reach its climate, biodiversity and land degradation neutrality targets, says the report. It shows investment in marine NbS is just about 9% of total investment.

READ I Green hydrogen opportunity may fizzle out without policy support

Funding climate change mitigation

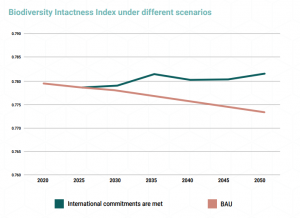

The doubling of fund flows to NbS can stop biodiversity loss and cut emissions significantly to achieve the 1.5°C global warming target set by the Paris agreement. It will also help restore close to 1 billion hectares of degraded land. Private sector investment in climate action must increase significantly from the current $26 billion per year, just about 17% of total investment in nature-based solutions. To ensure this, there is a need for rapid alignment of policies, regulations, economic activity, and fund flows with the Paris targets.

The report explores possible ways to scale up targeted funding of NbS and looks to set plans of action for different players. The recommendations highlight the need to increase fund flows to NbS through public expenditure and focused official development assistance. It seeks to ensure that multilateral funding agencies and development finance institutions make green finance a priority and to provide incentives for private investment in nature markets and sustainable supply chains.

Corporates and financial institutions need to adopt net zero, net positive business models. This needs disclosure of climate change-related financial risks, and details of supply chains. There is also a need to align public and private fund flows with the targets of the Paris Agreement and restoration commitments. Integration of climate risks and opportunities into decision-making, risk management and disclosure frameworks will cut fund flow into nature damaging activities. National and multilateral development finance institutions and development banks must desist from climate-negative lending and investment.

Both public and private sectors need to scale up investment in nature-based solutions to integrate just transition principles that will safeguard human rights. Such solutions include providing social protection, land rights and decent working conditions, as well as participation of marginalised people such as indigenous communities and women.

The State of Finance for Nature report has quantified fund flows into nature-based solutions to tackle global challenges related to biodiversity loss, land degradation and climate change. Current level of funding is compared with investment needed to meet targets set by international treaties.