The war on climate change has reached a critical juncture with global CO2 emissions surging to a record 37 billion tonne in 2023. The International Energy Agency projects a 50% increase in energy demand by 2050. These alarming trends highlight the urgency of decarbonising industries that are notoriously difficult to electrify such as steelmaking, refining, and heavy transport. Amid these challenges, green hydrogen emerges as a beacon of hope — promising to decarbonise sectors that account for a significant portion of global emissions. However, this potential solution comes with substantial hurdles that must be addressed for green hydrogen to fulfil its promise.

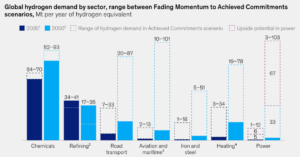

Hydrogen, the universe’s most abundant element, holds immense potential as an eco-friendly alternative to fossil fuels. When burned, hydrogen emits only water, making it an ideal candidate for reducing industrial carbon footprint. In the steel industry, which accounts for approximately 7% of global CO2 emissions, green hydrogen can replace coal in the basic oxygen furnace (BOF) process, reducing emissions by as much as 95%. Similarly, in refining and chemical production, which together represent nearly 10% of global CO2 emissions, green hydrogen can drastically cut the carbon intensity with minimal changes to existing processes.

READ I India’s biofuel push raises food security concerns

Green Hydrogen can be a game-changer

Green hydrogen can serve as a long-duration energy storage medium, crucial for balancing the intermittent nature of renewable energy sources like wind and solar. It can also be converted into e-fuels, such as green methanol and green ammonia, which are already being applied in the marine sector as alternatives to traditional fuel oil.

Despite its promise, the widespread adoption of green hydrogen faces several formidable challenges. The most significant of these is cost. Producing green hydrogen through water electrolysis powered by renewable energy is nearly four times more expensive than producing grey hydrogen from natural gas. This cost disparity makes it difficult to build hydrogen infrastructure when the demand is uncertain and may not materialise for years. No project developer will produce hydrogen without a buyer, and no banker will finance a project without reasonable confidence in future demand.

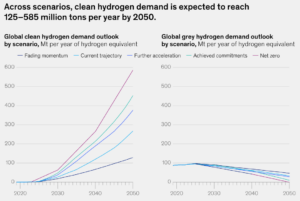

Infrastructure is another critical issue. The transition to a hydrogen economy requires massive investments in electrolyser capacity, carbon capture utilisation and storage for blue hydrogen, and the development of new transport and storage facilities. The IEA estimates that the world will need to produce 520 million tons of low-emissions hydrogen annually by 2050 to achieve carbon neutrality. However, building the necessary infrastructure is a daunting task, especially given the current financial and regulatory challenges.

Furthermore, while hydrogen’s versatility is one of its greatest strengths, it also complicates its adoption. Many industries that could potentially run on hydrogen require expensive retooling to accommodate the new fuel. This retooling process is a significant barrier, especially for sectors like steel and refining, where the margins are thin, and the capital costs are high.

Policy support and strategic investments

For green hydrogen to realise its full potential, bold government policies are essential. Governments must create demand through incentives such as grants, subsidies, and tax incentives. This would stimulate investment in hydrogen production projects, making them more financially viable. The European Union’s target to produce 10 million metric tonne of carbon-free hydrogen by 2030 and the US government’s $7 billion investment in regional hydrogen hubs are steps in the right direction. However, these efforts need to be scaled up and supported by a comprehensive regulatory framework that encourages private investment.

Moreover, successful hydrogen projects will likely be those that include the entire ecosystem — from production to end-use. For instance, Thyssenkrupp Nucera’s project in northern Sweden, which integrates green hydrogen production with steel manufacturing, is a model for future developments. This project has already secured €6.5 billion in funding, demonstrating that with the right combination of policy support, strategic investment, and customer commitment, green hydrogen can be a viable solution.

Green hydrogen offers a promising pathway to decarbonise some of the most challenging sectors of the global economy. Its potential to reduce emissions in steelmaking, refining, and chemical production, as well as its role in energy storage and transport, makes it an indispensable tool in the fight against climate change. However, realising this potential will require overcoming significant challenges, including high production costs, infrastructure gaps, and uncertain demand.

Bold government policies, strategic investments, and a holistic approach to hydrogen production and use will be critical in overcoming these challenges. If green hydrogen can be scaled up effectively, it could play a pivotal role in driving the global transition to a net-zero economy, bringing us one step closer to averting the worst impacts of climate change. The stakes are high, but the potential rewards are even higher. Now is the time to invest in the future of green hydrogen.