Donald Trump’s return as the US President has raised concerns over the trajectory of the global clean energy initiatives, particularly green hydrogen. While a shift in national policies under the Trump administration may reduce US federal government’s support for clean energy, green hydrogen’s momentum is bolstered by local government initiatives, private sector investments, and global market trends. Despite temporary setbacks in the US, the global green hydrogen industry will remain resilient, driven by its critical role in decarbonising industrial sectors and the steady growth in technology and infrastructure worldwide.

At COP29 in Baku, green hydrogen emerged as the focus of global decarbonisation strategies, with leaders and experts emphasising its role in achieving net-zero emissions. The negotiations recognised green hydrogen as a critical solution for decarbonising sectors like steel, chemicals, and shipping, which are otherwise difficult to electrify. While the summit showcased ambitious commitments, including a global pledge to increase clean hydrogen production six-fold, discussions were shadowed by reports of fossil fuel lobbying and critiques from former UN climate leaders about the COP process.

Green hydrogen has emerged as a critical element in the global pursuit of net-zero emissions, especially for sectors where direct electrification is challenging. Green hydrogen is produced through electrolysis powered by renewable energy sources, resulting in a carbon-free fuel. This makes it uniquely suited to decarbonise hard-to-abate industries such as steelmaking, shipping, and chemicals, which contribute significantly to greenhouse gas emissions. As nations strive to meet climate goals, green hydrogen’s role is expected to expand, fostering industrial transformation, energy security, and a sustainable economy on a global scale.

READ I Energy efficiency: The often overlooked key to climate action success

Global partnerships for green hydrogen

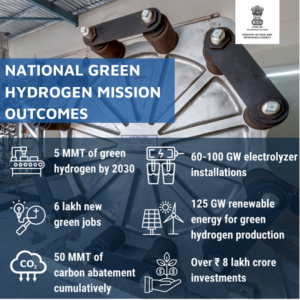

The international drive for clean energy has spurred governments and corporations worldwide to prioritise green hydrogen. Europe, the Middle East, and Asia have ambitious green hydrogen targets, supported by significant government funding and private-sector investments. The European Union’s Green Deal aims to produce 10 million tonnes of green hydrogen by 2030, while the Middle East, led by the United Arab Emirates and Saudi Arabia, is emerging as a global hydrogen hub. Such international partnerships highlight a long-term commitment to green hydrogen, making it a viable pillar of decarbonisation strategies, regardless of temporary political shifts.

In the US, where the Trump administration’s focus on fossil fuels may hinder federal support, the private sector and state-level initiatives continue to push forward. Local governments in states like California and New York remain committed to building green hydrogen infrastructure, ensuring progress continues independently of federal policies. Globally, investors view green hydrogen as a high-growth sector, with new projects and partnerships emerging despite recent market volatility.

Private sector and market uncertainty

The global green hydrogen market has faced challenges this year such as postponed projects due to regulatory uncertainty, tepid demand, and investor scepticism, leading to a fall in share prices for hydrogen companies. The industry has recently seen delays in high-profile projects, from the US to Europe, where financial strains and policy hurdles have created bottlenecks. Yet, private companies like Fortescue Future Industries and Nel ASA continue to invest heavily, recognising green hydrogen’s long-term potential. The US Inflation Reduction Act, although subject to regulatory ambiguity, has positioned the country as a major player in green hydrogen, incentivising corporations to make substantial investments.

This resilience stems from the understanding that green hydrogen offers unparalleled potential in decarbonising heavy industries. As market volatility subsides, green hydrogen’s advantages will become even more apparent to investors, reinforcing its role in the global energy transition.

Advancements in technology and infrastructure

Green hydrogen’s success hinges on cost-effective production, storage, and transportation technologies. Innovations in electrolyser efficiency, coupled with decreasing costs of renewable energy, are making green hydrogen more competitive. European companies such as Enapter and Plug Power, as well as Asian firms, are rapidly advancing electrolyser technology, driving down costs and enhancing the feasibility of large-scale green hydrogen production. Partnerships like those between Equinor and Hystar to integrate offshore wind with hydrogen production exemplify the industry’s efforts to scale sustainably and meet global demand.

This momentum is mirrored in the Middle East, where Saudi Aramco and Abu Dhabi’s ADNOC are investing in clean hydrogen to diversify their economies. Such initiatives are laying the groundwork for an interconnected global hydrogen infrastructure, capable of meeting the demands of industries worldwide and accelerating the transition to green hydrogen as costs fall.

Environmental and infrastructural challenges

While the promise of green hydrogen is significant, the industry faces several environmental and logistical challenges, particularly in production and distribution. Electrolytic hydrogen production requires significant amounts of water and electricity, which may strain resources in water-scarce regions like North Africa, the Middle East, and parts of Asia. Desalination and green ammonia are emerging as potential solutions, allowing hydrogen to be produced and transported in a more resource-efficient manner.

Infrastructure also remains a critical bottleneck globally. As green hydrogen becomes a mainstream energy source, the need for robust transportation and storage solutions will grow. Countries and corporations are investing in projects to overcome these hurdles, from building hydrogen pipelines to developing ammonia and liquid organic hydrogen carriers. These innovations will be instrumental in establishing a resilient, scalable infrastructure for green hydrogen.

Role of government policies

Green hydrogen’s role in decarbonising heavy industries is supported by policy frameworks and international commitments to reach net-zero emissions. Many countries, including Germany, Japan, and South Korea, have incorporated hydrogen into their energy strategies, providing subsidies, tax incentives, and public funding to drive its adoption. Despite recent setbacks in project financing, green hydrogen remains a cornerstone of climate action plans globally, as governments and corporations alike recognise its potential to reduce greenhouse gas emissions on a large scale.

The US remains a key player, with federal policies and investments catalysing domestic hydrogen production. The Inflation Reduction Act has introduced competitive tax credits, positioning the US as an attractive destination for hydrogen development. While regulatory delays have challenged implementation, the US market will likely experience continued growth, helping to stabilise the global hydrogen sector and meet long-term climate goals.

The global green hydrogen industry is positioned for sustained growth, driven by its indispensable role in decarbonising hard-to-abate sectors and reducing reliance on fossil fuels. While temporary setbacks, such as political shifts and market fluctuations, may affect national policies, the industry’s resilience is underscored by strong state and local initiatives, private-sector commitment, and international partnerships.

As the world transitions to a low-carbon economy, green hydrogen will play a vital role in powering industries and achieving net-zero emissions. Through technological advancements, strategic investments, and resilient infrastructure, green hydrogen’s momentum can withstand challenges, ensuring it remains central to the clean energy landscape for years to come.