The Union government may raise up to Rs 16,000 crore through the sale of sovereign green bonds in the next financial year also to fund investments in solar, wind and hydel projects, according to a media report. It had sold green bonds worth Rs 8,000 crore last month and another sale of Rs 8,000 crore is scheduled for Thursday. India’s first tranche of green bond issue was mostly subscribed by local banks and insurance companies with foreign investors staying away.

Governments across the world are issuing sovereign green bonds to fund climate change mitigation projects. Finance minister Nirmala Sitharaman had, in the last Union Budget, announced the government’s intention to issue green bonds. The government had announced the framework for sovereign green bonds last year, while the RBI published a calendar for their issue. The framework follows the principles listed by the International Capital Market Association for green bond issues. It brings clarity on four issues — use of proceeds, project evaluation and selection, management of proceeds, and reporting.

READ I Budget 2023: Focused on ESG and inclusive growth

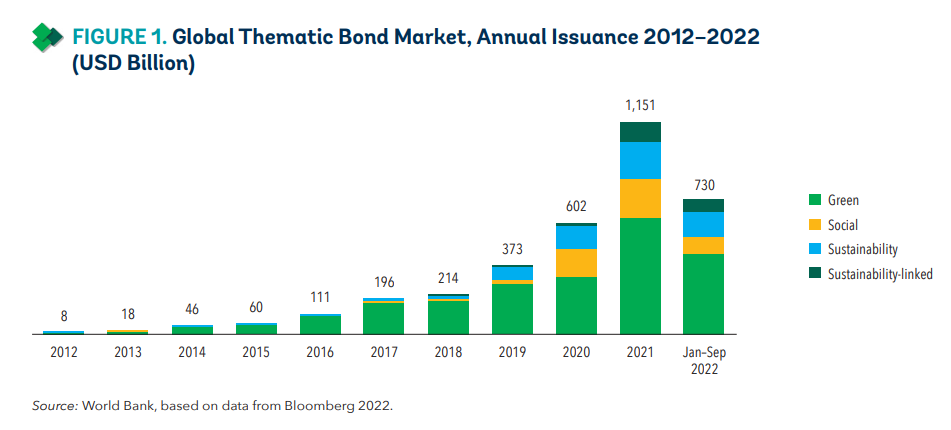

The importance of these bonds cannot be overstated especially in the wake of the increasing number of extreme weather events due to climate change and global warming. In fact, green bonds have emerged as an important financial instrument over the last few years in the fight against climate change. Connecting environmental projects with capital markets also solves the financial dilemma as heavy investments are needed to mitigate climate change challenges. India’s climate actions so far have been funded via domestic resources.

India needs investments to the tune of $1.4 trillion for its clean energy infrastructure and to meet global climate targets, according to the International Energy Agency. And that is just one of the steps towards climate change mitigation. What RBI raises from its present green bonds offering will be deployed in various green initiatives such as renewable energy, clean transportation, climate change adaptation, and sustainable water and waste management. However, the success of green bonds will be greatly influenced by the extent investors derive benefit from these issues.

How do sovereign green bonds work

A green bond is a fixed-income instrument that is specifically earmarked to raise money for climate and environmental projects and falls in the larger category of socially responsible and environmental, social, and governance (ESG) investment. Since these bonds are backed by the issuing entity’s balance sheet, they usually carry the same credit rating as their other debt obligations.

Green bonds are asset-linked and date back to the first decade of the 21st century. They are also called climate bonds at times. Green bonds work like corporate or government bonds. Borrowers issue these securities to secure financing for projects such as ecosystem restoration or reducing pollution.

Investors who purchase these bonds can expect to make a profit as the bond matures. Typically, green bonds come with tax incentives, making them lucrative to investors. These tax advantages provide a monetary incentive to tackle prominent social issues such as climate change and also promote movement toward renewable sources of energy. Green bonds also provide investors hedge against climate change risks while achieving similar interests as other asset class.

The country’s bond market will have to evolve much before it can make a significant dent in drawing international capital. For one, the current definitions of sustainability are vague and there is a lack of mandate to creditors. While India’s efforts to join the club of sovereign issuers is laudable, there are other arenas that need urgent attention of the government. This includes taxonomy issues that can hamper the deployment of green bonds. Also, the government must brace itself for intensified scrutiny due to the rising trend of greenwashing of projects.