The Indian pharmaceutical industry, a global leader in generic medicines, has long been struggling to break free from its dependence on China for active pharmaceutical ingredients. Despite being the third-largest producer of pharmaceutical products by volume, India’s reliance on China for essential raw materials has raised concerns, especially in the context of recent geopolitical tensions and the COVID-19 pandemic. The government has announced several schemes to reduce its industry’s dependence on Chinese APIs.

India’s dependence on China for APIs is substantial. In 2023-24, China accounted for 43.45% of India’s pharmaceutical imports, amounting to $3.6 billion. This reliance is not limited to APIs but extends to key starting materials (KSMs), chemicals, and solvents. The data from the Pharmaceutical Exports Promotion Council (Pharmexcil) shows a steady increase in the import of bulk drugs, with imports in the first two months of 2024-25 growing by 13.06% compared with the previous year.

READ I How poor is India? Outdated poverty line creates data dilemma

APIs – price dynamics

A significant factor driving continued imports of APIs from China is the price advantage. API prices have seen a marked decline recently, with paracetamol API prices dropping from Rs 900 per kg during the pandemic to Rs 250 per kg now. Similar trends are observed in other APIs, such as meropenem, where prices have fallen significantly. This price advantage makes Chinese APIs an attractive option for Indian pharmaceutical companies, leading to increased imports when prices are low.

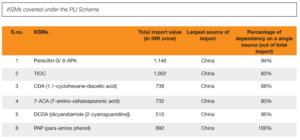

The Union government launched the Production Linked Incentive (PLI) scheme in February 202API 1, looking to bolster domestic production of APIs and KSMs. With an outlay of Rs 15,000 crore for 2020-2029, the scheme has seen significant investments and has started to yield results. By December 2023, Rs 3,586 crore had been invested under the PLI scheme for bulk drugs, with cumulative sales of Rs 844 crore for domestically produced bulk drugs.

However, the PLI scheme has its limitations. Despite the government’s efforts, imports from China have continued to grow. The scheme’s impact is gradual, and the initial investments and production increases have not been sufficient to drastically reduce imports. The Indian pharmaceutical industry still faces challenges in achieving self-reliance, particularly in the face of China’s established supply chain advantages.

Reducing dependency on Chinese APIs is fraught with challenges. The Indian pharmaceutical industry, despite its strengths, faces several obstacles. Chinese suppliers have a significant cost advantage due to economies of scale, established supply chains, and lower production costs. Competing with these prices while maintaining quality and regulatory compliance is challenging for Indian manufacturers. Building the necessary capacity and infrastructure for large-scale API production requires substantial investment and time. The PLI scheme, while a step in the right direction, needs to be scaled up to meet the industry’s demands.

The production of APIs and KSMs involves advanced technological processes and skilled labour. Bridging this gap requires not only investments in technology but also in training and development of the workforce. The global pharmaceutical market is highly interconnected. Any move to decouple from Chinese APIs could disrupt supply chains and lead to higher drug prices, affecting both domestic and international markets.

To effectively reduce its dependence on China for APIs, India needs a multi-pronged strategy. The government should consider expanding the scope of the PLI schemes to cover the entire pharmaceutical supply chain, including basic chemicals. This would provide a more comprehensive support structure for the industry. Collaboration between the government and private sector can drive innovation and investment in API production. Joint ventures and partnerships can help pool resources and expertise.

Increased focus on research and development can lead to the development of new processes and technologies that reduce production costs and improve efficiency. Investing in R&D will also help in creating a skilled workforce adept in advanced pharmaceutical manufacturing. India should diversify its import sources to reduce the risk of over-reliance on any single country. This involves building trade relationships with other countries and exploring alternative suppliers. Rather than viewing China purely as a competitor, India can explore collaborative efforts that benefit both countries. Joint ventures and technology exchanges can create a more resilient and mutually beneficial pharmaceutical supply chain.

Ending dependence on China for APIs is a complex but achievable goal for the Indian pharmaceutical industry. While the journey is fraught with challenges, strategic initiatives, policy support, and international collaboration can pave the way for a more self-reliant and robust pharmaceutical sector in India. The PLI schemes have set the foundation, but sustained efforts and a holistic approach are necessary to build a resilient and self-sufficient industry.