The steel industry, a vital cornerstone of modern infrastructure and manufacturing, is one of the world’s largest contributors to carbon emissions, accounting for 7–9% of global greenhouse gas output. As global demand for steel grows, propelled by population expansion and economic development, the sector’s carbon footprint presents a significant hurdle in achieving international climate targets. Emerging technologies, particularly green hydrogen, offer promising pathways for decarbonising this essential industry. However, in developing economies, implementing such transformative solutions poses unique challenges.

Traditional steel production relies on coal or coke to reduce iron ore in blast furnaces, resulting in significant carbon emissions. Green hydrogen offers a cleaner alternative by enabling the Direct Reduced Iron (DRI) method. This process produces Hot Briquetted Iron (HBI), a solid intermediary form of iron, while emitting negligible greenhouse gases when paired with renewable energy. Unlike traditional blast furnaces, DRI does not require the co-location of iron- and steelmaking facilities. This flexibility opens doors for countries with abundant renewable resources and iron ore deposits to become global hubs for green HBI production, exporting this lower-emission input to steelmakers in developed markets.

READ | Retail traders bear the brunt of speculation

Economic Viability: The $9 Billion Question

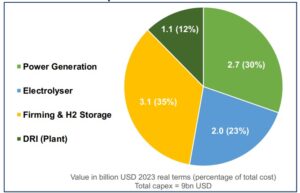

A study by the Oxford Institute of Energy Studies modelled an archetype green hydrogen-based DRI project in a developing country. Estimated to cost $9 billion, this project highlights the steep financial, technical, and logistical challenges associated with green ironmaking. The cost of producing green HBI was calculated at $690 per tonne—double the price of conventional “grey” HBI—largely due to the high costs of green hydrogen production ($4.84/kg) and renewable electricity ($45.5/MWh). This “green premium” underscores the financial barriers to adoption. Bridging this gap will require concerted efforts, including government policies, innovative financing mechanisms, and long-term commitments from both producers and buyers.

Capital costs of different components

Ensuring a reliable and cost-effective renewable energy supply is crucial for green hydrogen production and DRI plants. Dedicated wind and solar farms, as assumed in the study, offer a solution, though integrating these facilities with local grids could provide additional cost and operational efficiencies. The quality of iron ore is another significant challenge. High-grade iron ore with over 66% iron content, essential for DRI, is limited in global supply.

Securing long-term contracts with mining companies and investing in beneficiation plants to enhance ore quality are critical measures for ensuring reliable operations. Additionally, buyers in developed markets must be willing to absorb the green premium by paying higher prices for green steel. Mechanisms such as the EU’s Emissions Trading System (ETS) and Carbon Border Adjustment Mechanism (CBAM) can help mitigate competitive disadvantages by penalising carbon-intensive imports and rewarding low-emission products.

Financing such projects requires innovative structuring. A $9 billion project in a developing economy demands access to multilateral development banks (MDBs), development finance institutions (DFIs), and export credit agencies (ECAs), which can help lower the cost of capital and share risks. Long-term offtake agreements with buyers and carbon contracts for difference are also necessary to provide revenue certainty.

Host governments must play an active role in creating a favourable regulatory environment, including offering tax exemptions for imported renewable equipment and ensuring that clean energy generated by the project is not diverted to other uses. Regulatory frameworks that allow offshore hard-currency accounts for foreign investors further help mitigate currency risks, making the project more attractive to lenders.

The Role of Developed Markets

Importing countries also have a critical role in supporting the transition to green steel. Governments in developed economies must establish strong policy signals to ensure sustained demand for green steel. Carbon pricing remains a vital mechanism, but current global average prices of $23 per ton of CO2 are insufficient. More robust measures, such as carbon contracts for difference, public procurement mandates, and subsidies, can ensure that the demand for green steel grows steadily over time.

The EU’s CBAM, set to penalise imports based on their carbon intensity, is a promising example of how trade policy can incentivise the production and consumption of green products globally. Such mechanisms are crucial for creating a level playing field for investments in developing countries and spurring the growth of green industrial projects.

Green hydrogen-based DRI offers more than just a path to decarbonisation; it represents a transformative economic opportunity for developing economies. Countries with abundant renewable energy and natural resources, such as India, Brazil, and South Africa, are well-positioned to emerge as key players in the global green steel supply chain. These nations can leverage their competitive advantages to attract investments and generate significant economic value while contributing to global emission reduction efforts.

As the cost of green hydrogen declines and carbon pricing mechanisms gain traction, green steel production could become intrinsically profitable by 2040. This shift would likely see iron ore-exporting nations pivoting toward green HBI production, capturing more value locally and reducing their exposure to volatile raw material markets. Historically, similar shifts have occurred in other industries, such as petrochemicals, where production relocated closer to feedstock sources to reduce costs.

Decarbonising steel industry

Decarbonising the steel industry in emerging markets through green hydrogen is a daunting but achievable goal. While initial projects will require substantial collaboration among governments, private sectors, and multilateral institutions, the long-term benefits—in terms of emissions reductions, economic growth, and industrial competitiveness—are unparalleled. The steel industry, a symbol of industrial progress, has the potential to become a beacon of sustainable innovation. The journey toward green steel, however, must begin with bold commitments, innovative policies, and visionary partnerships.