Commercial banks have become wary of lending to smaller microfinance institutions, forcing MFIs to borrow from non-banking financial companies (NBFCs) at significantly higher interest rates. The same has been attributed to a policy change by the Reserve Bank of India with the Deputy Governor having criticised micro lenders for disproportionately raising their margins. However, the benefits of the new deregulated regime were not passed on to borrowers.

Smaller MFIs with loan portfolios under Rs 1,000 crore are particularly struggling to secure bank loans. There is a noticeable shift in bank behaviour following the government’s loan guarantee program during the COVID-19 pandemic. With the guarantee program now expired, banks have become more selective, impacting the flow of loans to smaller MFIs.

READ | New FPO policy seeks to transform farming with Amul model

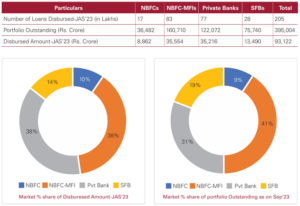

RBI data has also affirmed this trend. NBFC-MFIs, a rapidly growing segment, saw their assets reach Rs 1.36 trillion as of September 2023. However, a recent RBI regulation increasing risk weightings for bank loans to NBFCs has slowed this growth. Jiji Mammen, CEO of Sa-dhan, highlights the difficulties smaller MFIs are facing in accessing funds from banks and development finance institutions. He attributes this to banks’ cautious approach following the RBI’s guidelines, even though MFI loans are not directly impacted.

Both MFIN and Sa-dhan have appealed to the government for solutions. They propose a dedicated fund or a guarantee mechanism to facilitate borrowing from banks and development institutions like Sidbi and Nabard. Sa-dhan has specifically requested a Rs 500 crore equity fund and loan guarantees for smaller lenders in the upcoming budget.

Overview of microfinance sector

MFIN has argued that interest rates remain competitive compared to other lenders. It has also cited data showing a weighted average interest rate of 23.73% for the top 15 NBFC-MFIs, translating to an annual interest cost of Rs 12 for every Rs 100 borrowed by a client. MFIN has 74 members (including Banks, small finance banks, NBFCMFIS, and NBFCs), which make up 85% of the MFI sector in India.

Smaller MFIs are facing significant challenges in securing affordable funding. The industry seeks government intervention to ensure continued access to funds for these institutions, which play a crucial role in providing financial services to underserved populations.

MFIs and SME funding in India

Microfinance institutions, which have acted as a financial support system to low-income households by offering credit access to six crore borrowers in the last few years, will play a leading role in the growth process of India, according to a study by consultancy major PricewaterhouseCoopers(PwC).

There is a flipside to the MFI story as well. While they were formed with an expectation that they will help SMEs thrive, microfinance in India has become an exploitative option. MFIs were conceived to serve the unbanked population which covers women, marginalised communities or remote locations, Resmi Bhaskaran told Policy Circle. However, geographically, they are still concentrated where banks are already present such as South India where the presence of banks, especially cooperative banks is commendable. MFIs are hence not reaching out to places and communities where they are actually required.

In India, MFIs have moved away from their core objective. Now, they have moved on to extending individual loans to micro entrepreneurs. Also, MFI loans are actually costlier than other forms of loans. Communities are well aware of the crisis within the industry and micro entrepreneurs are very carefully taking loans from MFIs. However, MFIs still allure consumers with top-up loans on previously defaulted loans.

The solution to the problems in the MFI industry is that banks will need to step up and reach out to communities which are in need of loans but do not want to fall prey to the nexus of top-up loans provided by MFIs. However, banks are not approaching individuals as they used to do because they are highly understaffed.

In some northern regions, banks have deployed outreach managers which are women (sometimes men too) from the community itself who reach out to consumers. This is a good model to follow and every bank must focus on it.

On the other hand, there is a big cry from the MFI sector that MUDRA loans and SGHS loans should be diverted to MFIs. However, this is a dangerous thing.

This is not to say that MFIs are evil entities, on the contrary, they are endorsed by the likes of the World Bank. MFIs provide loans when there is no other option for individuals. However, they will do better with some tweaking.

Microlending was considered a solution to poverty eradication in India, but today a more modest goal has been taken for financial inclusion as an attempt to reach people without access to the banking system. Despite this shift, development banks remain firm believers in microfinance’s effectiveness. They see it as a crucial tool to reach the poor who would otherwise resort to predatory loan sharks. They emphasise that the vast majority of the over 5,000 micro lenders in India operate responsibly.