The government plans to free up more spectrum for 5G services as it looks shore up revenues from the telecom sector by enabling faster adoption of 5G technology across the country. It has announced its intention to auction 5G spectrum in the coming financial year beginning April 1. Other than spectrum of mid-band (1 GHz to 6 GHz), sub bands or the milli-metre bands which are crucial for rolling out the next generation services will also be auctioned. Currently, a DoT committee is holding consultations with other departments to finalise how much spectrum can be freed for auction. The departments to be consulted include space and broadcasting ministries.

The need for more 5G spectrum has come up as telecom companies need to ramp up their network in tune with the existing technology. They must also be future ready for emerging technologies like 6G. The DoT has recognised that keeping high-value spectrum for broadcasting and satellite is not prudent.

READ | Govt looks to piggyback ChatGPT, but must fix these issues first

The government is eyeing extra revenues and has budgeted for a 30% jump in revenues from the telecom sector in FY24 to nearly Rs 90,000 crore. While most of this amount will come from the deferred spectrum payments from the 2021 and 2022 auctions with a small part coming from the proposed sale of more 5G airwaves in the coming year.

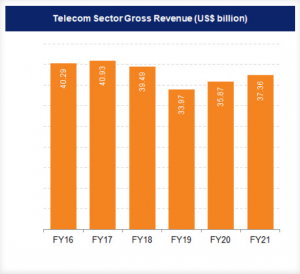

Telecom sector gross revenue in US $

What is 5G?

The fifth-generation technology standard for broadband cellular networks will offer higher speed and reduced latency to the network to make connectivity faster. The biggest benefit of 5G is the ability to transfer huge amounts of data in just seconds. In addition to speed, it will also have higher bandwidth and can thus connect more devices. It is claimed that 5G download speeds can reach up to 10 gigabits per second. Compared with 4G’s 150 Mbps speed, 5G offers a significant jump in download speeds. This will help users download heavy games and high-definition movies in seconds.

Last year, the Cellular Operators’ Association of India (COAI) wrote a letter urging the government against allotting 5G spectrum to private captive networks. The presence of the same could have rendered the point of offering 5G services pointless, the association had argued.

Ptivqte captive 5G network is basically a network set up by a private entity for the use of just one organisation. It is similar to a captive coal mine in that the 5G service offered by this captive network will only be utilised by the enterprise concerned, and no one else.

What is spectrum and how does it work

Airwaves are radio frequencies within the electromagnetic spectrum that can carry information wirelessly for a range of services including telecommunications. The government manages and allocates airwaves to companies or sectors. Thus, spectrum becomes an asset for companies which can be bought and used to make money. The spectrum auctions fetch government revenues. Spectrum can be divided into bands ranging from low frequency to high frequency, which determines their usage and is useful in allocation.

Of the several types of spectrum available in the country, companies are particularly fascinated by the one in the 3.3-3.8 GHz range as several countries have already designated it for 5G technology. In India, 3.8 GHz is currently used by some broadcasting and satellite players and the government is looking for ways to shift these players to higher frequency. This will help in freeing up the band for auction.

In its last round of the 5G auctions conducted in August 2022, Reliance Jio won the highest number of bands. The Mukesh Ambani-led telco emerged as the top bidder in the country’s 5G spectrum auction and it acquired 24,740 MHz spectrum worth Rs 88,078 crore. Sunil Mittal’s Bharti Airtel was the second-highest bidder with 19,867 MHz spectrum in various bands worth Rs 43,084 crore.

Overall, the government had received bids worth Rs 1.5 trillion. The 700 MHz band saw bids worth Rs 39,270 crore. Business conglomerate Gautam Adani’s Adani Group had also made its debut in the 5G auction. A unit of Adani Group acquired 400 MHz spectrum in 26 GHz band worth Rs 212 crore.

India is the world’s second-largest telecommunications market and it is no brainer that potential investors and private companies are fascinated towards the nation. The total subscriber base, wireless subscriptions as well as wired broadband subscriptions have grown consistently in the country especially after the government’s push for Digital India. It is expected that over the next five years, rise in mobile-phone penetration and affordable data costs will add 500 million new internet users in India. This will in turn create opportunities for new businesses and attract more foreign investments.