India must eye battery storage technology leadership: In November 2021, India met the target of achieving 40% of the installed power generation capacity from renewable energy sources. On that day, the installed renewable energy generation capacity (including hydropower) stood at 157.32 GW which was 40.1% of the total installed electricity capacity of 392.01 GW. This was a big achievement as the share of non-fossil fuel in the total installed capacity was just 30% in 2015.

In September 2022, the total generation capacity rose to 407.79 GW with 164.9 GW coming from renewables. In the updated nationally determined contributions submitted to the UNFCC as per Article 4 of the Paris Agreement, India has pledged to achieve 50% of the installed capacity from non-fossil fuel energy resources by 2030.

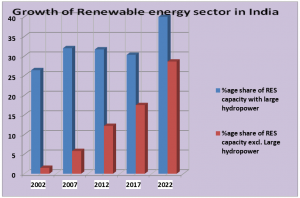

The growth of the renewable sector in terms of its share in total power generation capacity has been impressive in the last 20 years. As on August 2022, the installed capacity for power generation in the country from renewable sources including hydroelectric projects was 40.1%, out of which large hydropower contributed 11.5% as per information available at National Power Portal. Generally, the sources of energy under the renewable energy category include wind energy, bio-mass power, solar power, urban & industrial wastes, and small hydro power projects of capacity less than 25 MW. Despite the growth in the RES sector, coal continues to dominate with a share of 52% of the total installed capacity.

READ I India set to be a leader in renewable energy, but may still miss own targets

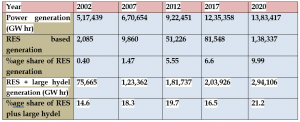

A close look at the year-wise energy generation trend shows that the actual share of power generation from renewable sources has always been less than half of their share in the installed generation capacity. The share of RES in the actual generation of power has not exceeded 10% as shown in the table below. (Source: National Power Portal)

Integration of renewables with the grid

The larger penetration of renewables in the grid is a welcome sign. However, it will need to overcome some challenges like aging infrastructure having outdated technologies, policy uncertainties, and varying geopolitical situations. There is no doubt that massive fall in renewable energy costs in the last decade has helped in the rapid transformation of the global electricity mix. The decreasing cost trends of renewables alone will not help overcome some of the challenges.

One of the major problems with renewable energy generation is that supplies are far more variable than other means of energy generation. Electricity generation from solar or wind sources cannot be in sync with the peak demand pattern as in the case of fossil fuel-based power generation. So is the volatility on the demand side.

What about those times when the sun is not shining? Grid operators will need to curtail or reduce the output from renewables during times of peak production for lack of demand. This can result in losses for renewable generators and a lower share of clean energy utilisation. The frequency and voltage of the electric supply must be kept within specified ranges to ensure the stable operation of equipment without causing any damage. Even countries at the forefront of technological development like the US find it difficult to achieve a share of 20% of energy generation from renewables. Such a situation could be addressed by coupling the generation facility with an energy storage device.

READ I Future tense: Too early to write off cryptocurrencies

On these aspects, comprehensive research titled “Western Wind and Solar Integration Study (WWSIS)” was commissioned by The National Renewable Energy Laboratory (NREL), US to find out the operational impact of up to 35% energy penetration of wind and PV Solar on the power grid system. The study concluded that at up to 10% renewable energy penetration in the grid, the grid is stable with manageable challenges. As the penetration reaches 20%, grid stability issues are seen more frequently which further rises at 30% penetration making the grid unstable, affecting the performance of other power generating plants connected to the grid.

In India also, a Renewable Grid Integration Study was conducted by the ministry of power with the support of USAID in 2017 to understand the impact on power system operations arising from the addition of renewable energy (RE) generation target of 175 GW by 2022.

The primary basis was that the RE generation would meet 22% of the total projected electricity consumption in the year 2022. The results of the study demonstrated that a power system balancing with 100 GW solar and 60 GW wind is achievable with minimal RE curtailment and India’s current coal-heavy power system has the inherent flexibility to accommodate the variability associated with the targeted RE integration.

The report also emphasised that storage is not necessary at these penetration levels, though it admits that achieving more ambitious RE targets will require detailed, model-based planning. While the real-time report on grid stability for the year 2022 is not available, it would be interesting to see the actual performance of the grid with a penetration of 175 GW of renewable power.

As per data available for the year 2020, the total actual generation of power from renewable sources (as per MNRE Press Release dated 09.09.22) was 138 TWatt hr as against power generation from all sources at 1383 TWatt hr which corresponds to a share of 9.97 %. It is thus yet to be seen whether the transmission infrastructure is robust enough to supply an energy mix with RE sources contributing more than 20%. The bottom line here is that the issue of maintaining vital parameters in a power grid supply system within limits is so fundamental that the future of renewable power in India will depend on how we find a practical solution for storing power to meet the unevenness of renewable power generation.

Battery storage technology and its deployment

A grid-connected solar PV system with an energy storage device in a residential or commercial setup has the potential not only to provide backup power in case of no supply from the grid but also earn by feeding back green energy into the grid from their energy generation and storage system. By permitting the exchange of data between the utility and the consumer, one can also optimise the running time of their electrical appliances thus saving on energy bills by load shifting which is the practice of moving energy consumption from peak tariff hours to the day when the tariff is lower.

To carry out these smart functions, a modern battery storage system usually includes an inverter, sensor, and computerized control systems to coordinate power generation and decide when to store the energy or release it back to the grid, opening up various commercial options.

Despite technological advancements, the cost of energy storage devices is standing in the way of being deployed extensively, the cost fell by almost 70% between 2015 and 2018. While the technologies employed for storing energy are numerous, the energy storage system could be classified as battery type energy storage system and non–battery type energy storage system.

The more popular and widely used battery type storage has Lithium-ion (Li-ion) batteries and Lead-acid batteries as the two technologies most commonly found. Despite the high cost and other challenges that they pose, lithium-ion batteries make up about 90% of the global grid battery storage market. It is due to its lightweight and very high energy density compared to the rival technologies. However, some aspects like the aging issue and safety need to be addressed.

Apart from these issues, the researchers are working to further improve lithium-ion battery performance in two aspects namely enhancing cycle life and higher power density, both of which are vital features required in a battery when connected to the grid. The high-power density gives an idea as to how much power a battery can deliver on demand.

Although a variety of grid-scale storage technologies are available and some more are under development, a technology based on regenerative fuel cells, in which energy is stored as hydrogen gas, has the potential to emerge as a preferred technology for storing energy at grid-scale in the coming decades. The Regenerative Hydrogen Fuel Cells (RHFCs) as it is known, provide a substantially higher energy density, flexibility, low rate of self-discharge, and competitive cost compared to any other energy storage medium currently available.

Due to these features, several RHFC projects have already been implemented. In India, Reliance group is aiming to reduce the production cost of green hydrogen below US$1/kg by the end of this decade and has announced a capital outlay of US$ 9.4 billion over the next three years to develop capacities to produce green hydrogen.

Some new storage battery technologies like Sodium-sulphur (NaS), Sodium-iodide (NaI), and Iron-air (Fe-air) batteries, mainly based on different elements being used as anode and cathode have offered low-cost, and high-performance characteristics as an alternative to Li-ion batteries, however, these rechargeable batteries in their current state of development have their limitations, so it remains a work in progress.

Global initiatives for energy storage

Given the push for the promotion of EVs and green power, no major economy can afford to disregard the need for reliable energy storage devices for the renewable energy-fed grid. As per the International Energy Agency (IEA), the total installed grid-scale battery storage capacity globally was estimated at 16 GW at the end of 2021, most of which was added during the last five years. The global investment in energy storage reached US$ 10 billion in the year 2022, out of which almost 70 % was on grid-scale storage.

The IEA report released in September 2022 also states that to meet the Net Zero Scenario, an average of over 80 GW every year in the grid storage battery over the 2022-30 period is required to be installed as against a battery capacity of 6 GW added in 2020.

In the US, for stationary storage application and use at power station connected to the grid, a 100 MW Tesla Megapack based on lithium-ion technology have been installed in Ventura County, California for stabilising the grid and meeting the peak power requirements.

The same technology with a storage capacity of 300 MW has been installed in the state of Victoria, Australia. Tesla is planning to build around 16 Giga factories like one set up in Nevada, USA by 2030 to meet the demand for its electric vehicles and also for balancing the grid with intermittent renewable energy sources. According to Tesla CEO Elon Musk, one hundred Giga factories would be necessary to transition the world to sustainable energy consumption. In the UK, the government has plans to ensure the deployment of sufficient large-scale long-duration electricity storage (LLES) to balance the overall system.

Where does India stand?

A study Report on Optimal Generation Capacity Mix for 2029-30 carried out by Central Electricity Authority in January 2020 suggested a battery-based energy storage capacity of 27 GW and 10.1GW of pumped hydro storage (PHS) meet the variability of renewable power in 2030 while IEA expects India to have a storage capacity of 140 GW by 2040. Currently, India has a 10 MW grid-connected storage system, owned by AES and Mitsubishi Corporation at Tata Power Delhi Distribution’s sub-station in Rohini, stated to be India’s first storage device installed to provide grid stabilization.

Tata Power Solar Systems Ltd has also received a contract from Solar Energy Corporation of India Ltd (SECI) to build a 100 MW EPC solar project in the state of Chhattisgarh to be supported with a 120 MWh utility-scale Battery Energy Storage System (BESS). Before these projects, India’s energy storage was almost entirely based on pumped hydropower.

The Indian government is stated to be working on a nearly $2.5 billion incentive plan to encourage domestic manufacturing of grid-scale batteries to speed up its energy transition. However, not many details of the plan are available in the public domain. What India needs is comprehensive guidelines on the use of storage technology, its impact on the environment, the safety aspects, and the governing market rules and regulations for applications of storage technologies in the grid, though these issues have been discussed and analysed in different reports and also stakeholders’ opinion invited.

For example, the draft Electricity (Amendment) Rules 2022 circulated for comments has proposed treating a standalone energy storage system (ESS) as a delicensed activity and creating a central pool of renewable sources of energy. However, these rules are under finalisation. These issues need to be settled at the earliest since such a policy vacuum may inhibit the interest of potential investors in India.

A NITI Aayog publication on Need for Advanced Chemistry Cell Energy Storage in India Part III brought out in September 2022 recommended that an enabling environment for long-term sustainable growth of the sector is needed to facilitate the growth which should be supported by direct fiscal incentives, tax credits, and partnerships with industry leaders beyond the PLI scheme on ACC energy storage.

As regards ground-level progress, India’s first lithium-ion cell manufacturing unit announced its pre-production trial a couple of months back at their Tirupati plant which will supply cells for the consumer market segment like mobile phones. Some other battery majors like Exide, Toshiba, Amara raja, Tata Chemicals, and others have set up JV to take up manufacturing of lithium-ion batteries, mostly for electronics, telecom, and EVs applications. Under the PLI scheme Ola Electric, Reliance, and Rajesh Exports have approved and signed the agreement for the implementation of the scheme.

India has committed to achieving 500 GW of installed generation capacity from renewable energy sources by 2030 and a net zero carbon emission by 2070. The grid-connected storage system will have an important role to play in decarbonisation efforts in India and at the global level to meet the target of net zero emissions by 2050 or 2070.

Besides providing short-term balancing and grid stability it can also lead India on the path of achieving energy security critical for a country dependent on imports of petroleum fuels. India’s ambition to emerge as a leading country in the EV sector is also largely dependent on the growth of this sunrise sector. These ambitious targets demand stepping up local R&D, manufacturing, and global technology & investment partnership in the energy storage sector.

The government has expressed its intention to bring out a comprehensive policy on energy storage in the power sector focusing on regulatory, financial including a revenue generation model for investors, demand management, safety standards, and other technological aspects to speed up the creation of storage capacity to permit flexibility in the power system to absorb the large-scale integration of the renewable energy in the coming years. India’s performance so far in creating generation capacity from renewable is remarkable, however, it must learn from failures in chip manufacturing in the past and act urgently and swiftly to avoid trailing behind on the storage battery front.

Krishna Kumar Sinha is an industrial policy and FDI expert based in New Delhi. His last assignment was as an industrial adviser in the department of industrial policy and promotion, DIPP, currently known as DPIIT, under the ministry of commerce and industry of the government of India.