The global insurance industry has recorded a surge in premiums in the post-pandemic recovery, but faces challenges posed by natural catastrophes. While insurers collected more than $6.5 trillion in premiums last year, growing risk from natural disasters is casting a shadow on the industry’s future. Verisk’s latest forecasts put average annual losses for the sector at $151bn — a staggering figure that reflects the growing risks posed by climate change, rapid urbanisation, and escalating rebuilding costs.

Insurers are grappling with a surge in property claims, forcing some to pull back from high-risk areas and pushing up the cost of cover. The scale of these challenges demands a fundamental rethinking of risk management strategies if the industry is to safeguard its financial stability in the face of an increasingly volatile environment.

READ I Aiming for stars: India’s space sector needs more than just technology

A new normal for insurance industry

In the past, years of high losses from natural catastrophes were viewed as anomalies. However, Verisk’s recent findings suggest that the difficulties of the last few years were not outliers. Instead, they reflect a new normal that insurers must now prepare for. The report reveals that the average insured loss over the past five years has been $106 billion annually — already a significant burden—but this figure is forecasted to grow due to expanding urban populations in high-risk areas, inflationary pressures, and the rising intensity of extreme weather events. The current forecast of $151 billion is a stark reminder that the sector must adapt to avoid long-term financial instability.

Average annual losses for insurance industry

While climate change is responsible for only about 1% of the annual increase in losses at present, its impact is expected to intensify in the coming decades. This, combined with the rising frequency of natural disasters, necessitates a more proactive approach to risk management across the insurance sector.

Rising impact of secondary perils

One of the most striking elements of recent natural catastrophe losses is the increased significance of secondary perils such as severe thunderstorms, wildfires, and floods. These events, while not as singularly catastrophic as hurricanes or earthquakes, have proven capable of causing substantial cumulative damage. In 2023, for instance, US severe thunderstorms contributed more than $57 billion to insured losses. With the five-year adjusted average annual loss from severe thunderstorms rising from $23 billion to $39 billion, insurers cannot afford to overlook these secondary perils.

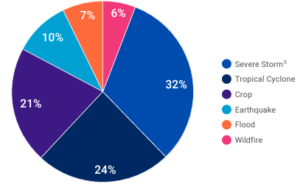

Contribution to average annual losses

Verisk’s report stresses that while the sector has historically focused on modelling primary perils like hurricanes and earthquakes, it must now prioritise understanding and mitigating the risks posed by secondary perils. Doing so will be essential for maintaining the solvency and profitability of insurers in the years to come.

Challenges of inflation, urban expansion

Urban expansion and inflationary pressures are worsening the situation. More than half of the world’s population now resides in urban areas, and in many developing countries, cities are rapidly expanding into regions prone to natural disasters. This growth drives up the exposure to risk, as does inflation in property values and construction costs. Even as price inflation returns to normal levels, these rising exposures will continue to contribute to the upward trajectory of insured losses.

The trend is clear — as urban centres expand and property values rise, insurers will need to reassess their exposure to risk in these areas. Without adequate foresight, insurers could find themselves overextended in high-risk regions, which could undermine their financial stability during catastrophic loss years.

Derisking insurers

Given the magnitude of the challenge, insurers must rethink their risk management strategies. Several steps can help them derisk and better prepare for the financial burden of future catastrophes. The key to derisking lies in the effective use of advanced catastrophe models that incorporate climate variability and urbanisation trends. Verisk’s report calls for the adoption of forward-looking models that provide a more accurate estimation of risks. Insurers must invest in tools that allow them to stress-test their portfolios against a range of possible catastrophe scenarios. This will help them anticipate future losses and adjust their coverage offerings accordingly.

Diversifying risk portfolios is another crucial strategy for derisking. By spreading risk across various geographical regions and peril types, insurers can reduce their exposure to any single event. This approach will become especially important as secondary perils continue to increase in frequency and intensity. Insurers should also consider re-evaluating their presence in high-risk areas, particularly those with a history of recurrent natural disasters.

Insurers should work closely with governments and urban planners to promote climate resilience and risk mitigation measures. This can involve supporting initiatives that reduce vulnerability in high-risk areas, such as improved building codes, flood defences, and wildfire prevention strategies. By investing in resilience now, both insurers and governments can reduce the long-term financial impact of natural disasters.

Parametric insurance is gaining traction as a tool for managing the financial fallout from natural catastrophes. Unlike traditional insurance, which compensates policyholders based on the assessed damage, parametric insurance provides payouts when predefined conditions—such as wind speed or earthquake magnitude—are met. This model can help insurers provide faster relief to affected parties and manage their own risk more effectively by using clear and objective payout triggers.

As the risk landscape changes, insurers may need to limit their exposure in certain high-risk areas. This could involve redrawing risk maps to reflect the new realities of climate change and urbanisation. In some cases, insurers might need to withdraw entirely from areas that have become too costly to cover. While this may seem drastic, it is a necessary step to prevent further financial strain on the industry.

As climate change continues to alter weather patterns and increase the frequency of extreme events, insurers must remain at the forefront of risk management innovation. While the immediate financial impact of climate change may be modest, its future potential to drive up losses should not be underestimated. Insurers need to adopt long-term strategies that account for the gradual, yet profound, changes in the global climate.

The message is clear: insurers must be proactive, not reactive, in their approach to natural catastrophes. By investing in advanced risk models, diversifying portfolios, and working with governments to build resilience, the insurance sector can better manage its exposure to growing catastrophe risks. Failing to adapt could result in more than just financial losses—it could risk the solvency of the industry itself.