Make in India: India exported $5 billion worth mobile phones in the first seven months of the financial year 2022-23, more than double the value of exports in the same period last year. The country’s mobile phone exports stood at $2.2 billion in the April-October period of last fiscal. The increase in exports can be attributed to companies like Apple and Samsung that increased their export shipments and domestic production to benefit from the government’s production-linked incentive scheme.

The PLI scheme in mobile manufacturing industry has become a success story for the government’s Make in India initiative which seeks to give a fillip to the domestic manufacturing industry. The scheme also played a major role in boosting exports. The government had introduced the Rs 1.97 lakh crore scheme for mobile manufacturers to make handsets in India. In fact, the support provided by the scheme may help the sector achieve the milestone of $1 billion of monthly mobile phone exports.

READ | NPA write-offs: Eight questions on Rs 10 lakh crore bad loans that beg for answers

Before the PLI scheme, only about 1% of Indian mobile manufacturing output was exported. The scheme was aimed at wooing away investors from China and Vietnam to set up base in India. The scheme saw global tech behemoths Apple and Samsung scaling up domestic production for both local and international markets. This not only brought cost reduction benefits for Indian buyers, but also ramped up employment opportunities in the handset manufacturing industry. The two companies account for 90% of India’s exports of mobile phones.

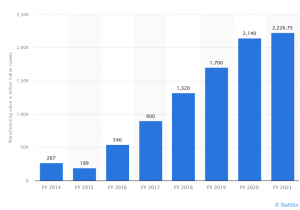

Value of mobile manufacturing in India (Rs bn)

A make in India success story

Mobile manufacturing is a capital-intensive industry and companies look to cut costs by outsourcing assembling to contract manufacturers. Many of the components that go into the phone are patented and are produced in select countries such as South Korea, Japan, and Taiwan. Global brands generally set up only the final assembly plants where mobile phones are assembled from imported semi or completely knocked down kits. Value addition of the companies is higher in branding or marketing activities compared with assembly.

India could now focus on domestic value addition, rather than incentivising domestic production. While India has been exporting handsets, what goes inside these handsets is still imported. The need is to create an indigenous manufacturing ecosystem and move the focus away from just shipping finished goods. The government also needs to nudge the PLI beneficiaries to locate their entire supply chain within the country. Lest, the final assembly plants may shut as soon as the PLI subsidies end. To gain from the export jump, India should improve competitiveness by lowering tariffs, ramping up the logistics sector, accelerating labour reforms, and deepening the ecosystem.

According to a report by the India Cellular and Electronics Association (ICEA), India’s reliance on mobile imports has decreased from 78% in 2014–15 to about 5% in FY22. The number is expected to fall even further in FY23. Analysts are of the opinion that if India continues to ship at such rates, exports from the second-largest smartphone market will complete FY23 at $8.5-9 billion. This will be a remarkable jump from the total for FY22. In FY22, India exported mobile phones worth $5.8 billion. However, mobile exports are facing a headwind because of geopolitical tension and a slowdown in international markets. Mobile phone shipments fell to about $900 million in October after crossing the $1 billion mark in September.

Currently, India is the second largest mobile phone manufacturer after China. The country produced 17 crore mobile handsets in 2021 compared with just 3 crore in 2014. India producer 11% of all handsets produced globally. The total value of mobile manufacturing in India is about Rs 2.2 lakh crore in 2021. India became the second largest market for mobile phones in 2021, surpassing the United States. The country has 780 million smartphones last year, second only to China. Around 3 crore smartphones are sold every quarter in India. The country has more than 140 crore phone connections as of 2021.