After a tepid performance last year, India’s fast-moving consumer goods sector is bracing for a turnaround, buoyed by a favourable monsoon forecast and government measures to stimulate consumption. The India Meteorological Department has predicted above-normal rainfall — 5% higher than the long-period average of 87 cm — which is expected to catalyse a broad-based FMCG demand revival across rural and urban markets.

This renewed optimism is rooted in the centrality of the monsoon to the Indian economy. Roughly 65% of the population lives in rural areas, with a majority dependent on agriculture. A good monsoon, particularly for the kharif crop cycle, translates into improved farm incomes, setting off a chain reaction of increased consumption. Combined with the government’s revised tax regime — which exempts annual incomes up to Rs 12 lakh in FY26 from income tax — FMCG firms expect rural demand to strengthen further.

READ I India’s export promotion needs a radical rethink

Rural demand outpaces urban recovery

Rural volumes have already begun to recover, outperforming urban markets over the past few quarters, helped by successive years of adequate rainfall and continuing allocations to welfare schemes. Higher minimum support prices for crops are also adding to rural spending power.

By contrast, urban demand had faltered through much of the last fiscal, battered by high food inflation, elevated interest rates, and stagnating wages. Personal care items and certain food and beverage segments bore the brunt of this downturn. But the tide appears to be turning, with early signs of urban recovery emerging alongside broader economic stabilisation.

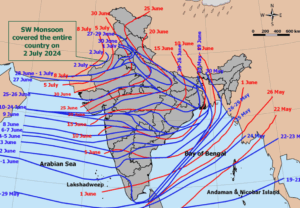

Advance of southwest monsoon

According to a report by Crisil Ratings, the FMCG sector is projected to register revenue growth of 6–8% in FY26, marking a rebound of 100–200 basis points from the anticipated 5–6% growth in FY25. While operating profitability is expected to remain stable at 20–21%, companies may find it difficult to sustain margins given rising input costs.

Key raw materials such as palm oil, coffee, copra, and wheat have witnessed price increases, compelling firms to pass on some of the burden to consumers. Crisil estimates a 2% boost in topline growth will stem from these price realisations in categories like soaps, biscuits, coffee, hair oil, and tea.

Urban markets account for roughly 60% of sector revenue, with rural areas contributing the rest. By segment, food and beverages dominate the revenue mix at nearly 50%, followed by personal care and home care, each comprising about a quarter.

Weather, wages, and welfare

India’s dependence on the monsoon for agricultural output cannot be overstated. A deficient rainfall year spells disaster — crop failures lead to diminished farm incomes and rising food prices, choking off discretionary spending. On the other hand, above-normal rainfall supports abundant harvests, moderates food inflation, and leaves more disposable income in the hands of consumers.

This agricultural cycle has implications well beyond FMCG. Consumer durables, two-wheelers, and tractors also tend to see a demand uptick during good monsoons. Recent data from NIQ shows that during Q3FY25 (October–December), both urban and rural markets witnessed sequential recovery in consumer demand, with rural demand outstripping urban across most regions.

The rise of regional brands

Even as macroeconomic factors align in favour of traditional FMCG firms, competitive pressures are intensifying. A growing number of regional and local players are chipping away at market share, aided by consumers downtrading to more affordable alternatives. The boom in direct-to-consumer (D2C) brands — empowered by e-commerce and digital marketing — has further levelled the playing field.

Examples abound: regional beverage brands like Lahori Zeera in Punjab and Sosyo by Hajoori and Sons in Gujarat are rapidly gaining popularity, even challenging global giants such as Coca-Cola and PepsiCo in their strongholds.

This shift in consumer behaviour is being accelerated by digital retail. Where once legacy FMCG firms dominated retail shelves through expansive distribution networks and aggressive brand promotions, today’s online marketplaces have democratised visibility. Smaller brands can now compete directly with multinational giants, often with lower overheads and more nimble product offerings.

Quick commerce — hyperlocal delivery platforms promising delivery within minutes — is further transforming the landscape. FMCG sales via quick commerce channels are growing at 30–40%, significantly outpacing growth in traditional retail. This trend poses both a threat and an opportunity for legacy brands, many of which are now focusing on acquiring D2C startups and expanding their own digital footprint.

A crucial year for consumption revival

The year 2025 was widely projected as a potential inflection point for consumption. With monsoon prospects favourable, inflation softening, and real incomes inching upward, the stage appears set for a demand revival. If these factors hold, FMCG companies will likely be among the first beneficiaries of this shift.

However, the road ahead is not without hurdles. Companies must balance rising input costs with pricing power, navigate growing competition from local and digital-first brands, and adapt to rapidly evolving consumer expectations in an increasingly digital economy.

Still, for now, the sector is hopeful. And with the monsoon clouds gathering — quite literally — there may just be silver linings for India’s FMCG industry.