The Indian banking sector, a vital cog in the nation’s economic system, is likely to experience a rise in nonperforming assets. Rating agency ICRA has predicted an uptick in the generation of fresh NPAs in fiscal year 2025, after a period of decline. This can have far-reaching implications for the sector’s sustenance and growth in the backdrop of changes in credit dynamics and regulatory frameworks.

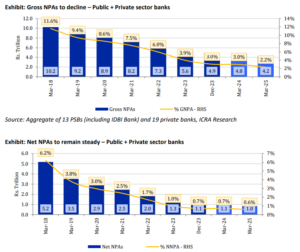

The rise in NPAs is not a new experience for Indian banks. In the mid-2010s, the banking system witnessed a major NPA crisis, with gross NPA ratios exceeding 11%. This was due to factors such as aggressive lending practices during the economic boom which was followed by a slowdown in several sectors, and lax credit appraisal processes. To address this challenge, the Reserve Bank of India implemented stricter NPA recognition norms and strengthened regulatory oversight. The banks also adopted cautious lending practices and focused on recovery efforts. These measures, coupled with a pick-up in economic activity, contributed to a steady decline in NPA ratios in recent years.

The anticipated rise in NPAs in FY25 marks a potential reversal of the positive trend, necessitating renewed focus on prudent risk management and proactive NPA resolution strategies. ICRA’s projections suggest an escalation in the NPA generation rate to 1.5% for public sector banks and 2.2% for private banks. This trend will expose potential vulnerabilities in the banking sector, necessitating steps to mitigate risks and bolster resilience.

READ I US-China relations: Rivals seek to stabilise ties amid intense competition

NPAs and sectoral dynamics

The projected rise in NPAs is particularly worrying for public sector banks as they typically have a larger exposure to certain stressed sectors such as infrastructure and steel, which are more vulnerable to economic downturns. Additionally, PSBs may face challenges in loan recoveries due to bureaucratic hurdles, potentially leading to slower NPA resolution compared with private banks. This necessitates tailored strategies to address the NPA challenge.

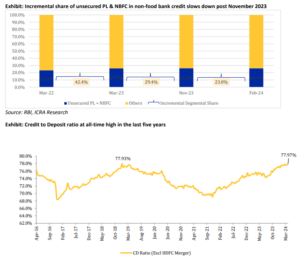

The forecast must be understood against the backdrop of economic and sectoral dynamics. A moderation in credit growth, influenced by regulatory measures and market conditions, is expected to impact profitability metrics and interest margins. The situation warrants adept management of the credit-to-deposit ratio, which has soared to its highest since December 2018, and effective strategies to maintain liquidity and capital adequacy.

Global economic uncertainties play a crucial role in shaping the asset quality of Indian banks. Fluctuations in international markets, varying interest rate regimes abroad, and geopolitical tensions can have a cascading effect on India’s banking sector. These factors can impact corporate profitability and, consequently, their ability to service debt, potentially leading to an increase in NPAs. Recognising the global linkages and their impact on the domestic banking system is essential for crafting strategies that can withstand external shocks.

The rise in NPAs has a significant impact on the lending patterns to micro, small and medium enterprises, a sector that forms the backbone of the Indian economy. As banks become more cautious in their lending practices, MSMEs may face challenges in accessing credit, which can stifle their growth and innovation. It is imperative for banks to strike a balance between managing asset quality and supporting the growth of MSMEs, ensuring that credit flows to this vital sector are not unduly restricted.

Strategic responses and future trajectory

Despite the anticipated rise in fresh NPAs, the overall asset quality of Indian banks is expected to improve, with gross NPAs projected to decline to their lowest in over a decade by March 2025. This paradoxical situation highlights the complexity of the banking system, where growth and challenges coexist. Banks will need to fortify their operational frameworks, emphasising robust credit appraisal, risk management, and recovery mechanisms to survive future crises.

Technological advancements offer a potent tool for banks in tackling the NPA menace. Innovative approaches using data analytics, machine learning, and blockchain technology can enhance the accuracy of credit appraisals, improve the monitoring of loan accounts, and streamline the recovery process. Leveraging technology can lead to a more proactive approach in identifying and mitigating risks associated with non-performing assets, thereby enhancing the overall efficiency and effectiveness of NPA management.

The role of regulatory oversight by RBI remains key to the banking sector’s future course. Stringent NPA recognition norms and the strengthening of resolution mechanisms such as the Insolvency and Bankruptcy Code (IBC) have been instrumental in the recent fall in NPAs. Continuous regulatory vigilance and enhancements in the IBC process will be crucial in maintaining the momentum of NPA reduction and ensuring the sector’s robustness against macroeconomic shocks.

The Indian banking sector’s record in tackling non-performing assets is a testament to its resilience and adaptability. While the predicted rise in fresh NPA generation in FY25 presents challenges, it also offers an opportunity for banks and regulatory bodies to reinforce their frameworks and strategies. As the sector braces for the challenges, its role in propelling India’s economic growth remains undiminished, supported by the collective efforts to tame the NPA challenge and harness the potential of a robust banking ecosystem.