By Naliniprava Tripathy and Harsh Alipuria

India has come a long way from the days when its forex reserves were just $5.8 billion in 1991 due to limited foreign investment. It has become one of the world’s most favored investment destinations. Over the years, the Union government has taken various steps to make India an exciting investment opportunity, leading to tremendous growth in PE/VC investments. In the last 30 years, the number of active PE/VC funds has increased by over 3600%, going from 8 in 1992 to over 300 in 2021. The amount of investment grew from $30 million to $240,000 million during the period.

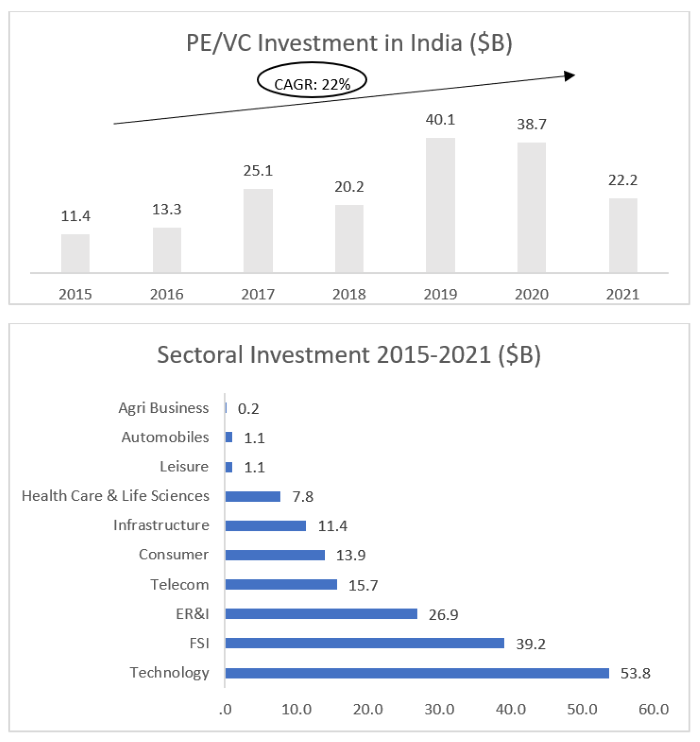

Global Financial Crisis of 2008 and the uncertainties in the global markets generated strong headwinds for foreign investment at the beginning of the last decade. Questions around corporate governance, flexibility in the exit options, and contract enforcement discouraged many investors. Investment was stunted in the early part of the last decade, but grew tremendously in the second half due to the government’s efforts to make India a viable investment opportunity. Even the downturn triggered by the Covid-19 pandemic hasn’t slowed down the PE/VC investment in the country.

READ I India’s fledgling e-commerce industry needs a robust policy framework

In 2020, PE/VC investment stood at $47.6 billion, primarily due to the investments in Jio platforms and Reliance retail. The pandemic has also brought a new trend where the funds are looking at new and upcoming sectors to invest in and moving away from ‘in favor’ sectors of the platform and technology-enabled businesses. EdTech, life sciences, and financial payment companies have increased their businesses during the pandemic, leading to higher interest and investment from the funds.

The PE/VC investments in the last 5 years have increased at a CAGR of 22%. In the last decade alone funds made an investment of $232 billion in India, which is more than twice the value invested in the previous decade. The major investment was in companies like Flipkart, Reliance platforms etc.

With the investments at an all-time high, it is logical to touch upon the exits as well. Exiting an investment has always been a tricky part of the Indian context. The market mood was highly volatile in GFC, leading to muted investment and exit opportunities. As touched upon earlier, the exits are challenging due to the below factors:

- Lower than expected Corporate Governance leading to a mismatch between the expectations and the performance of the asset.

- Strategic buying and IPOs have been limited as a lot of the investments haven’t returned profits that the buyers expect.

- Minimal buyable assets are making the environment extraordinarily competitive and assets valuable.

These factors have made secondary exits and open market exits more viable than strategic or IPO exits.

READ I Scrappage policy: A big business opportunity awaits India

Barring the Flipkart-Walmart deal and Alliance Tire – Yokohama Rubber deal, there aren’t many big deals that have taken the strategic exit route. Traditionally, investments by PE/VCs in Indian companies have been in sectors that are in high-growth stage and for minority stakes, hence constraining their ability to drive the transaction towards strategic buyers.

With Indian promoters prefer to control majority stakes, strategic buying becomes less of an option. However, this trend might change going forward as there has been an increase in the buyout deals, increasing the potential for strategic sales. Strategic buyers are also opening to the idea of retaining the promoters to manage the business, creating a win-win situation for all stakeholders involved.

High market volatility during the pandemic and the dampened investor mood, IPO exits haven’t been the preferred route. With the added burden of limited profit-making investments, IPO exits become even more challenging. But in 2021, the market is highly bullish, resulting in multiple IPO exits, Zomato being the marquee of the lot. IPO exits are expected to increase if the markets continue to perform well.

READ I Targeted incentives can boost manufacturing sector, revive MSMEs

Future outlook for PE/VC investment

Technology-enabled businesses to rule the roost: Technology has become a critical part of all life aspects and continues to disrupt the traditional business models. With EVs and AR/VR on the horizon, the investment in tech enables and technology backed companies will increase.

Construction and infrastructure to emerge: InvITs and REITs have proved to be highly successful investment options in the last decade. With increased focus on infrastructure development and urbanization, expect the investment to continue in these instruments.

Investing in private credit / distressed assets to increase: With the pandemic raging on, multiple start-ups with suitable business modes have gone bust. PE/VCs are looking at such assets and potentially make money by reviving the operations and then selling on for good profits.

Venture debt funding could emerge as an option for cash strapped start-ups: Cash-strapped start-ups don’t want to dilute their stake in the entity and seek alternate funding routes. Debt funding by PE/VC funds has emerged as a viable option and is expected to grow in the coming decade.

(Dr Naliniprava Tripathy is Professor of Finance at IIM Shillong. Harsh Alipuria is Consultant, IIM Shillong Alumni.)

Naliniprava Tripathy is an Indian economist based in Shillong. She teaches finance at IIM Shillong.