Reliance Retail is looking to consolidate its presence in the country by acquiring Metro Cash and Carry’s India operations and assets. Reliance’s smooth transition from a petrochemicals giant into a retail-focused diversified conglomerate coincided with India’s emergence as the fourth largest retail market in the world.

India’s large population base has made its retail market a lucrative one. Its large middle class saw several multinationals making a beeline for India. The early entrants included Wal-Mart, Carrefour, Metro, and a large number of Indian corporates joined the fray soon. Kishore Biyani’s Future Group, Mukesh Ambani-led Reliance, Tata Group and Aditya Birla group made a foray into the retail market.

ALSO READ: UGC woos foreign universities with autonomy promise; chokes the best at home

As part of its plans to make the group a consumer-facing one, Reliance went on a shopping spree and built its retail empire block-by-block. Toy-maker Hamley’s, Urban Ladder, and Netmeds were some of the top picks. RIL has made some more acquisitions to get a foothold in every conceivable retail segment. Metro Cash and Carry will make another valuable asset in RIL portfolio, if the current plan to acquire the company succeeded.

In August 2020, Reliance got into a Rs 24,713 crore deal with Kishore Biyani to buy his Future Group’s wholesale, logistics, retail, and warehousing businesses. This deal got into trouble after e-commerce giant Amazon, which had agreed in 2019 to purchase 49% in one of Future’s unlisted firms with the right to buy into flagship Future Retail, challenged the deal.

Metro Cash and Carry is a subsidiary of German parent Metro AG which is worried over the growing economic nationalism in India and Prime Minister Narendra Modi’s push for swadeshi over videshi. Retail groups in the country have been lobbying against overseas retailers. Moreover, the company is finding it hard to compete with deep-pocketed rivals such as Reliance and Amazon. After reviewing its operations in India, it decided to make an exit.

Indian retail industry at a glance

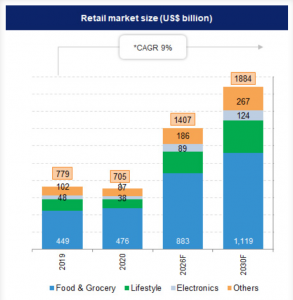

The Indian retail market is estimated to touch $2 trillion by 2032. India is among most lucrative retail markets for investors. This can be largely attributed to socio-demographic and economic factors such as urbanisation, income growth and rise in the number of nuclear families. Other factors that make India an attractive investment destination include its large population, growing middle class, rising household incomes, connected rural consumers and increasing consumer spending.

With expanding retail segment, e-commerce is also witnessing a boom. The Indian e-commerce industry is expected to cross $350 billion mark by 2030, growing at a CAGR of 23%, according to Invest India. The sector contributes to a tenth of the India’s gross domestic product (GDP) and 8% of employment.

The retail market in India has undergone a major transformation. It witnessed tremendous growth in the last decade. The e-retail market is projected to touch $120-140 billion by 2025-26, expanding 25-30% annually in the next 5 years. India is expected to become the 3rd largest online retail market by 2030, with an estimated annual gross merchandise value of $350 billion.

ALSO READ: Two landmark deals will transform green hydrogen industry

While the retail market in India is largely unorganised, over the next 3-5 years, the share of modern retail (including e-commerce) is pegged at 30-35% with the share of traditional retail coming down to 65-70%. India’s e-retail industry bloomed during the Covid-19 pandemic that saw near-total lockdown of the economy. India is home to the third largest online shopping community after China and the US. The number of direct-to-consumer shipments are expected to touch 2.5 billion by 2030.

FMCG, apparel and footwear, and consumer electronics are the largest retail segments, constituting 65%, 10% and 9% respectively of the retail market. Reliance retail has a presence in all of these segments with the company running its own supermarket chain Reliance Fresh in cities across India. The company also sells its in-house products in Reliance Fresh stores. The group also runs e-commerce platform Ajio which deals in apparels, fashion and lifestyle products.

However, Reliance now has a further agenda of entering the FMCG business. In its 45th AGM held on Monday, chairman Mukesh Ambani announced that Reliance Retail will enter the fast-moving consumer goods space and launch its own FMCG business this year.

Reliance Retail invested around Rs 30,000 crore in 2021-22 to add 2,500 stores to its retail network. With this, it has raised the number of its stores to 15,196. The company also added 11.1 million square feet warehousing space.

Prachi Gupta is an Assistant Editor with Policy Circle. She is a post graduate in English Literature from Lady Shri Ram College For Women, Delhi University. Prachi started her career as a correspondent with financialexpress.com. She specialises in policy impact studies.