On May 22, the government imposed an export duty on iron ore and steel to tackle the rising domestic steel prices. India consumes 88-90% of domestic steel output and exports just 8-12% of its steel output. This means, the exports are not at the cost of domestic availability of steel. Similarly, steel with low iron content is not consumed by local manufacturers – they are either exported or used in pellet making. So, even that is not at the cost of domestic iron ore requirements. In the case of high Fe content iron ore, there was already an export duty of 30% to discourage exports.

India’s steel exports in July stood at 1,56,000 tonnes, the lowest in more than three years, while imports rose by 8% to 444,000 tonnes. The country became a net importer of the commodity after 18 months.

The government also cut the import duty on coking coal, ferro nickel and PCI. It has been a long-standing demand of the steel industry. However, it was not good enough to offset the damage caused to the industry by the imposition of import duty which undermined India’s position in the global steel market and affected the capacity utilization by the industry.

READ I Shift to renewables will cut cost of farming, strengthen food security

Steel export duty — wrong prescription

Pellet making consumes wasteful fines with low Fe content iron ore. This helps the system to dispose waste and prevent environmental hazards. Any doubts of high iron content ore being used in pellet making can be cleared by a better inspection mechanism and imposing 45% duty is kind of over-reaction.

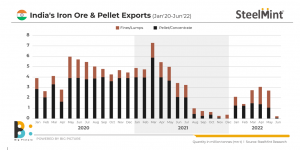

The pellet making units were using 65% of their capacity before the duty was imposed, but has fallen after the levy. This is clearly depicted in the chart below. The removal of the 45% import duty will encourage beneficiation and thus usage by Indian steel makers. The vacuum created by the fall in Indian exports is now being occupied by exports from other countries.

There was already a 30% export duty to discourage Iron ore exports. The decision to raise it to 50% has adversely affected the industry. Exports have come down drastically, and local iron ore prices are once again showing an upward trend. So, the government needs to take a relook at this policy and bring down the export duty back to 30%.

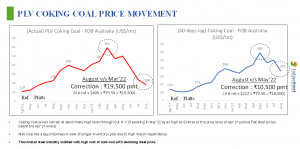

The intention behind the 15% duty on steel products was to bring down domestic steel prices, but it is not based on hard facts. The price of steel in India and across the globe rose because of high coking coal prices. Even before the imposition of the export duty on May 22, the steel prices had started showing a downward trend because of a fall in the coking coal prices.

Thus, the cause of high steel prices was high coking coal prices and not exports. So, the duty was clearly wrong prescription and needs to be removed. The loss of foreign exchange inflows from exports is a big loss for the economy, but the loss of face in the international steel market because of arbitrary decisions will hurt Indian steelmakers more.

It is important to note that the steel policy 2017 targets export of 60MT of 300MT domestic steel output. So, the manufacturers enhanced capacities to meet export demand. The sudden imposition of export duty has disrupted their plans. The decision will cost them a space in the global steel market and earn them a bad name as an unreliable supplier.

The steel ministry had sought information from the industry on the causes of falling exports. A meeting was held in the last week of August to evaluate exports of different categories of steel and their demand outlook.

The duties need to be debated and deliberated, keeping the holistic scenario in mind. A through cost-benefit analysis needs to be done to see if the levy had delivered the desired results. Any delay in scrapping these duties will cause unintended injury to India’s steel industry.

Dr Aruna Sharma is a New Delhi-based development economist. She is a 1982-batch Indian Administrative Service officer. She retired as steel secretary in 2018.