Less than a decade after witnessing a revolution in the telecom industry brought about by Mukesh Ambani-led Reliance Jio, India may be gearing up for another disruption in the sector. The fourth richest man on the planet, Gautam Adani, is throwing his hat into the ring for the upcoming 5G spectrum auctions. Adani Data Networks says it is participating in the 5G spectrum auction to provide private network solutions of its business verticals such as airports, logistics, power generation, transmission and ports and that it does not plan to be in the consumer mobility space.

Can Adani group have a personal 5G network? The answer is yes. In June, the government proposed that tech companies and other enterprises can acquire spectrum directly from it to test and build industry 4.0 applications such as machine-to-machine communications, the Internet of Things (IoT), artificial intelligence (AI) etc. in the wake of rising technological and data revolution in the country. These networks are called private networks and are meant to serve a specific organisation, and not the general population.

READ ALSO: India is losing its demographic dividend amid jobless growth

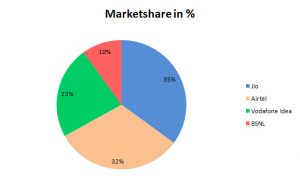

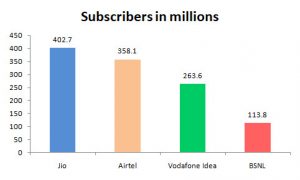

Telecom industry analysts, however, feel that Adani’s foray into telecom may someday turn into a consumer business as a part of a long-term strategy. The two richest Indians, Gautam Adani and Mukesh Ambani, are already fighting on various turfs such as energy, media and consumer goods. Adani’s entry into the telecom industry is expected to disrupt the sector that is controlled by four players — Reliance Jio, Bharti Airtel, Vodafone-Idea and BSNL.

The state of telecom industry

India is the world’s second-largest telecommunications market, making it a lucrative one for investors and private companies. The total subscriber base, wireless subscriptions as well as wired broadband subscriptions have grown consistently in the country especially after Prime Minister Narendra Modi’s Digital India push. As of December 2021, the total subscriber base stood at 1.18 billion. The Gross revenue of the telecom industry stood at Rs 64,801 crore ($8.74 billion) in the first quarter of FY22, according to government data.

It is expected that over the next five years, rise in mobile-phone penetration and decline in data costs will add 500 million new internet users in India. This will in turn create opportunities for new businesses. The country has also been a hotbed for foreign investments with a daily increasing subscriber base. The FDI inflow in the telecom industry stood at $38.25 billion from April 2000 to December 2021.

What does Adani’s entry in telecom mean?

The Adani Group has been issued a letter of intent by the DoT for the grant of a unified licence for the Gujarat circle. This will allow the company to offer long-distance calls and Internet services commercially. Adani’s foray in the sector is likely to result in aggressive bidding for 5G spectrum, according to analysts. This will also compel established players to strengthen their hold on the industry and raise competition in enterprise 5G.

READ ALSO: Explained: Will government’s free Covid vaccine booster drive do the trick?

To the common man, this may mean another price disruption akin to what was seen in the infancy of Reliance Jio. The spectrum auctions are scheduled to start on July 26. The group may also look to expand in consumer business in coming years, according to brokerage houses. In Adani’s presence, the bidding is no longer a game play between Bharti Airtel and Reliance Jio, the largest telcos.

Currently, the Adani subsidiary has a net worth of Rs 248.35 crore. Sunil Mittal-owned Bharti Airtel’s net worth as of March 31 was Rs 75, 887 crore with a paid-up capital of Rs 2,795 crore. Mukesh Ambani-owned Reliance Jio’s net worth was Rs 1,97,790 crore with a paid-up capital of Rs 1,54,125 crore. Of the major four players, only Vodafone-Idea has a negative net worth of Rs 80,918 crore with a paid-up capital of Rs 32,119 crore.

While the government has stated that it has no plan for privatising BSNL, it cannot be taken on face value when Ambani and Adani are competing in the sector. This especially rings true considering the privatisation marathon that the Modi government has been participating in for some time now.

Air India was the first in the list of disinvestment targets and Maharaja has been dutifully returned to its previous owners- the Tata Group. BSNL is also expected to go down the same route considering the history of privatisation drive by the NDA government. Previously, under Vajpayee it had managed to sell as many as 12 PSUs, despite strong opposition from within the government and the bureaucracy which turned out to be a successful enterprise for companies including Modern Bread and Maruti Udyog, among others. BSNL, once enjoyed a monopoly in the telecom industry which was systematically destroyed for private operators by successive govts.

Both Vodafone-Idea and BSNL are currently sitting ducks for the cash-rich firms. VI, the now company after the merger between Vodafone and Idea, has been witnessing a downward spiral especially after the entry of Reliance Jio, which financially strained the beleaguered telco at a time when it was also burdened with adjusted gross revenue (AGR) dues to the government. The company is currently going through tough times and Adani’s entry in the sector is no respite. This year in January, Vodafone Idea approved a state bailout to stave off an imminent collapse.

Both BSNL and VI combined may help the government bolster its telecom portfolio and assets, which it can leverage to sell to an investor later. Now it is to be seen whether the government will be able to leverage the assets of these company and make it a win-win for both investors and the companies.

Prachi Gupta is an Assistant Editor with Policy Circle. She is a post graduate in English Literature from Lady Shri Ram College For Women, Delhi University. Prachi started her career as a correspondent with financialexpress.com. She specialises in policy impact studies.