When the government introduced Unified Payment Interface (UPI) nearly half a decade ago, nobody would have, in their wildest dreams, imagined the kind of success it would achieve within a short period. While the real-time payment transfer system achieved instant success, it created an entirely different problem for the government – the interface is dominated by PhonePe and Google’s GPay. While there are a few players competing with the market leaders, most users use PhonePe and Google Pay to carry out UPI transactions.

In fact, India is not the only country facing these problems. The United States is also taking on big tech platforms that dominate the payments market, Reserve Bank of India (RBI) deputy governor T Rabi Sankar said at the US India Business Council meeting. He said the central bank is now mulling over a solution to end the duopoly in payments.

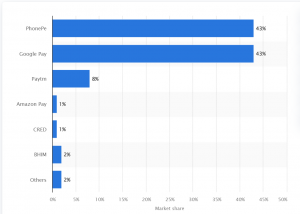

Market share of UPI players

The government had red-flagged the issue way back in March 2021 when the National Payments Corporation of India mandated a cap on adding new users by UPI platforms once they cross 30% market share. However, like any other policy, this cap never got implemented.

READ I Deficient monsoon threatens to derail farm output, consumer demand

The UPI success story

Prime minister Narendra Modi’s Digital India push and demonetisation were major reasons for the success of UPI. The payment platforms have been clocking steady growth ever since their launch. The coronavirus pandemic further facilitated the adoption of the interface as the fear of catching the virus via surface contact became a hindrance to physical payment. UPI aims to process a billion transactions a day in the coming five years and the RBI’s decision to link Rupay credit cards to UPI is expected to provide another boost to the number and value of UPI transactions in the coming months.

The growing e-commerce segment, digital boom due to increasing smartphone penetration, inexpensive data, and the wider availability of the facility at stores are also among the major reasons behind the success of UPI.

UPI has clocked over 6 billion transactions in July which is the highest in a month by the flagship digital payments platform since its inception in 2016. The platform reported 6.28 billion transactions amounting to Rs 10.62 trillion, according to data released by NPCI. The platform had crossed 1 billion transactions for the first time in October 2019, almost three years after its debut.

The UPI marketshare

PhonePe leads the chart of the monthly UPI transactions across the country and has nearly 50% of the market under it. Google Pay also comes at a whopping 38% while the third-placed Paytm Payments Bank has just 17%. Meanwhile, WhatsApp has also rolled out its payments interface with an intention to revolutionise the space.

The government looks up to other countries to standardise their API protocols. There is a need to avoid fragmentation of API and data standards. It has acknowledged that cross border payments are now a deal of the past and to make it better, CBDC (central bank digital currencies) are the most efficient solution. Also, the cost needs rationalisation. India currently has Bhutan, Nepal, Malaysia, Singapore, UAE and France as UPI markets by cross border payments agreement.

Recently the RBI has published the Payments Vision 2025 report which has a core theme of E-Payments for Everyone, Everywhere, Everytime (4 Es). This contains a roadmap of activities in the payments space till 2025 that the government wants to achieve such as more than three times increase in the number of digital payment transactions.

Moreover, the sector is currently plagued with fraudulent cases and fraud management, needs one priority for both the players and the government if it needs to instil faith in digital transactions. It is of utmost important to understand the underlying goal of introducing UPI.

The BJP-led government had incentivised digital currency to make India a cashless economy while also aiming to control black money and corruption which happen mostly in cash. However, people still have faith in hard currency due to rising fraud cases. It is an area that the government must focus on if it plans to scale up digital payment.